AUTHOR : HANIYA SMITH

DATE :14/09/2023

In the fast-paced world of e-commerce, businesses often find themselves facing unexpected challenges, especially when it comes to payment processing[1]. One such challenge is the classification of being a high-risk merchant.[2] If you’re operating in Europe and fall into this category, it’s crucial to understand the intricacies of high-risk merchant services [3]to ensure the smooth flow of your business operations. In this article, we’ll explore what high-risk merchant services are, why your business might be considered high-risk, and how to navigate this complex landscape effectively.

1. Understanding High Risk Merchant Services

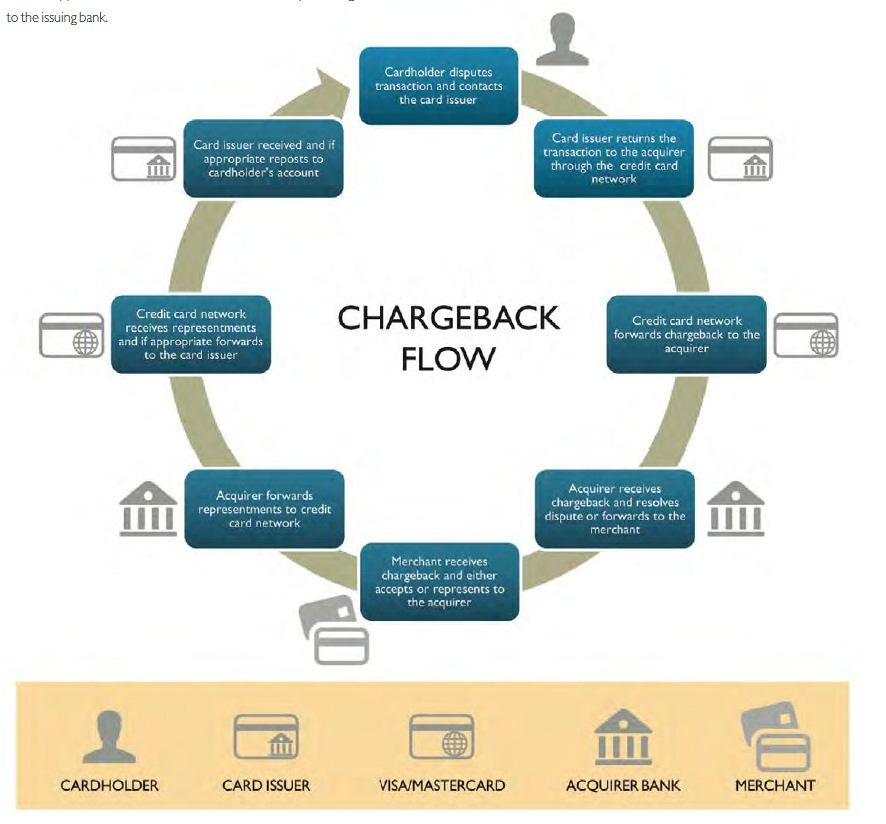

High-risk merchant services refer to financial services tailored to businesses operating in industries prone to a higher degree of risk and chargebacks. These services are designed to accommodate the unique needs and also challenges faced by such businesses, allowing them to accept payments from customers[4] securely.

2. Why Businesses Are Classified as High-Risk

Several factors can lead to a business being categorized as high-risk, including[5]:

- Industry Type: Certain industries, like adult entertainment, online gaming, and cryptocurrency, are inherently riskier due to regulatory scrutiny or a history of high chargeback rates.

- Credit History: If a business has a poor credit history or a record of excessive chargebacks, it may be deemed high-risk.

- International Operations: Companies that engage in cross-border transactions often face higher risk due to currency fluctuations and also varying regulations.

3. High-Risk Industries in Europe

In Europe, high-risk industries encompass a wide range of businesses, including online gambling, pharmaceuticals, and nutraceuticals. These industries face greater scrutiny and also may find it challenging to secure traditional payment processing solutions.

4. Challenges Faced by High-Risk Merchants

High-risk merchants in Europe encounter several challenges, such as:

- Limited Payment Options: Many traditional payment processors may refuse to work with high-risk businesses, leading to a restricted choice of payment options.

- Higher Processing Fees: Due to the elevated risk, high-risk merchants often face higher processing fees and rolling reserves.

- Regulatory Hurdles: Compliance with European and also international regulations can be a complex and costly endeavor.

5. Finding the Right Payment Processor

Selecting the right payment processor is crucial for high-risk merchants. Look for a processor with experience in your industry, a strong reputation, and a willingness to work with high-risk businesses.

6. High-Risk Merchant Account Requirements

To open a high-risk merchant account in Europe, you’ll typically need:

- A registered business entity

- A secure, functional website

- Clear and transparent terms and conditions

- Strong anti-fraud measures in place

7. Mitigating Risk and Reducing Chargebacks

To reduce the risk of chargebacks, implement stringent fraud prevention measures, provide excellent customer service, and also clearly communicate your refund and return policies.

8. The Role of Payment Gateways

Payment gateways play a vital role in facilitating secure transactions. Choose a payment gateway that offers robust security features and also integrates seamlessly with your chosen payment processor.

9. Benefits of High-Risk Merchant Services

While the challenges are evident, high-risk merchant services[1] in Europe offer several benefits, including:

- Access to a broader customer base

- Specialized risk management tools

- Tailored payment solutions

- Expert guidance on compliance

10. Selecting the Right Service Provider

Research potential service providers thoroughly. Read reviews, ask for references, and also compare pricing structures to ensure you make an informed decision.

11. The Cost of High-Risk Merchant Services

High-risk merchant services[2] may come at a higher cost compared to standard services. However, the benefits of risk mitigation and also access to a larger customer base often outweigh the expenses.

12. Regulations and Compliance

Stay updated on the continuously changing regulatory environment in Europe.Compliance with data protection and also financial regulations is essential to avoid legal issues.

13. Case Studies: Success Stories

Learn from the experiences of successful high-risk merchants who navigated the complex landscape and achieved sustainable growth.

14. Common Myths About High-Risk Merchants

Dispelling myths surrounding high-risk merchants[3] is crucial. These businesses can thrive with the right strategies and also partnerships in place.

15. Conclusion: Navigating Success in the High-Risk Landscape

In conclusion, being classified as a high-risk merchant in Europe doesn’t have to be a roadblock to your business success. With the right knowledge, strategies, and partnerships, you can thrive in this complex landscape.

FAQs

- What is a high-risk merchant account? A high-risk merchant account[4] is a specialized financial service designed for businesses operating in industries prone to higher risk and chargebacks.

- How can I reduce chargebacks as a high-risk merchant? Implement strict fraud prevention measures, provide excellent customer service, and also clearly communicate your refund and return policies.

- What industries are considered high-risk in Europe? Industries like online gambling, pharmaceuticals, and also nutraceuticals are often categorized as high-risk in Europe.

- Are high-risk merchant services expensive? Yes, high-risk merchant services may come at a higher cost due to the increased risk, but they offer specialized solutions to mitigate that risk.

- What should I look for in a high-risk payment processor? Look for a processor with experience in your industry, a strong reputation, and also a willingness to work with high-risk businesses.