AUTHOR : EMILY PATHAK

DATE : 20 – 09 – 2023

In today’s digital age, online transactions[1] have become an integral part of our lives. Whether it’s purchasing your favorite gadgets, subscribing to streaming services, or making bill payments, payment gateways[2] play a pivotal role in ensuring secure and seamless transactions. In this article, we will delve into the intricacies of payment gateway architecture[3], breaking down the complex processes into digestible pieces. Let’s embark on this journey to demystify the technology that powers our online payments[4].

Introduction to Payment Gateways

Payment gateways[5] are the digital equivalents of cashiers in the online world. They serve as the virtual point of sale, facilitating the transfer of funds from the buyer to the seller securely. In essence, payment gateways act as a bridge between various stakeholders in an online transaction.

How Payment Gateways Work

2.1 Understanding the Transaction Flow

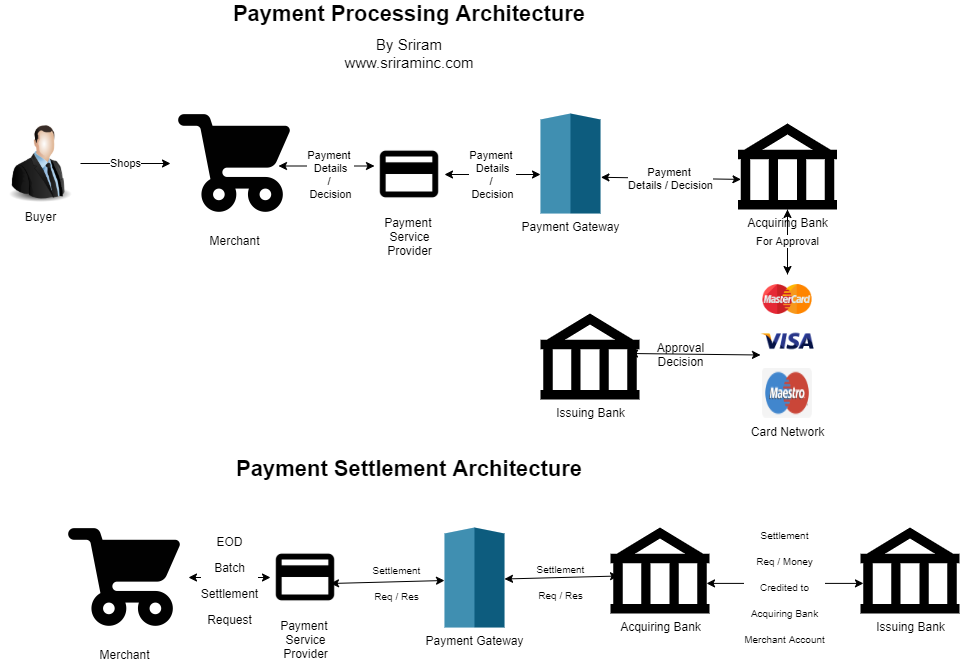

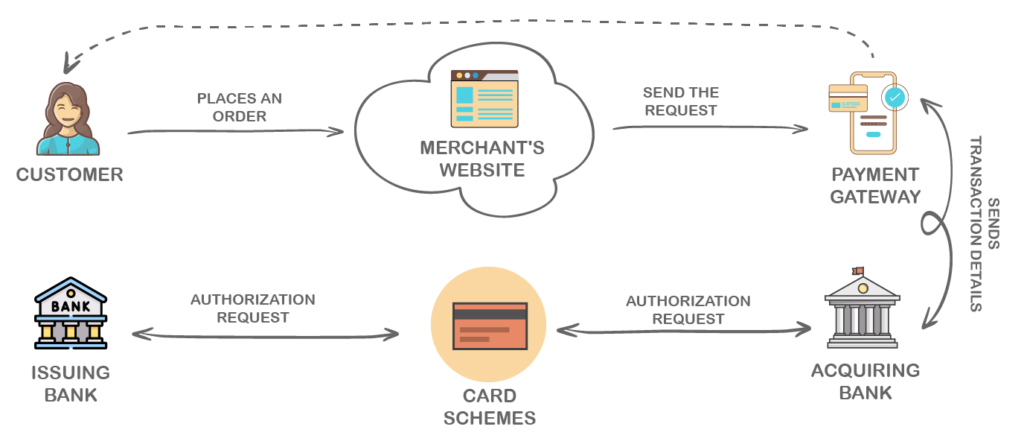

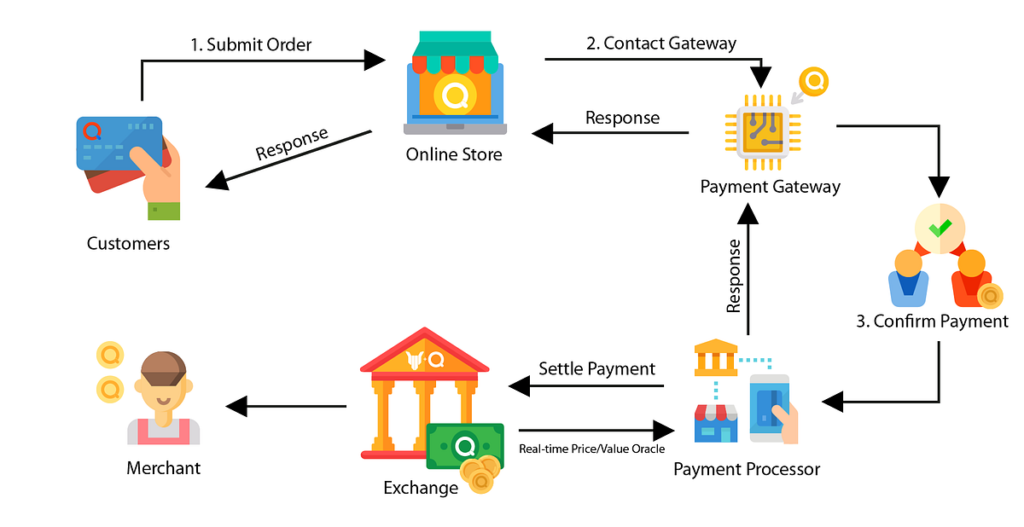

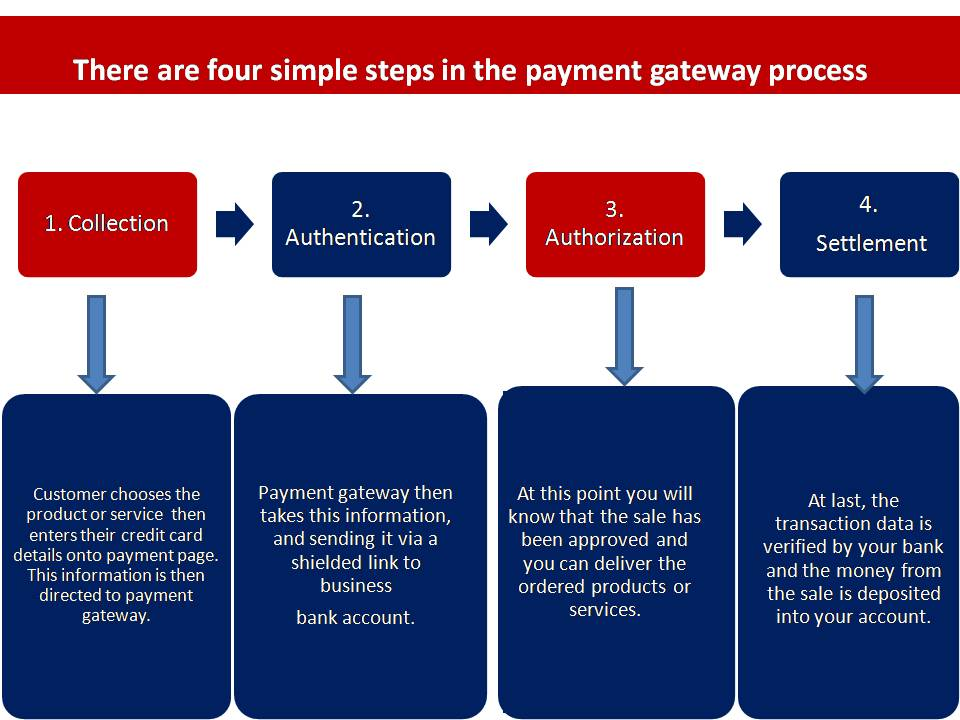

Online transactions involve multiple steps, from the moment a customer hits the “Checkout” button to the completion of the payment. Payment gateways manage this flow by:

- Collecting payment information

- Verifying the authenticity of the transaction

- Routing the transaction to the payment processor

- Authorizing or declining the transaction

- Returning the response to the merchant and customer

2.2 Encryption and Security

Security is paramount in payment gateway architecture{1}. Encrypted communication protocols ensure that sensitive information, such as credit card details, remains confidential during transmission.

2.3 Authorization and Authentication

Payment gateways validate{2} the transaction by communicating with the issuing bank to ensure the buyer has sufficient funds. Authentication mechanisms, like OTPs and biometrics, add an extra layer of security.

Types of Payment Gateways

Payment gateways come in various forms, each catering to different business needs.

3.1 Hosted Payment Gateways

These gateways redirect customers to a secure payment page hosted by the gateway provider.{3} Popular examples include PayPal and Stripe.

3.2 Self-hosted Payment Gateways

Merchants host the payment page {4}on their website, giving them more control over the user experience and branding.

3.3 API Integrated Payment Gateways

API-based gateways allow for seamless integration into the merchant’s website or application, providing a customized checkout experience.

Key Components of Payment Gateway Architecture

To understand payment gateway architecture, it’s essential to know its key components.

4.1 Merchant Account

This is where funds from successful transactions are deposited. Merchants need a merchant account to use a payment gateway.

4.2 Payment Processor

Payment processors are responsible for handling the technical aspects of the transaction, including data transmission and settlement also.

