AUTHOR : HANIYA SMITH

DATE : 11/09/2023

In today’s fast-paced digital economy, businesses of all sizes are increasingly relying on online payment gateways to facilitate their transactions. However, for high-risk businesses[1], finding the right payment gateway[2] can be a challenging endeavor. In this comprehensive guide, we will delve into the world of high-risk business payment gateways[3], exploring what they are, why they matter, and how to navigate this critical aspect of financial operations.

1. Understanding High Risk in Business

High-risk businesses[4] are those that, due to their nature or industry, face a higher likelihood of chargebacks, fraud, or regulatory scrutiny. Examples include online gaming, adult content, and also CBD products. As a result, these businesses[5] often struggle to secure reliable payment processing solutions.

2. The Importance of Payment Gateways

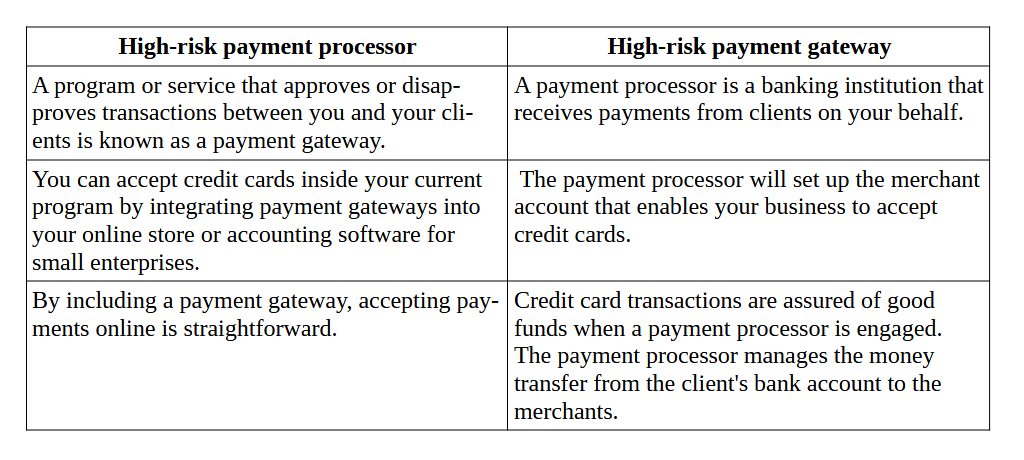

Payment gateways act as intermediaries between the customer, merchant, and financial institutions. They play a crucial role in authorizing and facilitating online transactions, making them an indispensable part of modern business operations.

3. What Makes a Business High Risk?

High-risk businesses are typically categorized based on factors such as industry reputation, chargeback ratios, and legal regulations. Understanding what makes your business high risk is the first step towards finding an appropriate payment gateway.

4. Characteristics of a Reliable Payment Gateway

A reliable payment gateway for high-risk businesses should offer features like robust fraud protection, global reach, multiple payment options, and also seamless integration with your website or platform.

5. Finding the Perfect Payment Gateway

Finding the perfect payment gateway requires[1] research and due diligence. You must evaluate your specific business needs and match them with a gateway that aligns with your goals.

6. Factors to Consider When Choosing a High Risk Payment Gateway

Consider factors such as transaction fees, chargeback management, security measures, and contract terms when selecting a high-risk payment gateway.

7. Top High Risk Payment Gateway Providers

Explore the leading high-risk payment gateway providers, including names like PaymentCloud,[2]Durango Merchant Services, and also Instabill, to discover which one suits your business best.

8. Steps to Secure Your High Risk Payment Gateway

Security is paramount for high-risk businesses. Implement strong encryption, tokenization, and authentication methods to safeguard sensitive customer data.

9. The Role of Fraud Prevention

High-risk businesses are attractive targets for fraudsters. Learn how to implement comprehensive fraud prevention measures to protect your business and also customers.

10. Cost Analysis: Fees and Rates

Understand the fee structure[3] of your chosen payment gateway, including setup fees, transaction fees, and also monthly charges, to manage your financial resources effectively.

11. Integration and User Experience

A seamless integration process and user-friendly interface are essential for providing customers with a positive payment experience.

12. Customer Support: A Lifeline for High Risk Businesses

Responsive customer support can make a significant difference when issues arise with your payment gateway. Choose a provider with a stellar support team.

13. Optimizing Payment Gateway Performance

Regularly monitor and also optimize your payment gateway’s performance to ensure it meets your evolving business needs and maintains a competitive edge.

14. The Future of High Risk Payment Gateways

Stay informed about emerging trends and technologies in the high-risk payment gateway industry to position your business for future success.

15. Conclusion

In conclusion, for high-risk businesses, choosing the right payment gateway[4] is not just a financial decision; it’s a strategic one. By understanding your business’s risk profile, evaluating payment gateway providers, and prioritizing security and also customer experience, you can navigate the financial landscape with confidence.

FAQs

- What defines a high-risk business?

- High-risk businesses are those that face increased chargebacks, fraud, or regulatory scrutiny due to industry, reputation, or other factors.

- Why are payment gateways crucial for high-risk businesses?

- Payment gateways facilitate secure online transactions and help high-risk businesses manage financial operations effectively.

- How can I find the ideal high-risk payment gateway?

- Research payment gateway providers, evaluate their features, and match them to your business needs and risk profile.

- What measures can I take to prevent fraud in my high-risk business?

- Implement robust fraud prevention measures such as encryption, tokenization, and authentication methods.

- What is the future of high-risk payment gateways?

- The industry is continually evolving with new technologies and trends, so staying informed is key to future success.