AUTHOR : ADINA XAVIER

DATE : 23-10-2023

Introduction

In our increasingly digital world, online transactions have become an integral part[1] of our lives. Whether you’re running an e-commerce website or managing an online service[2], ensuring smooth and secure payment processing[3] is crucial. This is where payment gateways [4]come into play. In this article, we will delve into the world of payment gateways, exploring their features, benefits, and why they are a vital component of online business.[5]

What is a Payment Gateway?

A payment gateway is a technology that facilitates online transactions by connecting the merchant’s website or application with the financial networks responsible for processing payments. It acts as a bridge between the customer and also the merchant, ensuring that sensitive financial information is transmitted securely.

Importance of a Payment Gateway

Payment gateways play a pivotal role in modern commerce. They offer numerous advantages, including real-time transaction processing, secure data transmission, and also broad payment method support. But what features make a payment gateway exceptional?

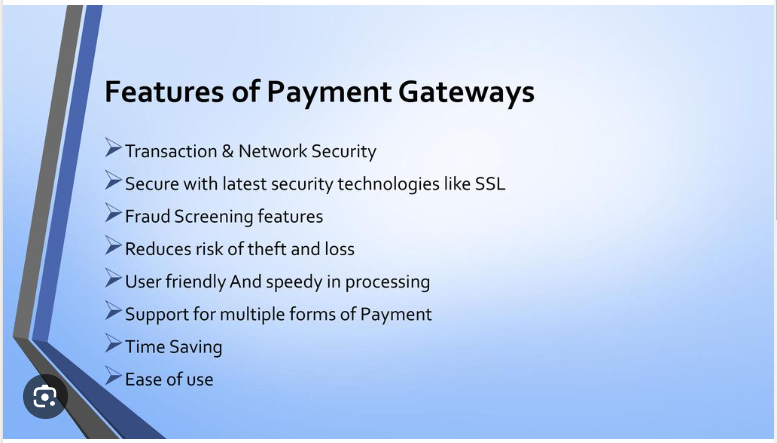

Key Features of a Payment Gateway

Security

Security[1] is paramount in the world of online transactions. A robust payment gateway[2] should offer advanced encryption[3] and also fraud protection. It should also be compliant with industry standards to safeguard both customer data [4]and your business.

Payment Options

Diversity in payment options is a significant feature. Your payment gateway should support various payment methods, including credit [5]and debit cards, digital wallets, and also even cryptocurrencies.

Integration

Seamless integration with your website or application is key. A good payment gateway should have simple APIs and also plugins for popular e-commerce platforms.

User-Friendly Interface

A user-friendly interface ensures a smooth customer experience. Look for a payment gateway that provides a straightforward checkout process and also minimizes cart abandonment.

Choosing the Right Payment Gateway

Selecting the right payment gateway can be a game-changer for your online business. Consider factors like transaction fees, international support, and also the specific needs of your target audience.

How Payment Gateways Work

Payment gateways operate by encrypting sensitive data, authorizing transactions, and also ensuring that funds are transferred from the customer to the merchant’s account. This process happens in a matter of seconds, providing a hassle-free payment experience.

Benefits of Using Payment Gateways

Using payment gateways offers numerous benefits, including increased trust, enhanced security, and also access to a global customer base. It simplifies the payment process, boosting conversion rates.

Challenges in Payment Processing

Payment processing can sometimes be challenging due to technical issues, fraud attempts, or unexpected downtimes. A reliable payment gateway should have measures in place to address these challenges promptly.

Popular Payment Gateway Providers

There are various payment gateway providers in the market. Some of the most renowned ones include:

a. PayPal

PayPal is one of the oldest and also most trusted payment gateways, known for its ease of use and widespread acceptance.

b. Stripe

Stripe is highly popular among businesses of all sizes for its robust features and also developer-friendly tools.

c. Square

Square offers both online and in-person payment solutions, making it a versatile choice.

d. Authorize.Net

Authorize.Net is known for its secure and reliable payment processing.

e. Braintree

Braintree, a PayPal service, provides excellent support for mobile payments and subscription billing.

Trends in Payment Gateway Technology

The payment gateway landscape is constantly evolving. Stay updated on the latest trends, such as biometric authentication, contactless payments, and blockchain technology.

Mobile Payment Gateways

With the increasing use of smartphones, mobile payment gateways have gained prominence. They allow customers to make payments with their mobile devices, providing a convenient and efficient payment method.

E-commerce and Payment Gateways

In the world of e-commerce, payment gateways are the backbone of online transactions. A reliable payment gateway is essential for attracting and retaining customers.

Tips for Secure Online Transactions

To ensure the security of online transactions, follow best practices, such as regularly updating your payment gateway software, educating your team about security, and monitoring transactions for suspicious activity.

Conclusion

In conclusion, payment gateways are a fundamental component of modern online business. They offer a secure, efficient, and user-friendly solution for processing payments. By understanding their features and selecting the right one for your business, you can ensure a smooth and trustworthy payment experience for your customers.

FAQs

1. What is a payment gateway?

- A payment gateway is a technology that facilitates online transactions by connecting the merchant’s website or application with the financial networks responsible for processing payments.

2. Why is security crucial for payment gateways?

- Security is vital to protect sensitive customer data and prevent fraud in online transactions.

3. Which payment gateway providers are popular in the market?

- Popular payment gateway providers include PayPal, Stripe, Square, Authorize.Net, and Braintree.

4. How do mobile payment gateways work?

- Mobile payment gateways allow customers to make payments with their smartphones, providing a convenient and efficient payment method.

5. What are the latest trends in payment gateway technology?

- The latest trends include biometric authentication, contactless payments, and blockchain technology.