AUTHOR : EMILY PATHAK

DATE : 21 – 09 – 2023

In today’s fast-paced digital world, the payment gateway industry plays a pivotal role in facilitating seamless transactions for businesses and consumers alike. With the increasing demand for online payments, understanding the payment gateway business model becomes crucial for entrepreneurs, merchants, and anyone involved in the e-commerce ecosystem[1].

Introduction: Navigating the Digital Payment Landscape

The world of payments[2] has evolved significantly over the years. The introduction of payment gateways[3] has revolutionized how businesses handle transactions. This article delves into the intricacies of payment gateway business models[4], shedding light on their importance and functionality.

What is a Payment Gateway?

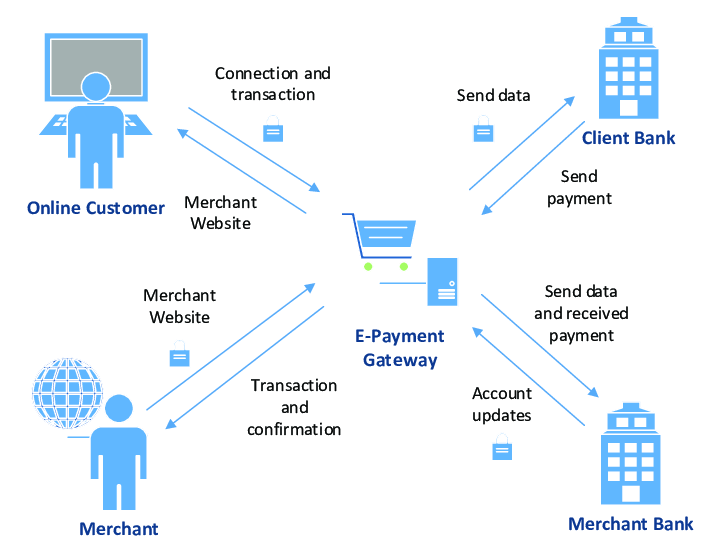

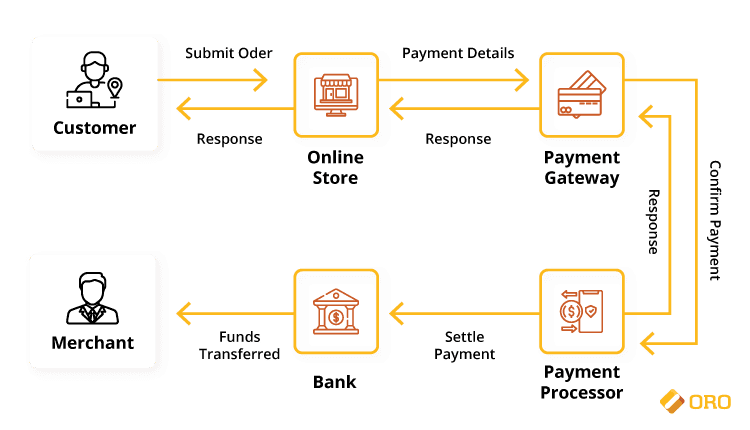

Before we dive deeper, let’s define what a payment gateway is. Simply[5] put, a payment gateway is a technology solution that enables online transactions by securely connecting merchants, banks, and consumers. It acts as a bridge between the seller and also the buyer, ensuring that the payment process is smooth{1} and secure.

Understanding the Basics

To comprehend the payment gateway business model{1}, it’s essential to break it down into its fundamental components:

1. Merchant Integration

Merchants, or businesses, integrate payment gateways{2} into their websites or apps to accept online payments. This integration involves the use of APIs (Application Programming Interfaces) to connect their platform with the payment gateway.

2. Payment Processing

Once a customer makes a purchase, the payment gateway processes{3} the transaction. It encrypts sensitive data, such as credit card information, and securely transmits it to the acquiring bank.

3. Authorization and Settlement

The acquiring bank receives{4} the transaction data and also requests authorization from the customer’s issuing bank. Once approved, the payment gateway settles the funds, transferring them from the customer’s account to the merchant’s account.

Diving Deeper: Payment Gateway Business Models

Payment gateway providers operate under various business models, each with its unique features and revenue streams. Here are some of the most common models:

1. Transaction-Based Model

In this model, payment gateway providers charge a fee for each transaction processed. The fee is usually a percentage of the transaction amount, plus a fixed amount per transaction. This model is popular among small and medium-sized businesses due to its simplicity.

2. Subscription-Based Model

Under the subscription-based model, merchants pay a monthly or annual fee to access the payment gateway’s services. This model is favored by larger enterprises that require a high volume of transactions.

3. Hybrid Model

Some payment gateway providers combine elements of both transaction-based and subscription-based models. They offer tiered pricing plans, allowing merchants to choose the one that best suits their needs.

4. Value-Added Services

Many payment gateways offer additional services, such as fraud prevention, data analytics, and currency conversion. These value-added services generate extra revenue for the providers.

Selecting the correct payment gateway holds immense significance.

