AUTHOR : ADINA XAVIER

DATE : 21/09/2023

In the era of digitalization, online payments[1] have seamlessly woven themselves into the fabric of our daily existence. Whether you are running an e-commerce[2] store, a subscription-based service, or a nonprofit organization, you’ll likely need a reliable payment gateway[3] to facilitate transactions. Understanding how payment gateway API documentation[4] works is crucial for businesses and developers alike. In this article, we will delve into the world of payment gateway API documentation[5], breaking down its significance, components, also best practices.

Introduction

Why Payment Gateway API Documentation Matters

Payment gateway API documentation may not be the most glamorous aspect of your business, but it’s undeniably crucial. It serves as a bridge between your payment gateway also developers, ensuring that they can seamlessly integrate your gateway into their applications. In this article, we will explore why understanding and creating effective payment gateway API documentation is vital for your business’s success.

What is a Payment Gateway?

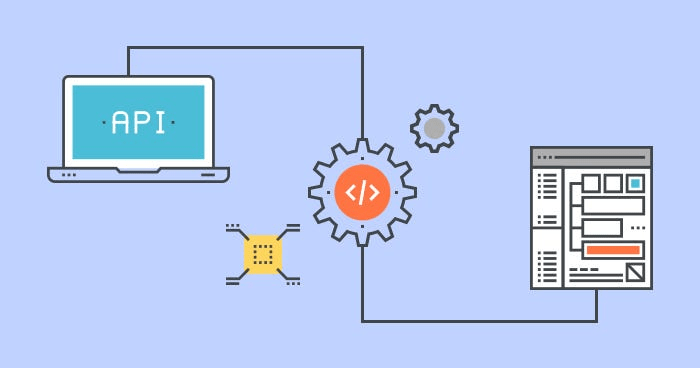

Before diving into API documentation, let’s establish a solid understanding of what a payment gateway is. In its simplest form, a payment gateway is a technology that facilitates online transactions by transmitting payment data between a customer’s bank also the merchant’s website. We’ll discuss the fundamental workings of payment gateways to set the stage for API documentation comprehension.

The Role of API in Payment Gateways

Now that we know what a payment gateway[1] is, it’s time to explore the integral role that APIs (Application Programming Interfaces) play in their operation. APIs are the unsung heroes that enable seamless communication between your website or application and also the payment gateway. We’ll delve into how APIs function as the backbone of online transactions.

Understanding API Documentation

API documentation is the user manual for developers looking to integrate your payment gateway. It’s a comprehensive guide that provides detailed instructions on how to interact with your gateway’s API. In this section, we’ll break down what API documentation includes and why it’s essential for both developers and businesses.

