AUTHOR : ADINA XAVIER

DATE : 21/09/2023

In today’s digital age, the world of commerce has shifted dramatically towards online platforms[1]. As businesses strive to adapt to this ever-evolving landscape, understanding the intricacies of payment gateways[2] and merchant accounts[3] has become paramount. This article will take you on a journey through the world of payment processing[4], shedding light on the key concepts also differences between payment gateways and merchant accounts.[5]

What is a Payment Gateway?

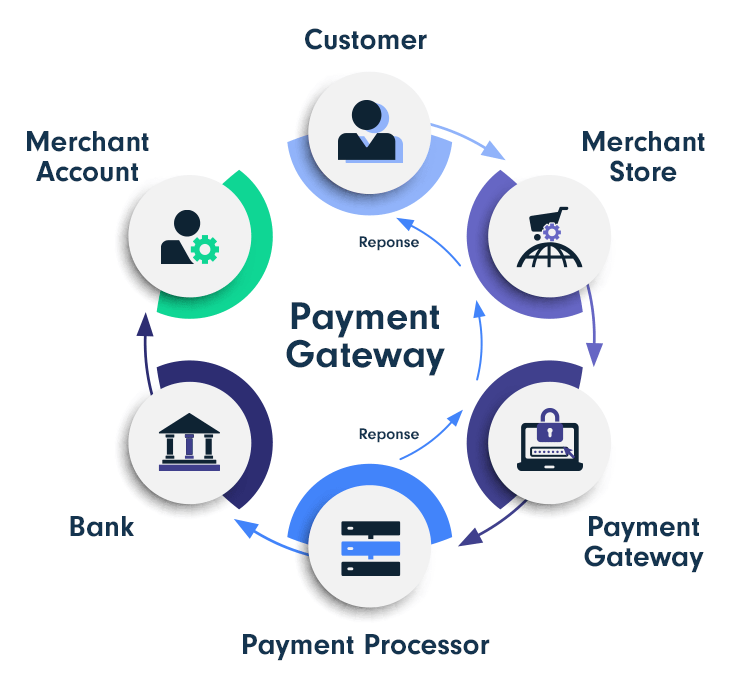

A payment gateway is like the digital bouncer at the entrance of an online store, ensuring that each transaction is smooth also secure. It acts as a bridge between a customer’s bank also the merchant’s website, allowing for the transfer of payment information.

Types of Payment Gateways

There are various types of payment gateways available, including hosted entrance and integrated gateways. Hosted gateways redirect customers to a secure payment page, while integrated gateways allow customers to complete transactions without leaving the merchant’s website.

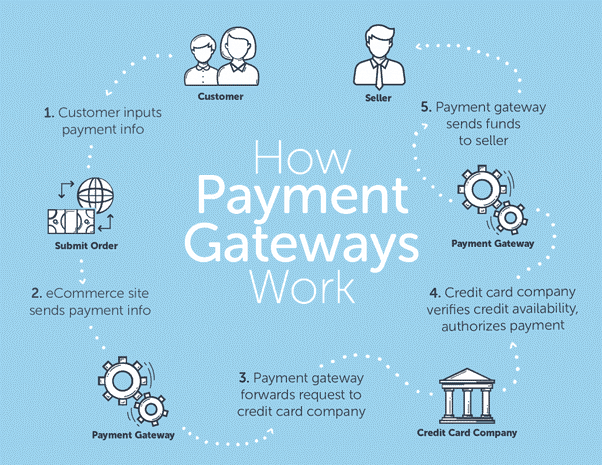

How Does a Payment Gateway Work?

- It encrypts sensitive information like credit card numbers to protect against fraud.

- It checks if the funds are available in the customer’s account.

- It authorizes the transaction.

- It sends a confirmation to the merchant and the customer.

The Significance of a Merchant Account

A merchant account is essentially a holding place for funds collected from customer payments. It acts as an intermediary between the payment gateway[1] also the business owner’s bank account.

