AUTHOR : EMILY PATHAK

DATE : 20 / 09 / 2023

Introduction

In the current era of digital advancements, the manner in which we conduct financial transactions has undergone a profound transformation. Payment gateway apps have played a pivotal role in this evolution, making online transactions[1] faster, more secure, and incredibly convenient. In this article, we will explore the world of payment gateway apps[2], their significance, how they work[3], and also the top choices available. Whether you’re a business owner or a consumer, understanding payment gateway apps is crucial for a seamless online financial experience[4].

Understanding Payment Gateways

What Are Payment Gateway Apps?

Payment gateway apps[5] are software applications that facilitate online transactions by connecting e-commerce websites or mobile apps to financial institutions, ensuring secure payment processing. They act as the virtual cashiers of the digital world, ensuring that money flows seamlessly from the customer’s account to the merchant’s account.

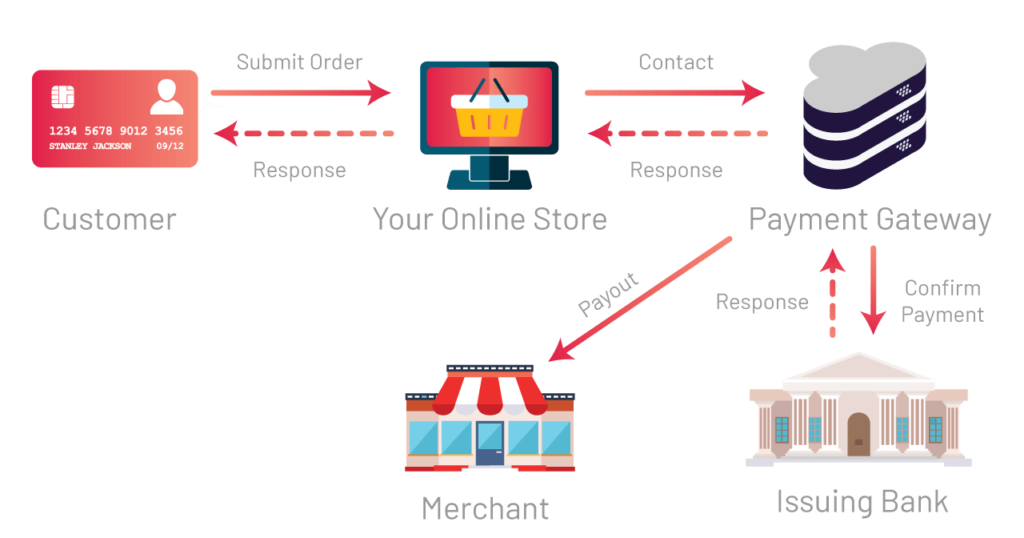

How Do Payment Gateways Work?

The working of payment gateways can be broken down into several steps:

Step 1: Customer Initiates Payment

The customer initiates a payment by clicking the ‘buy’ button on an e-commerce website or app.

Step 2: Encryption and also Data Transmission

The payment information, including credit card details, is encrypted to ensure security. It is then transmitted to the payment gateway.[1]

Step 3: Authorization Request

The payment gateway forwards the transaction data to the customer’s bank or credit card company for authorization.

Step 4: Authorization Response

The bank reviews the request and also sends an authorization response to the payment gateway, either approving or declining the transaction.

Step 5: Transaction Approval

If the transaction is approved, the payment gateway sends the approval to the merchant, allowing the customer to complete the purchase.

Significance of Payment Gateway Apps

They offer numerous benefits to both businesses and also consumers:

Enhanced Security

Payment gateways use advanced encryption and also security protocols to protect sensitive data, making online transactions safer than ever.

Global Reach

They allow businesses to expand their reach by accepting payments from customers all over the world.

Streamlined Transactions

Payment gateways streamline the checkout process, reducing cart abandonment rates and also increasing sales.

Real-Time Reporting

Businesses can access real-time transaction data and also financial reports, aiding in better decision-making.

Top Payment Gateway Apps

Now, let’s delve into some of the top payment gateway apps[2] available:

1. PayPal

PayPal is one of the most widely used payment gateways, known for its user-friendly interface and also global acceptance. It offers multiple payment options and also secure transactions.

2. Stripe

Stripe is a developer-friendly payment gateway that provides businesses with customizable solutions. It supports various payment methods, making it a versatile choice.

3. Square

Square is an excellent option for small businesses and also entrepreneurs. It offers a simple and affordable way to accept card payments.

