AUTHOR : ADINA XAVIER

DATE : 20/09/2023

In the rapidly evolving world of digital business[1], companies are continually exploring creative methods to optimize their processes and elevate customer interactions. One area that has seen significant transformation[2] is payment processing[3]. Traditional payment[4] methods have given way to modern, more efficient solutions; one such solution that has gained prominence is Payment as a Service” (PaaS)[5]. In this article, we will delve into the world of payment as a service solutions, exploring their benefits, implementation, and role in shaping the future of financial transactions.

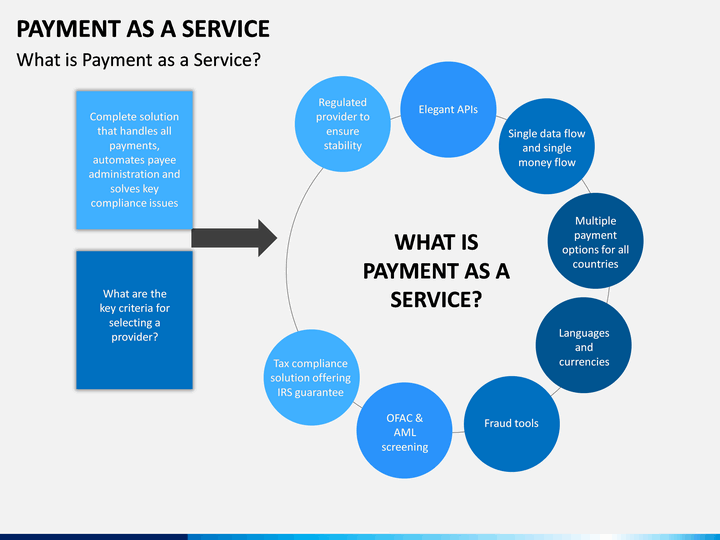

Understanding Payment as a Service Solution (PaaS)

Payment as a Service solution , often abbreviated as PaaS, is a comprehensive payment processing solution that allows businesses to outsource their payment infrastructure to a third-party provider. This service encompasses everything from payment gateways also transaction processing to security and compliance, offering a holistic approach to managing financial transactions.

The Key Components of PaaS

- Payment Gateway Integration: PaaS providers offer seamless integration with various payment gateways, enabling businesses to accept payments from a wide range of sources, including credit cards, debit cards, also digital wallets.

- Transaction Processing: PaaS solutions are equipped with robust transaction processing capabilities, ensuring that payments are processed swiftly also accurately.

- Security and Compliance: Security is paramount in the world of payments. PaaS providers adhere to stringent security standards and compliance regulations, safeguarding sensitive customer data.

- Reporting and Analytics: PaaS solutions provide businesses with valuable insights through comprehensive reporting also analytics tools, helping them make data-driven decisions.

Advantages of Implementing PaaS

1. Enhanced Efficiency

By adopting it, businesses can streamline their payment processes[1], reducing manual intervention also minimizing errors. This, in turn, leads to increased operational efficiency.

2. Cost Savings

Outsourcing[2] payment processing to a PaaS provider eliminates the need for costly in-house infrastructure. This cost-effective approach can lead to significant savings for businesses.

3. Scalability

PaaS solutions are highly scalable, making them suitable for businesses of all sizes. As your business grows, the payment infrastructure can easily adapt to accommodate increased transaction volumes.

4. Improved Customer Experience

A smooth and secure payment process is essential for customer satisfaction. PaaS solutions offer a seamless payment experience, enhancing customer trust also loyalty.

Implementing Payment as a Service Solution

To implement Payment as a Service within your organization, follow these steps:

1. Research and Selection

Begin by researching reputable PaaS providers. Consider factors such as pricing, security measures, and compatibility with your existing systems. Choose a provider that aligns with your business needs.

2. Integration

Work closely with your chosen PaaS provider to integrate their solution into your existing infrastructure. Ensure that the integration process is seamless also thoroughly tested.

3. Training

Train your staff on how to use the new payment system effectively. This step is crucial to ensure that your team can navigate the system with ease.

4. Monitoring and Optimization

Regularly monitor the performance of your payment processing system. Optimize it based on data insights to ensure it continues to meet your business requirements.

The Future of Payment Processing

As businesses continue to embrace digital transformation, Payment as a Service is poised to play a pivotal role in shaping the future of payment processing. Its ability to provide secure, efficient, also scalable solutions makes it an indispensable tool for modern businesses.

PaaS and the E-commerce Revolution

In an era dominated by e-commerce[3], where online shopping has become the norm, the importance of a smooth and secure payment process cannot be overstated. PaaS has emerged as a game-changer for e-commerce businesses, providing them with the tools they need to thrive in a highly competitive market.

Seamless Checkout Experience

One of the primary challenges faced by online retailers[4] is shopping cart abandonment. Frequently, shoppers abandon their carts as a result of a complex or protracted checkout procedure. PaaS solutions offer a simplified and user-friendly checkout experience, reducing the likelihood of cart abandonment and increasing conversion rates.

Global Expansion

For e-commerce businesses looking to expand their reach internationally, PaaS is a valuable asset. These solutions support a wide range of payment methods also currencies, making it easier for businesses to cater to a global customer base.

Fraud Prevention

Online businesses are vulnerable to payment fraud, which can result in substantial financial losses. PaaS providers employ advanced fraud prevention[5] measures, including real-time transaction monitoring also machine learning algorithms, to detect and prevent fraudulent activities.

The Role of PaaS in Subscription Services

Subscription-based business models have gained immense popularity in recent years, from streaming services to subscription boxes. Managing recurring payments and billing cycles can be complex, but PaaS simplifies the process.

CONCLUSION

In conclusion, Payment as a Service (PaaS) offers a comprehensive solution to the evolving payment processing landscape. It empowers businesses to streamline their operations, enhance customer experiences, and adapt to the ever-changing demands of the digital age. By embracing PaaS, businesses can unlock new levels of efficiency and competitiveness in the marketplace.

FAQs

1. What is Payment as a Service?

Payment as a Service (PaaS) is a payment processing solution that allows businesses to outsource their payment infrastructure to a third-party provider. It encompasses payment gateway integration, transaction processing, security, and compliance.

2. How can PaaS benefit my business?

PaaS offers enhanced efficiency, cost savings, scalability, also improved customer experiences. It can streamline payment processes, reduce costs, also provide a secure and seamless payment experience for your customers.

3. Is PaaS suitable for small businesses?

Yes, PaaS solutions are highly scalable also can be adapted to businesses of all sizes. Small businesses can benefit from the cost savings also efficiency improvements offered by PaaS.

4. Are PaaS solutions secure?

Yes, PaaS providers adhere to strict security standards and compliance regulations to ensure the security of sensitive customer data.

5. What is the future of payment processing with PaaS?

The future of payment processing lies in the continued adoption of PaaS solutions. As businesses seek more efficient also secure payment options, PaaS will play a pivotal role in shaping the landscape of financial transactions.