4.3 Payment Gateway Provider

The payment gateway provider connects the merchant’s website with the payment processor and ensures secure data transmission.

The Role of Tokenization

Tokenization replaces sensitive card data with tokens, reducing the risk of data breaches and enhancing security.

Challenges in Payment Gateway Architecture

6.1 Security Concerns

As cyber threats evolve, payment gateways must stay one step ahead to protect customer data.

6.2 Scalability

With the growth of online transactions, payment gateways must scale their infrastructure to handle increased demand.

6.3 Compliance and Regulations

Adhering to strict financial regulations and compliance standards is a continuous challenge for payment gateway providers.

Future Trends in Payment Gateway Architecture

7.1 Mobile Payments

Mobile payment solutions are on the rise, making transactions more convenient for users.

7.2 Cryptocurrency Integration

The acceptance of cryptocurrencies as a payment method is gaining traction, requiring payment gateways to adapt.

7.3 Biometric Authentication

Biometric security measures, such as fingerprint and facial recognition, are becoming more common for authentication.

The Role of Tokenization

One of the critical components in payment gateway architecture is tokenization. This process involves replacing sensitive cardholder data, such as credit card numbers, with a unique token. The token serves as a reference to the actual data, but it cannot be used to reveal the original information. Here’s why tokenization is essential:

- Enhanced Security: By replacing sensitive data with tokens, payment gateways significantly reduce the risk of data breaches. Even if a hacker gains access to the token, it’s useless without the corresponding decryption key.

- Protection from Data Theft: In the event of a data breach, cybercriminals won’t find actual credit card numbers or personal information. This minimizes the damage and potential fraud.

- Reduced Compliance Burden: Tokenization helps businesses comply with strict data protection regulations such as the Payment Card Industry Data Security Standard (PCI DSS). Since sensitive data is not stored, the compliance burden is considerably reduced.

Tokenization is a game-changer in the payment industry, providing a robust layer of security that benefits both merchants and customers.

Challenges in Payment Gateway Architecture

While payment gateways have transformed the way we conduct online transactions, they face various challenges that require continuous adaptation and innovation. Let’s delve deeper into these challenges and examine them with a finer lens:

6.1 Security Concerns

As the landscape of technology advances, so too do the strategies employed by cybercriminals. Payment gateways must stay vigilant against emerging threats such as phishing attacks, malware, and data breaches. Investing in cutting-edge security measures and regular security audits is paramount to maintaining trust with customers.

6.2 Scalability

The global e-commerce landscape is ever-expanding, leading to a surge in online transactions. Payment gateways must be prepared to scale their infrastructure to handle increasing traffic and ensure uninterrupted service. Scalability issues can lead to downtime, which can be detrimental to businesses.

6.3 Compliance and Regulations

Financial regulations and compliance standards are continually evolving. Payment gateway providers must navigate a complex web of regulations to ensure they meet legal requirements. Failure to adhere to regulations can result in monetary penalties, legal entanglements, and harm to a firm’s standing.

Adhering to these challenges requires not only technical expertise but also a deep understanding of the regulatory landscape.

Future Trends in Payment Gateway Architecture

The world of payment gateway architecture is dynamic, with several exciting trends shaping its future:

7.1 Mobile Payments

Mobile payment solutions are gaining widespread adoption. With the increasing use of smartphones, consumers prefer the convenience of making payments through mobile apps and digital wallets. Payment gateways are evolving to support these mobile payment methods seamlessly.

7.2 Cryptocurrency Integration

Cryptocurrencies, such as Bitcoin and Ethereum, are gradually becoming mainstream. Payment gateways are exploring ways to integrate cryptocurrencies as a payment option, catering to users who prefer digital currencies.

7.3 Biometric Authentication

Biometric authentication methods, such as fingerprint recognition and facial scanning, are gaining traction. These methods provide an extra layer of security and a seamless user experience, as customers can authorize payments with a touch or glance.

In conclusion, payment gateway architecture plays a pivotal role in the world of online transactions. It ensures that our digital payments are not only secure but also efficient. As technology continues to advance, we can expect payment gateways to evolve further, offering even more convenience and security to users and businesses alike

Conclusion

Payment gateway architecture is the unsung hero of online transactions, ensuring that our digital payments are smooth and secure. As technology advances, we can expect even more innovative solutions to further simplify and enhance the online payment experience.

Frequently Asked Questions (FAQs)

- What is a payment gateway’s primary function?

- A payment gateway’s primary function is to facilitate secure online transactions by acting as a bridge between buyers, sellers, and also payment processors.

- How do payment gateways ensure security?

- Payment gateways ensure security through encryption, authentication mechanisms, and tokenization of sensitive data.

- What are the different types of payment gateways?

- There are three main types of payment gateways: hosted, self-hosted, and API integrated.

- What challenges do payment gateway providers face?

- Payment gateway providers face challenges related to security, scalability, and also compliance with financial regulations.

- What is the future of payment gateway architecture?

- The future of payment gateway architecture includes trends like mobile payments, cryptocurrency integration, and also biometric authentication, making transactions more convenient and secure.