4. Authorize.Net

Authorize.Net is a robust payment gateway that caters to businesses of all sizes. It offers a wide range of payment options and also strong security features.

Mobile Payment Gateway Apps

With the increasing use of mobile devices for online shopping, payment gateway apps have adapted to cater to mobile users. They offer mobile-optimized interfaces and also support various mobile payment methods. This is particularly important in a world where consumers demand the convenience of making purchases on their smartphones and tablets. Mobile payment gateway apps provide a user-friendly experience, making it easy for customers to complete transactions on smaller screens.

Integrating Payment Gateway Apps

Integrating a They with your website or app is a crucial step in ensuring a seamless payment process for your customers. The integration process should be smooth, with clear instructions provided by your chosen payment gateway provider[3]. It’s essential to test the payment system thoroughly before making it live to ensure that everything works as expected. This testing phase helps identify and also rectify any potential issues that could affect the customer experience.

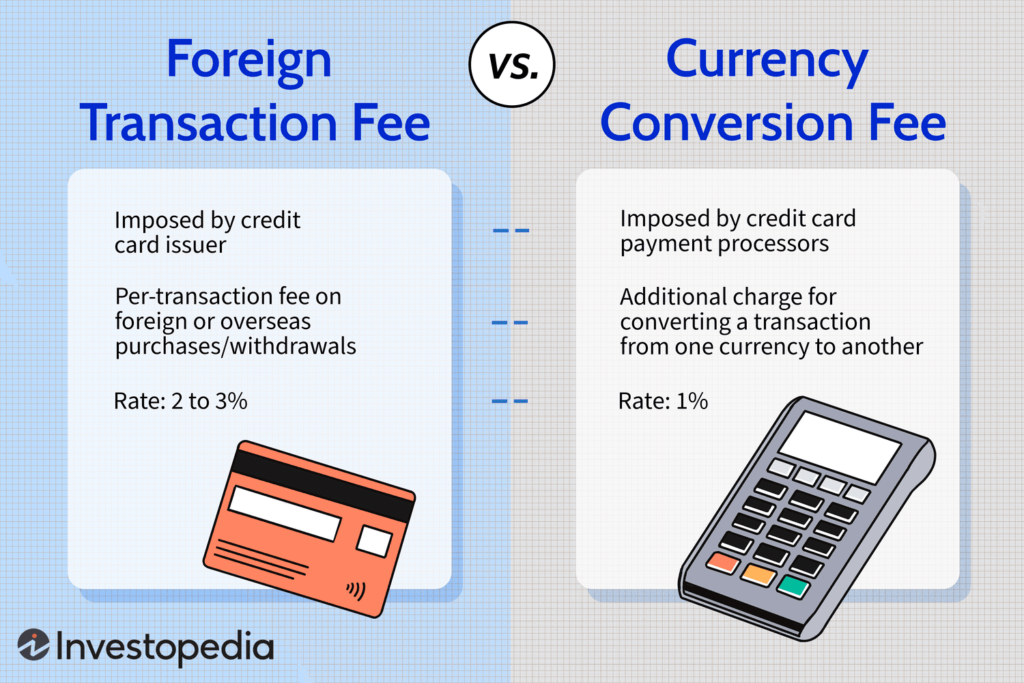

Transaction Fees and Charges

Different payment gateway apps have varying fee structures. Understanding these fees and charges is vital, as they can directly impact your overall revenue. Common fee structures include a percentage of the transaction amount and a fixed fee per transaction. It’s crucial to review and also compare the fee schedules of different payment gateway [4]providers to select the one that aligns with your business’s financial goals. Transparency in fees is key, as it ensures that you can predict your costs accurately.

Conclusion

Payment gateway apps have revolutionized the way we conduct financial transactions https://cricpayz.io/in the digital age. Their significance in ensuring secure, seamless, and convenient online payments cannot be overstated. As technology continues to advance, payment gateway apps will play an increasingly pivotal role in shaping the future of commerce.

FAQs

1. Are payment gateway apps safe to use?

Yes, They use encryption and security measures to ensure the safety of online transactions.

2. How do I choose the right payment gateway app for my business?

Consider your business needs, transaction volume, and the payment methods you want to support when choosing a payment gateway.

3. Can I use multiple They on my website?

Yes, many websites use multiple payment gateways to offer customers a variety of payment options.

4. Do payment gateway charge fees?

Yes, payment gateway providers usually charge transaction fees. The fees may vary based on the provider and your business volume.

5. Can payment gateway apps handle international transactions?

Yes, many payment gateway support international transactions, allowing businesses to expand globally.