AUTHOR : EMILY PATHAK

DATE : 23 – 09 – 2023

In today’s digital age, where e-commerce is flourishing and online transactions have become a part of our daily lives, having a secure and efficient payment gateway on your website is paramount. In this comprehensive guide, we will delve into the world of payment gateways, understanding what they are, how they work, and why they are crucial for the success of your online business. So, fasten your seatbelts as we embark on this journey to demystify the payment gateway in websites.

Understanding Payment Gateways

Payment gateways are virtual portals that facilitate the secure and smooth transfer of funds from a customer to a merchant during an online transaction. They play a pivotal role in ensuring that payments are processed swiftly, accurately, and securely.

How Payment Gateways Work

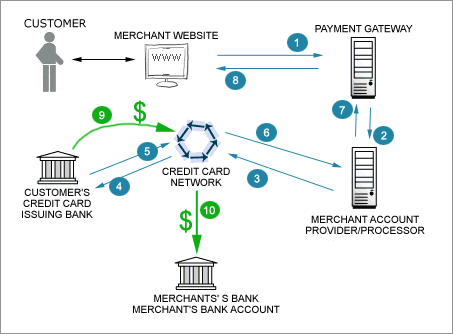

Payment gateways act as intermediaries between the customer’s chosen payment method (credit card, debit card, digital wallets) and the merchant’s website. When a customer makes a purchase, the gateway encrypts the payment data and sends it to the payment processor.{1} The processor then communicates with the customer’s bank to verify the transaction’s legitimacy. Once granted the green light, the funds smoothly find their way into the awaiting embrace of the merchant’s bank vault.

Types of Payment Gateways

Hosted Payment Gateways

Hosted gateways redirect customers to a third-party page to complete their payment. {2}This is a popular choice for small businesses as it simplifies security compliance.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to complete their payment on the merchant’s website.{3} While offering more control, they require additional security measures.

The Significance of Making the Correct Payment Gateway Selection

Selecting the right payment gateway is critical {4}for your business’s success. It can impact user trust, conversion rates, and overall customer satisfaction.

Points to Ponder While Choosing the Ideal Payment Gateway

Security

Ensuring that customer payment data is secure should be a top priority. Look for gateways that are PCI DSS compliant and offer robust encryption.

Transaction Fees

Different gateways have varying fee structures. Consider your business’s transaction volume and choose a gateway that aligns with your budget.

Integration Ease

A user-friendly integration process can save you time and resources. Opt for gateways that offer seamless integration with your website.

User Experience

A smooth checkout experience can reduce cart abandonment rates. Choose a gateway that offers a user-friendly interface.

Challenges in Payment Gateway Integration

Integration challenges may arise, but with careful planning and the right support, they can be overcome.

Future Trends in Payment Gateways

Keep an eye on emerging trends such as cryptocurrency payments and biometric authentication in payment processing.

Expanding Your Business with Payment Gateways

Expanding your business reach is a goal for many website owners. One of the ways to achieve this is by offering various payment options to your customers. Here are some additional insights on this topic:

Diversify Payment Options

To cater to a broader audience, consider offering multiple payment options. While credit and debit cards are the most common, integrating digital wallets like Apple Pay and Google Wallet can attract tech-savvy customers. Additionally, providing alternative payment methods like bank transfers or even cryptocurrency can make your website more accessible to a global clientele.

Subscription and Recurring Payments

If your business model involves subscription-based services or recurring payments, your payment gateway should support this functionality. Many modern gateways offer features that allow you to set up recurring billing easily. This can streamline your revenue collection process and enhance customer convenience.

Fraud Detection and Prevention

As your online business grows, so does the risk of fraudulent transactions. Ensure that your chosen payment gateway provides robust fraud detection and prevention measures. Look for features such as real-time monitoring, transaction verification, and the ability to set risk thresholds.

Reporting and Analytics

Understanding your transaction data is essential for making informed business decisions. Choose a payment gateway that offers comprehensive reporting and also analytics tools. These insights can help you identify trends, optimize pricing strategies, and also improve overall financial management.

Customer Support

Reliable customer support is invaluable, especially during technical issues or payment disputes. Give precedence to payment gateways that provide highly attentive and also swift customer assistance. Check reviews and testimonials to gauge the quality of support provided by the gateway provider.

Optimizing the Checkout Process

The checkout process is a critical component of your website’s user experience. A convoluted or confusing checkout can lead to cart abandonment. Here are some tips to optimize the checkout process:

Streamline the Process

Minimize the steps needed to finalize a purchase, ensuring a streamlined and also efficient checkout experience. Ideally, customers should be able to check out in just a few clicks. Reducing friction in the process can significantly boost conversion rates.

Guest Checkout Option

Not all customers want to create an account on your website. Offer a guest checkout option that allows them to make a purchase without the need for registration. You can always encourage account creation after the purchase.

Clear Pricing and Policies

Ensure that pricing, taxes, shipping costs, and return policies are transparent and clearly displayed. Hidden fees or unclear policies can lead to mistrust and cart abandonment.

Mobile Optimization

A notable chunk of e-commerce activity takes place on handheld mobile devices.

Ensure that your payment gateway and checkout process are mobile-friendly. Test it thoroughly on various devices and browsers to guarantee a seamless experience.

Final Thoughts

In conclusion, a well-chosen payment gateway can significantly impact your website’s success. By understanding the diverse needs of your customers, offering a variety of payment options, and optimizing the checkout process, you can enhance user experience and drive sales.

As technology continues to evolve, staying up-to-date with the latest payment gateway trends and continuously improving your payment process will be key to maintaining a competitive edge in the digital marketplace.

Conclusion

A reliable payment gateway is the lifeblood of any e-commerce website. It ensures that transactions are secure, convenient, and hassle-free. Selecting the right payment gateway for your business and maintaining the highest level of security will pave the way for success in the competitive online marketplace.

FAQs

1. What is a payment gateway?

A payment gateway is a virtual portal that facilitates secure online transactions by connecting the customer’s payment method with the merchant’s website.

2. How do I choose the right payment gateway?

Consider factors like security, transaction fees, integration ease, and user experience when selecting a payment gateway for your business.

3. What are some popular payment gateway options?

Popular payment gateways include PayPal, Stripe, Square, and Authorize.Net, each with its own features and benefits.

4. How do I ensure payment security on my website?

Invest in SSL certificates, maintain PCI compliance, and choose a reputable payment gateway provider to ensure payment security.

5. What are the future trends in payment gateways?

Keep an eye on emerging trends such as cryptocurrency payments and biometric authentication, which are likely to shape the future of payment gateways.