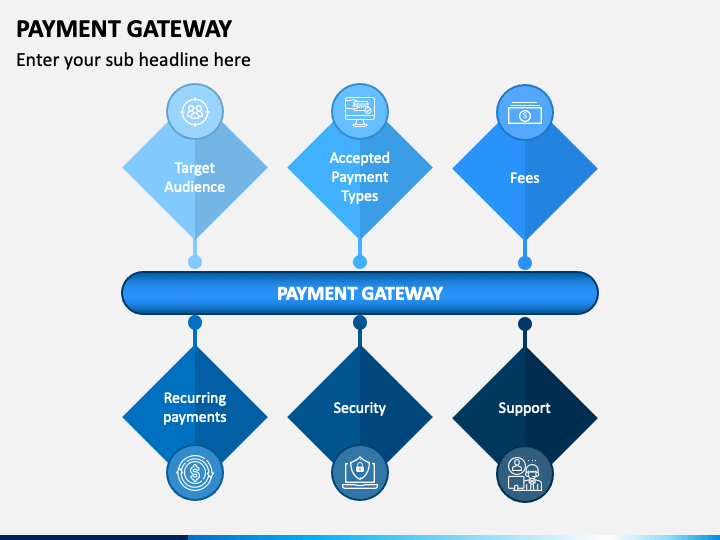

Choosing the most suitable payment gateway for your enterprise is an absolutely pivotal decision. It can impact your revenue, customer satisfaction, and overall success. When evaluating your options for a payment gateway, it’s essential to take into account various factors, such as:

- Security: Ensure that the payment gateway complies with industry security standards to protect customer data.

- Compatibility: Check if the payment gateway is compatible with your e-commerce platform or website.

- Cost: Analyze the fee structure to determine the most cost-effective option for your business.

- Scalability: Consider whether the payment gateway can handle your expected transaction volume as your business grows.

The Evolution of Payment Gateways

The history of payment gateways traces back to the early days of e-commerce when businesses were first venturing into the world of online sales. Initially, these gateways were rudimentary, with limited functionality and security measures. However, as technology advanced, payment gateways evolved to meet the growing demands of both businesses and consumers.

Security Enhancements

One of the most significant advancements in payment gateways is the focus on security. With the rise in cyber threats and online fraud, payment gateway providers invested heavily in encryption technologies, secure data transmission, and robust authentication methods. Today, state-of-the-art security features are integral to any reputable payment gateway.

Global Reach

As e-commerce expanded globally, payment gateways adapted to support transactions in multiple currencies and languages. This globalization has allowed businesses to reach a broader customer base, transcending geographical boundaries.

Integrating Payment Gateways

The process of integrating a payment gateway into an e-commerce website or app has become more streamlined over the years. Most payment gateway providers offer developer-friendly APIs and plugins that make integration relatively straightforward. This accessibility has empowered small businesses to set up online payment systems with ease.

Mobile Payments and Contactless Transactions

In recent years, the surge in mobile device usage has led to the emergence of mobile payment gateways. These gateways enable customers to make purchases using their smartphones, making transactions faster and more convenient. Contactless payments, including NFC technology, have also gained popularity, offering a secure and efficient way to pay.

Challenges in Payment Gateway Business Models

While payment gateways have brought immense convenience to the digital world, they are not without challenges. Some of the common challenges faced by payment gateway providers include:

- Regulatory Compliance: Staying compliant with ever-evolving financial regulations and also data protection laws can be complex and costly.

- Competition: The payment gateway industry is highly competitive, with new players entering the market regularly. Providers must continually innovate to stay relevant.

- Security Threats: Cybersecurity threats are constantly evolving, requiring payment gateways to invest in robust security measures to protect customer data.

- Customer Trust: Building and maintaining trust with customers is essential. Any security breach or data leak can severely damage a payment gateway’s reputation.

Future Trends in Payment Gateways

Looking ahead, several trends are likely to shape the future of payment gateways:

- Blockchain and Cryptocurrency: The adoption of blockchain technology and cryptocurrencies may offer more secure and efficient payment options.

- Artificial Intelligence (AI): AI-powered fraud detection and customer support are expected to become more prevalent in payment gateways.

- Biometric Authentication: Enhanced biometric authentication methods, such as fingerprint and facial recognition, will contribute to enhanced security.

- Enhanced User Experience: Payment gateways will focus on providing a seamless and user-friendly experience to boost customer satisfaction.

Conclusion

In conclusion, the payment gateway business model is a pivotal component of the e-commerce ecosystem. Understanding the various models and factors to consider when choosing a payment gateway can significantly impact the success of your online business.

Remember, selecting a payment gateway is not a one-size-fits-all decision. It requires careful evaluation to ensure it aligns with your business goals and customer needs.

FAQs (Frequently Asked Questions)

- What is the role of a payment gateway in e-commerce?

A payment gateway facilitates online transactions by securely connecting merchants, banks, and consumers, ensuring smooth and secure payments. - How do payment gateway providers generate revenue?

Payment gateway providers generate revenue through transaction fees, subscription fees, value-added services, and hybrid pricing models. - What factors should I consider when choosing a payment gateway for my business?

When selecting a payment gateway, consider factors such as security, compatibility, cost, and scalability to meet your business’s unique needs. - Can a payment gateway handle a high volume of transactions?

Yes, payment gateways are designed to scale and can handle high transaction volumes as your business grows.