AUTHOR : SAYYED NUZAT

DATE : 20-10-2023

Introduction

In today’s fast-paced digital age, the payment landscape[1] in India has seen a remarkable transformation. With the advent of technology, the way people make transactions[2] has evolved significantly. This article delves into the diverse payment platforms[3] in India, exploring the options available for consumers[4], merchants, and businesses[5]. From traditional banking systems to cutting-edge digital wallets, we will unravel the dynamic world of payment solutions.

The Rise of Digital Payments

India, with its burgeoning population and increasing internet penetration, has become a fertile ground for digital payment platforms. As smartphones have become more accessible, the convenience of digital transactions has gained popularity.

Traditional Banking Systems

1. Cash Transactions

Cash[1] transactions, though still prevalent, are gradually making way for digital alternatives. The ease of cash transactions, however, cannot be overlooked.

2. Cheques and Demand Drafts

While less common for everyday transactions, cheques[2] and demand drafts[3] are still widely used in the business sector[4].

Digital Payment Solutions

3. Debit and Credit Cards

Debit and credit cards[5] have long been a popular choice for online and in-store payments. Various banks offer a wide range of credit and debit card options with different features and benefits.

4. Mobile Wallets

Mobile wallets, such as Paytm, PhonePe, and Google Pay, have become extremely popular in India. These digital wallets allow users to store money and make payments using their smartphones.

5. UPI (Unified Payments Interface)

The Unified Payments Interface, commonly known as UPI, is a game-changer in the Indian payment landscape. It enables instant bank-to-bank transfers and is widely used for various transactions, including bill payments and online shopping.

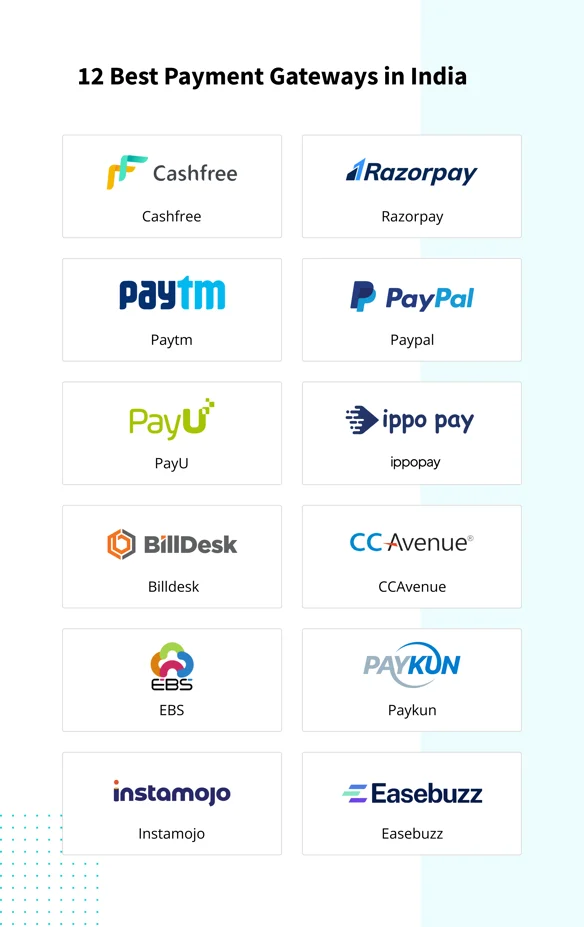

Online Payment Gateways

6. Payment Gateways for E-commerce

E-commerce platforms often integrate payment gateways, allowing customers to make online payments securely. Popular payment gateways include Razorpay, PayU, and CCAvenue.

Evolving Technologies

7. Contactless Payments

The concept of contactless payments has gained traction in India, making it easier for users to make payments without physical contact with the payment terminal.

8. QR Code Payments

QR code payments have gained immense popularity, especially in small businesses and local stores. Customers can scan QR codes to make payments conveniently.

9. Biometric Authentication

The use of biometrics for authentication, such as fingerprint and facial recognition, is becoming increasingly common, adding an extra layer of security to digital transactions.

Challenges and Security

10. Security Concerns

With the growth of digital transactions, the concern for security breaches and fraud has also risen. Payment platforms are continuously working to enhance security measures.

11. Digital Literacy

Despite the rapid digitization, there’s still a need to improve digital literacy among the Indian population to ensure the seamless adoption of payment platforms.

The Future of Payment Platforms

12. Blockchain and Cryptocurrency

The emergence of blockchain technology and cryptocurrencies could revolutionize the payment industry in India, offering faster and also more secure transactions.

13. Integration of Artificial Intelligence

The integration of AI in payment platforms is expected to enhance user experiences and also provide more tailored services.

14. Regulatory Changes

The Reserve Bank of India (RBI) and other regulatory bodies continue to make changes and updates to ensure the safety and also efficiency of payment systems.

Conclusion

The payment platforms in India have come a long way, evolving from traditional banking systems to cutting-edge digital solutions. As the country continues to embrace technology, the future promises even more innovation, security, and convenience in the world of digital transactions.

FAQs

1. What is UPI, and how does it work?

- UPI stands for Unified Payments Interface, a real-time payment system in India. It allows users to transfer money between bank accounts instantly. Users can link their bank accounts to UPI and also make payments through mobile apps.

2. Are digital wallets safe for storing money?

- Yes, digital wallets are considered safe for storing money. They use encryption and security features to protect your funds. However, it’s essential to choose a reputable wallet and follow best practices for security.

3. What are the advantages of contactless payments?

- Contactless payments offer convenience and speed. They reduce the need for physical contact, making transactions faster and more hygienic, which is especially important in today’s context.

**4. How do I report a fraudulent transaction on a payment platform?

- If you notice a fraudulent transaction, contact your bank or the customer support of the payment platform immediately. They will guide you through the process of reporting and also resolving the issue.

**5. Can I use cryptocurrency for everyday transactions in India?

- Currently, the use of cryptocurrency for everyday transactions in India is limited. The regulatory environment is evolving, so it’s essential to stay updated on the latest developments regarding cryptocurrency in the country.