AUTHOR : ADINA XAVIER

DATE : 21/10/2023

Introduction

In today’s digital age, where online transactions[1] have become the norm, the need for secure and efficient payment solutions[2] is paramount. It play a pivotal role in ensuring smooth and secure financial transactions[3] over the internet. But what exactly are , and why are they so essential?

The Importance of Payment Gateways

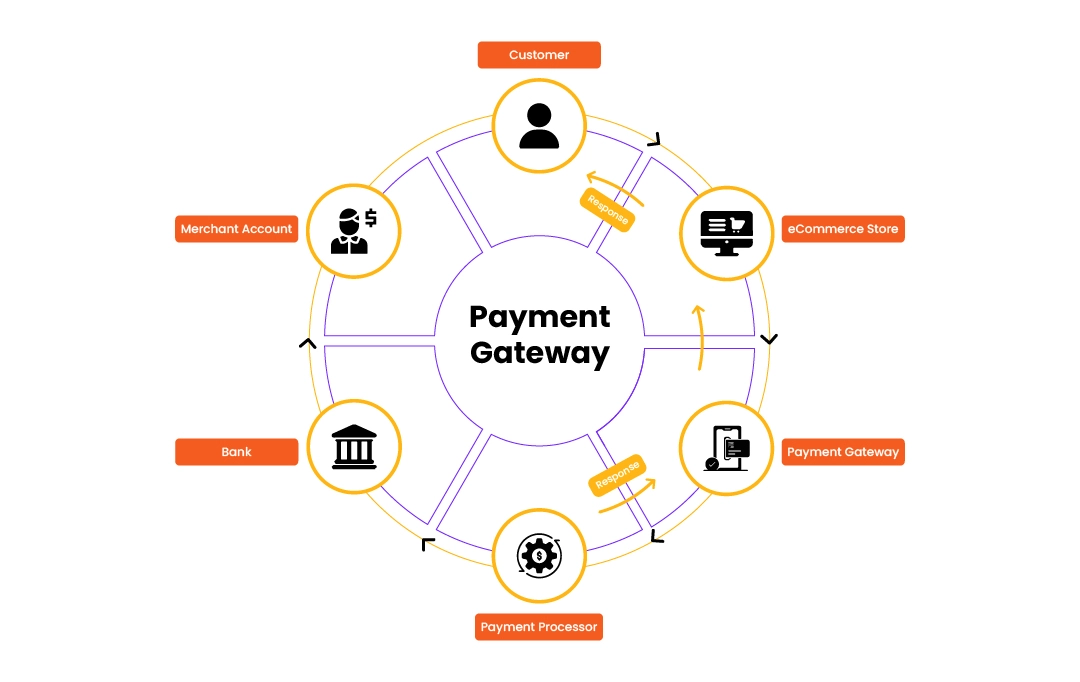

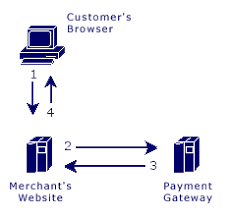

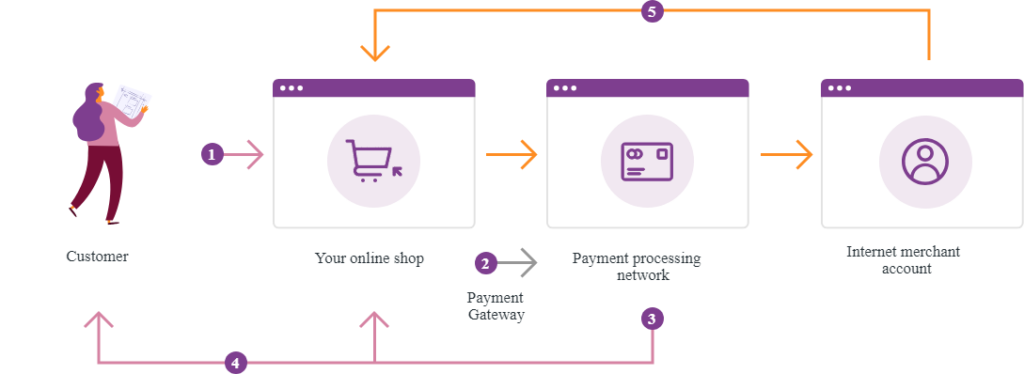

Before delving into the world of it, let’s understand the significance of payment gateways[4] in our modern economy. Payment gateways[5] are the virtual bridges that connect online businesses with their customers, allowing seamless transactions also ensuring the safe transfer of funds.