Key Elements of Payment Gateway API Documentation

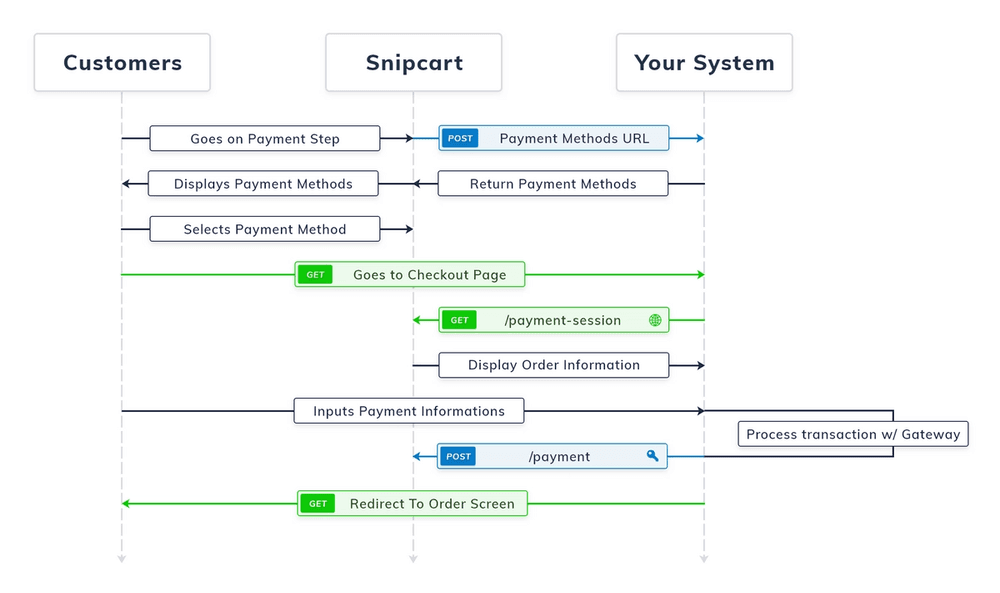

Endpoint URLs and Methods

The first step in API integration[2] is knowing where to send requests and which methods to use. We’ll discuss how to define clear endpoint URLs also methods in your documentation.

Authentication Procedures

Security is paramount in payment transactions. Learn how to explain authentication procedures, keeping sensitive data safe.

Request and Response Formats

Understanding the structure of requests and responses is vital. We’ll explore how to define the formats developers should follow.

Error Handling

Mistakes happen. Your documentation[3] should guide developers on how to handle errors gracefully.

Rate Limiting and Security

Preventing abuse and ensuring system stability are vital. We’ll cover best practices for rate limiting also security.

Importance of Clarity and Consistency

Effective API documentation is all about clarity and consistency. We’ll share insights into how these principles can streamline integration.

Tips for Writing Effective Payment Gateway API Documentation

Keep It User-Friendly

Complex technical[4] jargon can be daunting. Learn how to make your documentation user-friendly.

Provide Code Examples

Practical examples can be a game-changer. We’ll discuss how to include code snippets to guide developers.

Include FAQs

Anticipating common questions can save time for both developers and your support team.

Keep It Up to Date

APIs evolve, and so should your documentation. Discover how to maintain up-to-date documentation.

Common Challenges in API Documentation

Versioning

Dealing with multiple API versions can be tricky. We’ll explore strategies for versioning in your documentation.

Handling Edge Cases

Not all integrations are straightforward. Learn how to address complex scenarios in your documentation.

Benefits of Well-Structured API Documentation

Effective API documentation offers numerous benefits, from reducing integration time to enhancing troubleshooting efforts. We’ll delve into the advantages of creating clear also comprehensive documentation.

Case Studies: API Documentation Done Right

PayPal

Explore how PayPal’s API documentation sets a high standard for clarity and user-friendliness.

Stripe

Discover how Stripe’s API documentation excels in providing practical examples and maintaining relevance.

The Future of Payment Gateway APIs

As technology continues to advance, payment gateway APIs evolve as well. We’ll take a glimpse into the future, exploring innovations also emerging trends in this field.

Conclusion

In conclusion, creating well-structured payment gateway API documentation is a vital step in ensuring a smooth payment experience for both developers and customers. By following the best practices outlined in this article, you can enhance the integration process[5], reduce support requests, and build trust with your user base.

FAQs

- What is the primary purpose of API documentation for payment gateways?API documentation for payment gateways serves as a comprehensive guide for developers, enabling them to integrate the gateway into their applications seamlessly.

- Why is user-friendliness crucial in API documentation?User-friendly documentation makes it easier for developers to understand and implement the API, reducing integration time and potential errors.

- How often should API documentation be updated?API documentation should be regularly updated to reflect any changes in the API, ensuring accuracy and relevance.

- What are some common security measures discussed in API documentation?API documentation typically covers authentication procedures, error handling, rate limiting, and other security measures to protect sensitive data.

- Can you recommend tools for creating and maintaining API documentation?Popular tools for creating and maintaining API documentation include Swagger, Postman, and Redoc.