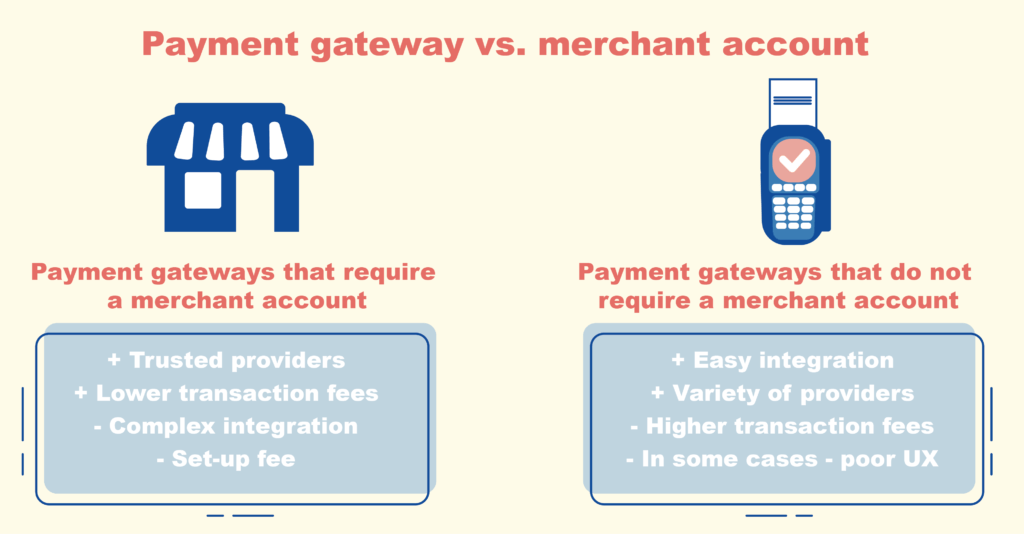

Merchant Account vs. Payment Gateway

While payment gateways facilitate transactions, merchant accounts store and manage the funds. Think of the payment gateway as the cashier at a store, also the merchant account as the cash register where the money is collected.

Setting Up a Payment Gateway and Merchant Account

Setting up these crucial components requires careful consideration.

Choosing the Right Payment Gateway

Selecting the right payment gateway involves assessing factors like fees, supported payment methods[2], also security features.

Applying for a Merchant Account

To acquire a merchant account[3], businesses must typically go through a thorough application process, which may include credit checks also underwriting.

Integration and Security

Ensuring the seamless integration of your payment gateway and maintaining robust security measures is essential.

Ensuring Payment Gateway Integration

Proper integration with your website is vital to ensure a hassle-free shopping experience for customers. Test thoroughly to iron out any glitches.

Security Measures for Merchant Accounts

Implementing security measures such as encryption and PCI compliance safeguards both your business and your customers’ sensitive data.

Transaction Process Explained

Understanding the step-by-step transaction process is crucial for businesses.

Step 1: Authorization

During this stage, the payment gateway verifies the customer’s payment details.

Step 2: Batching

Multiple transactions are grouped into a batch for processing.

Step 3: Clearing

The money is moved from the customer’s bank to the merchant’s account.

In the end, the money is placed into the merchant’s bank account.

Fees and Costs

Both payment gateways and merchant accounts come with associated fees.

Payment Gateway Fees

These may include setup fees, transaction fees[4], also monthly service charges.

The Future of Payment Processing

The payment processing landscape is continuously evolving, with innovative trends shaping the industry’s future.

1. Mobile Wallets

Mobile wallets have gained tremendous popularity as a convenient and secure way to make payments using smartphones. Services like Apple Pay, Google Pay, and Samsung Pay allow users to store their credit card information securely also make contactless payments at supported merchants. As more consumers adopt mobile wallets, businesses must ensure their payment gateways are compatible with these systems to stay competitive.

2. Cryptocurrency Integration

The rise of cryptocurrencies[5] like Bitcoin and Ethereum has opened up new avenues for online payments. Certain enterprises have started embracing cryptocurrencies as a valid mode of payment. Payment gateways that support cryptocurrency transactions enable these businesses to tap into a global customer base and benefit from the speed and security of blockchain technology.

3. Biometric Authentication

Security is paramount in online transactions, and biometric authentication methods such as fingerprint and facial recognition are becoming more prevalent. Payment gateways are increasingly integrating biometric verification, enhancing the security of transactions also reducing the risk of fraud.

4. Cross-Border Transactions

With the global nature of e-commerce, businesses often engage in cross-border transactions. Payment gateways that offer multi-currency support and seamless international payments are crucial for expanding businesses looking to reach a global audience. Streamlining the process of accepting payments in different currencies is essential for reducing conversion costs and providing a better customer experience.

5. Subscription and Recurring Payments

Many businesses now offer subscription-based services or products, which require recurring payments. Payment gateways that support subscription management simplify billing processes, reducing administrative overhead also ensuring a steady revenue stream for businesses.

Conclusion

In conclusion, payment gateways and merchant accounts are the backbone of online transactions. Businesses must carefully select their payment gateway, establish a merchant account, and prioritize security. By understanding the transaction process and associated fees, you can navigate the world of payment processing with confidence.

FAQs

1. What is the main function of a payment gateway? A payment gateway facilitates online transactions by encrypting payment information and authorizing payments.

2. Can I use any payment gateway with my website? No, you should choose a payment gateway that aligns with your business needs and integrates seamlessly with your website.

3. What is a chargeback, and how can I handle it?A chargeback is initiated when a customer raises concerns about a particular transaction. Handling it involves providing evidence to support your case.

4. Are there alternatives to traditional payment gateways and merchant accounts? Yes, alternatives like mobile wallets and cryptocurrencies are becoming increasingly popular.

5. How can I ensure the security of customer payment data? Implementing encryption and adhering to PCI compliance standards are key to securing customer payment data.