What is a Payment Gateway SDK?

A Payment Gateway Software Development Kit is a set of software tools and libraries that enable developers to integrate payment processing capabilities into their applications and websites. These provide the necessary code also infrastructure to connect with payment gateways and handle transactions efficiently.

Benefits

- Enhanced Security: SDKs come equipped with the latest security protocols, protecting sensitive customer data.

- Customization: Developers can tailor the payment process[1] to match the look also feel of their brand.

- Multi-platform Compatibility: It work seamlessly across various platforms and devices.

- Efficiency: Quick and hassle-free payment processing, reducing cart abandonment rates.

Choosing the Right Payment Gateway SDK

Selecting the right is crucial for the success of any online business. Factors such as transaction fees, ease of integration, and security features should be considered.

Top Payment Gateway SDK Providers

Several companies offer this, including PayPal, Stripe, Square, and Braintree. Each has its unique features also benefits, catering to a wide range of business needs.

Setting Up a Payment Gateway SDK

The process of setting up a it involves registering with the chosen provider, obtaining API keys[2], also integrating the SDK into your application or website.

Security Measures

Security is paramount in online transactions. SDKs implement encryption, tokenization, also fraud detection mechanisms to protect customer information and financial data.

Integrating into E-commerce Websites

E-commerce[3] websites often rely on to enable customers to make purchases securely. This integration enhances the user experience and builds trust.

Mobile App Integration

Mobile apps have become a significant part of the online business landscape. This make it easy to process payments within mobile applications, enhancing user convenience.

Popular Programming Languages for SDK Integration

To successfully integrate it, developers commonly use languages such as Python, Java, PHP, and Ruby.

The Future of Payment Gateway SDKs

As technology continues to evolve, This will adapt also incorporate new features to meet the ever-changing demands of online businesses.

Tips for Successful SDK Implementation

Implementing a Payment Gateway SDK requires careful planning and testing. Ensure a smooth transition by following best practices.

Case Studies

Let’s take a look at some real-world examples of businesses that have harnessed the power of Payment

to streamline their payment processes[4] and enhance their overall customer experience.

Case Study 1: XYZ Electronics

XYZ Electronics, a renowned online electronics retailer, experienced a surge in sales after integrating . Customers appreciated the seamless and secure checkout process. The company reported a significant reduction in cart abandonment rates and an increase in customer trust, leading to substantial revenue growth.

Case Study 2: Artisan Boutique

Artisan Boutique, a small online shop specializing in handmade crafts, switched to a Payment Gateway SDK to provide a more convenient payment experience. This led to a boost in customer loyalty and word-of-mouth referrals. Their decision to integrate an SDK translated into a steady increase in their customer base.

Case Study 3: QuickFood Delivery

QuickFood Delivery, a food delivery service, implemented to streamline their mobile app’s payment process. This change resulted in quicker transactions, fewer payment-related issues, and happier customers. The improved user experience led to a significant increase in app downloads and a more loyal customer base.

Conclusion

In conclusion, Payment Gateway SDKs have revolutionized the way businesses handle financial transactions online. These software development kits provide a secure and efficient way to process payments, leading to increased customer satisfaction and trust. As technology[5] continues to advance, the role of Payment Gateway SDKs in shaping the digital economy is only set to grow.

Frequently Asked Questions

1. What is the primary purpose of a Payment Gateway SDK? A Payment Gateway SDK facilitates the integration of payment processing capabilities into applications and websites, ensuring secure and efficient financial transactions.

2. How can I choose the right Payment Gateway SDK for my business? Consider factors such as transaction fees, ease of integration, and security features when selecting a Payment Gateway SDK that suits your needs.

3. Which programming languages are commonly used for SDK integration? Common programming languages for SDK integration include Python, Java, PHP, and Ruby.

4. What are the security measures in place for Payment Gateway SDKs? Payment Gateway SDKs implement encryption, tokenization, and fraud detection mechanisms to protect customer data and financial information.

5. Can mobile apps benefit from Payment Gateway SDK integration? Yes, mobile apps can significantly benefit from Payment Gateway SDKs, making it easier for users to make secure payments within the app.