AUTHOR : HANIYA SMITH

DATE : 26/10/2023

Introduction

In this era of digital advancements, online transactions have seamlessly woven themselves into the fabric of our daily existence. Whether you’re a business owner or a customer, understanding also payment gateway costs is crucial. In this article, we will delve into the intricacies of payment gateway pricing, helping you make informed decisions for your online transactions.

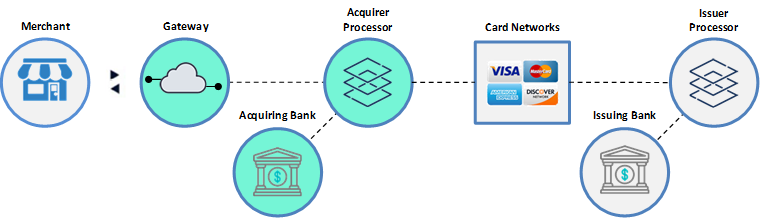

The Role of Payment Gateways

Before we dive into the costs, it’s essential to comprehend the significance of payment gateways. These digital intermediaries facilitate secure online transactions by encrypting sensitive data, authorizing payments, and also ensuring a seamless transfer of funds.

What Determines Payment Gateway Costs?

Payment gateway providers offer various pricing models, and it’s vital to understand also the factors that influence the costs. Here are the key elements:

1. Setup Fees

Most payment gateway providers charge a one-time setup fee. This fee covers the initial configuration and also activation of your account. It can vary significantly from one provider to another.

2. Transaction Fees

Transaction fees are incurred with every successful transaction. These charges may manifest as a predetermined sum for each transaction or as a fraction of the transaction’s total value. Often, it’s a combination of both.

3. Monthly Subscription

Some payment gateways charge a monthly subscription [1]fee. This cost is usually associated with advanced features, and it’s also essential to assess whether these features are necessary for your business.

4. Cross-Border Fees

If your business operates internationally, cross-border fees come into play. These fees are applied when dealing with transactions in foreign currencies or when serving customers from different countries.

5. Chargeback Fees

Chargebacks occur when customers dispute a transaction. Payment gateways may charge a fee for handling also these disputes, which can impact your costs.

Selecting the Right Payment Gateway Provider

Now that you are acquainted with the types of pricing models,[2] it’s crucial to select the right payment gateway provider. Consider the following factors:

1. Business Size

Your business size can greatly influence your choice. Small businesses may find flat-rate pricing more suitable, while larger enterprises may benefit from interchange pricing.

2. Transaction Volume

If your business processes a high volume of transactions, interchange-plus pricing might be the most cost-effective solution, offering transparency and also flexibility.

3. International Operations

For global businesses, cross-border fees and also multi-currency support are essential factors to consider.

Exploring Additional Features

Apart from the core costs, payment gateway providers often offer additional features that can add value to your online business. These features can vary widely, so it’s essential to assess whether they align with your specific requirements. A few examples of the typical supplementary functionalities encompass:

1. Fraud Protection

Many payment gateways provide advanced fraud protection tools to safeguard your business and also customers from fraudulent transactions. While this may come at an extra cost, it’s a valuable investment in the long run.

2. Recurring Billing

If your business relies on subscription-based services or products, the ability to set up recurring billing is a must. Not all payment gateways offer this feature, so ensure it’s available if needed.

3. Mobile Integration

In an increasingly mobile-driven world, having a payment gateway[3] that seamlessly integrates with mobile applications and also websites is vital. This feature ensures a user-friendly experience for mobile users.

4. Reporting and Analytics also

Access to detailed reports and analytics can provide valuable insights into your business’s financial performance. It can help you make data-driven decisions and also optimize your operations.

The Importance of Security

Security is paramount in online transactions. Ensure that your chosen payment gateway prioritizes data encryption and also compliance with industry standards, such as the Payment Card Industry Data Security Standard (PCI DSS). A breach in security not only risks financial loss but also damages your reputation.

Keeping an Eye on Hidden Fees

While payment gateway providers are obligated to disclose their fees transparently, it’s wise to carefully review their terms and conditions. Sometimes, additional or unexpected fees can emerge, such as chargeback fees or fees associated with account termination. Always read the fine print.

Customization and Branding also

Consider how much control you want over the checkout experience. Some payment gateways allow for extensive customization, enabling you to maintain your brand’s identity throughout the payment process.

Maintaining Customer Trust

Your customers’ trust is paramount. Ensure that the payment gateway you choose offers a smooth and secure checkout process. A clunky or complicated payment process can deter customers and also lead to cart abandonment.

Conclusion

Understanding payment gateway costs is vital for the financial health of your online business. [4]Take the time to evaluate your needs and the pricing models available to make an informed decision. A well-chosen payment gateway can streamline your transactions and also contribute to your business’s success.

FAQs

1. Are there any hidden fees associated with payment gateways?

No, payment gateway providers are required to disclose all their fees transparently. However, it’s essential to carefully review their terms and conditions.

2. Can I change my payment gateway provider if I’m not satisfied with the costs?

Yes, you can switch to a different payment gateway provider if you find a better fit for your business needs.

3. Is it necessary to have a payment gateway even for a small online store?

Yes, a payment gateway is crucial for processing online payments securely, regardless of the size of your online store.

4. Are there payment gateway providers that specialize in specific industries?

Yes, some payment gateway providers offer industry-specific solutions. It’s advisable to explore these options if they align with your business niche.

5. Can I negotiate the fees with a payment gateway provider?

In some cases, negotiation is possible, especially for businesses with a significant transaction volume. It’s worth discussing with the provider to find a mutually beneficial arrangement.