AUTHOR : ADINA XAVIER

DATE : 20/09/2023

In today’s digital age, where e-commerce[1] is booming, ensuring seamless online transactions[2] is vital for businesses. One key player in this ecosystem that often remains behind the scenes is the Payment Gateway Aggregator[3]. In this article, we’ll delve into the world of Payment Gateway Aggregators[4], uncovering their significance, functionality, and how they benefit both businesses also consumers[5].

1. Introduction

In the realm of online transactions, a Payment Gateway Aggregator plays a pivotal role in ensuring that your payments are processed smoothly. But what exactly is , and why should you care?

2. What is a Payment Gateway Aggregator?

A Payment Gateway Aggregator is a service provider that acts as an intermediary between e-commerce businesses also multiple payment processors. Instead of dealing with individual payment processors, businesses can simplify their payment processes by connecting with a Payment Gateway Aggregator.

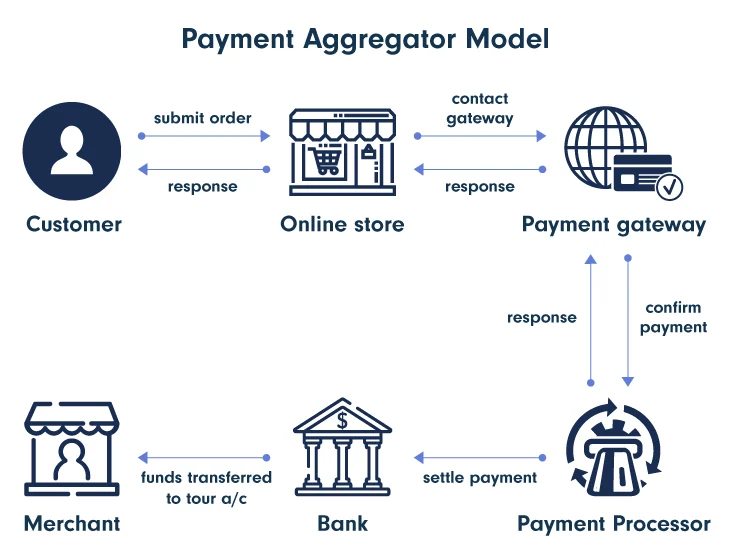

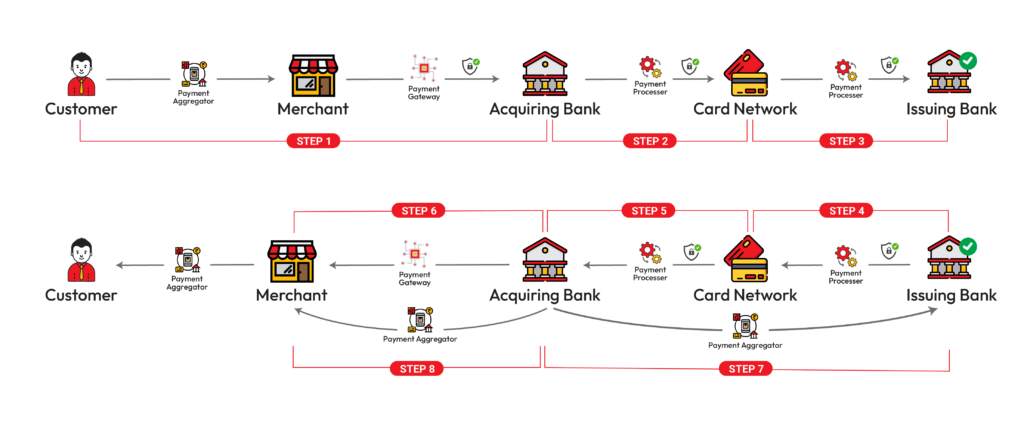

3. How Payment Gateway Aggregators Work

It consolidate transactions from multiple businesses also route them to the appropriate payment processor. This simplifies the payment process[1], reducing the complexity of handling various payment methods.

4. Benefits

4.1 Cost-Efficiency

This often offer competitive pricing, making it cost-effective for businesses to accept a variety of payment methods.

