AUTHOR : SAYYED NUZAT

DATE : 04-09-2023

In today’s fast-paced digital world, businesses are constantly[1] seeking ways to streamline their operations and also enhance customer experiences[2]. One crucial aspect that can make or break a business is its payment processing[3] system. Enter the White Label Payment Gateway Solution, a powerful tool that has been revolutionizing the way businesses handle payments. In this comprehensive guide, we will delve into the world of White Label Payment Gateway Solutions[4], exploring what they are, how they work, and why they are essential for modern businesses.

Introduction

Understanding Payment Gateways

Payment gateways are the virtual bridges that facilitate transactions[5] between customers and businesses in the digital landscape. They serve as the crucial link that securely transmits payment information from the customer to the merchant, ensuring a seamless and also secure process.

What is a White Label Payment Gateway?

A Brief Overview

A White Label Payment Gateway is a versatile payment processing solution that allows businesses to integrate payment functionality [1]into their platforms while retaining full control over the branding and user experience.

How White Labeling Works

White labeling involves a provider offering its payment gateway infrastructure to businesses, allowing them to customize it with their own branding elements such as logos and color schemes. This creates a seamless payment experience [2]that aligns with the business’s identity.

Advantages of White Label Payment Gateways

Customization and Branding

One of the primary advantages of using a White Label Payment Gateway is the ability to tailor the payment process to align with the business’s branding, creating a consistent and also trustworthy experience for customers.

Cost-Efficiency

White Label solutions often prove to be cost-effective, as they eliminate the need for businesses to develop their payment infrastructure from scratch, saving both time and money.

Enhanced Security

White Label gateways typically come with robust security features, including PCI DSS compliance and also advanced fraud detection mechanisms, ensuring that customer data remains safe.

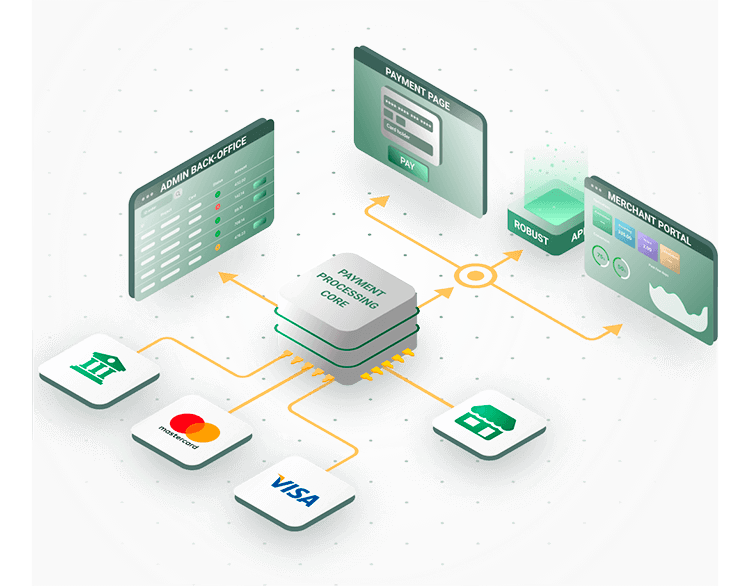

How Does a White Label Payment Gateway Work?

The Transaction Process

The transaction process[3] involves several key steps, including authorization, capturing, and also settlement, ensuring that funds move seamlessly from the customer’s account to the merchant’s.

Integration Methods

Businesses can integrate White Label Payment Gateways[4] using various methods, including API integration, hosted payment pages, and also mobile SDKs, providing flexibility to suit different platforms.

Choosing the Right White Label Payment Gateway

When selecting a White Label Payment Gateway, businesses should consider factors such as transaction fees, compatibility with their platforms, and support for multiple payment methods. Popular providers in this space include XYZ Payments and ABC Transactions.

Benefits for Businesses

White Label Payment Gateways offer numerous benefits to different types of businesses:

- E-commerce Stores: Streamlined checkout processes lead to increased conversions and sales.

- Subscription-Based Services: Seamless recurring billing ensures customer retention.

- Mobile Applications: Mobile-friendly payment solutions enhance user experiences.

Challenges and Solutions

While White Label Payment Gateways offer numerous advantages, they also come with challenges, such as technical issues and regulatory compliance. However, these challenges can be overcome with proper planning and support from the gateway provider.

Future Trends

The payment landscape is continually evolving, with trends like contactless payments and cryptocurrency integration gaining traction. White Label Payment Gateways are poised to adapt to these changes, ensuring businesses stay at the forefront of payment technology.

Case Studies

Several businesses have successfully implemented White Label Payment Gateways, achieving higher customer satisfaction, increased revenue, and improved operational efficiency. These case studies highlight the real-world benefits of adopting this payment solution.

Steps to Integrate a White Label Payment Gateway

Integrating a White Label Payment Gateway involves steps such as setting up an account with the provider, selecting the integration method that suits the business, and implementing the necessary code or plugins.

Security Measures

To ensure the security of customer data and transactions, businesses must adhere to Payment Card Industry Data Security Standard (PCI DSS) compliance and implement fraud detection measures provided by the gateway.

Customer Experience

A seamless and convenient checkout process, coupled with multiple payment options, enhances the overall customer experience, fostering loyalty and trust.

ROI and Revenue Growth

Businesses can measure the return on investment (ROI) of their White Label Payment Gateway implementation by tracking metrics like transaction success rates and customer satisfaction. This data can inform strategies for scaling and revenue growth.

Common Myths Debunked

Misconceptions about White Label Payment Gateways can hinder adoption. This section addresses common myths, clarifying the benefits and dispelling any concerns businesses may have.

Conclusion

The Future of Payment Processing

In conclusion, White Label Payment Gateways offer businesses a powerful tool to enhance payment processing, improve customer experiences, and drive revenue growth. As the payment landscape continues to evolve, businesses that embrace these solutions will stay ahead in the competitive digital marketplace.

FAQs (Frequently Asked Questions)

- What is a White Label Payment Gateway?

- A White Label Payment Gateway is a payment processing solution that businesses can customize with their branding while offering secure and seamless transactions.

- How does White Labeling work?

- White Labeling involves a provider offering its payment infrastructure for businesses to customize with their branding elements.

- What are the advantages of White Label Payment Gateways?

- The advantages include customization, cost-efficiency, and enhanced security.

- How can businesses choose the right White Label Payment Gateway?

- Factors to consider include transaction fees, platform compatibility, and support for various payment methods.

- What is PCI DSS compliance?

- PCI DSS compliance is a set of security standards that businesses must follow to protect customer payment data.