4.2 Streamlined Onboarding

Setting up with is typically faster and easier compared to individual payment processor onboarding.

4.3 Enhanced Security

Many prioritize security, offering advanced fraud detection[2] also encryption measures.

5. Choosing the Right Payment Gateway Aggregator

Selecting the best for your business requires careful consideration of factors like transaction fees, supported payment methods, also security features.

6. Setting Up a Payment Gateway Aggregator

Let’s explore the step-by-step process of setting up for your e-commerce business.

7. Integrating Payment Gateway Aggregators

Discover how seamless integration with your website or app can enhance the overall customer experience.

8. Common Challenges and Solutions

8.1 Transaction Failures

Learn how to tackle transaction failures also minimize revenue loss.

8.2 Security Concerns

Addressing security concerns is crucial. We’ll discuss best practices for keeping your transactions safe.

8.3 Technical Glitches

Explore common technical issues also how to troubleshoot them effectively.

9. The Future

What does the future hold for Payment Gateway Aggregators? We’ll explore emerging trends also technologies.

10. Case Studies: Success Stories

Discover how businesses have thrived by leveraging to their advantage.

11. Key Players in the Industry

Explore some of the prominent players in the landscape.

The Role of Subscription Services

This have become invaluable for businesses that offer subscription-based services. Whether it’s a streaming platform, a software-as-a-service (SaaS) provider, or a monthly subscription box service, the ability to handle recurring payments[3] efficiently is crucial. It simplify the subscription billing process, automating recurring charges also ensuring that subscribers have a seamless experience.

Scalability and Payment Gateway Aggregators

This are designed with scalability in mind. They can handle increased transaction loads without compromising on performance. This scalability is vital for businesses experiencing rapid expansion also ensures that they can continue to provide a smooth payment experience for customers.

Payment Gateway Aggregators and Mobile Commerce

With the increasing popularity of mobile shopping, businesses must adapt to meet the demands of mobile consumers. This often offer mobile-friendly solutions, allowing businesses to accept via mobile apps also websites seamlessly. This accessibility is crucial for tapping into the vast mobile commerce market.

Regulatory Compliance

Payment processing[4] is subject to various regulations also compliance standards. This stay up-to-date with these regulations and ensure that businesses using their services remain compliant. This saves businesses from the complexities of regulatory compliance, such as PCI DSS (Payment Card Industry Data Security Standard) requirements.

Data Analytics

In addition to processing payments, it provide valuable data and analytics insights. They offer businesses access to transaction data, allowing them to gain insights into customer behavior, purchase patterns, and other valuable information.

API Integration and Customization

For businesses with unique needs, it often offer API (Application Programming Interface) integration and customization options. This allows businesses to tailor the payment process to their specific requirements, creating a more personalized and branded payment experience for customers.

Continuous Innovation in Payment Technology

The payment landscape is constantly evolving, with new technologies and payment methods emerging regularly. This are at the forefront of this innovation, integrating new payment options such as digital wallets, cryptocurrencies[5], and contactless payments. Staying updated with these innovations ensures that businesses can cater to the preferences of modern consumers.

12. Conclusion

In a world where online payments are the norm, Payment Gateway Aggregators have emerged as indispensable tools for businesses of all sizes. Their ability to simplify transactions, enhance security, and reduce costs make them an essential part of the digital commerce ecosystem.

13. FAQs

Q1. Are Payment Gateway Aggregators the same as payment gateways?

No, they are not the same. This aggregate transactions from multiple businesses, while payment gateways facilitate individual transactions.

Q2. How do Payment Gateway Aggregators handle international payments?

It often support multiple currencies and have partnerships with international payment processors, making cross-border transactions seamless.

Q3. Is it safe to use for online businesses?

Yes, reputable Payment Gateway Aggregators prioritize security and employ robust encryption and fraud detection mechanisms.

Q4. Can I switch easily?

Switching Payment Gateway Aggregators can be done, but it requires careful planning and integration to minimize disruptions.

Q5. How do this impact the user experience?

By simplifying payment processes and offering various payment options, it can significantly improve the user experience on e-commerce websites.