AUTHOR : ADINA XAVIER

DATE : 21/10/2023

In today’s digital age, online payment gateways[1] have revolutionized the way we conduct financial transactions[2]. Whether it’s shopping online, paying bills, or transferring money, payment gateways[3] have made our lives more convenient. However, this convenience comes with its share of risks, as the digital landscape is not without its security challenges[4]. In this comprehensive guide, we will delve into the world of payment gateway security[5], exploring the measures, strategies, and technologies that ensure the safety of your financial data.

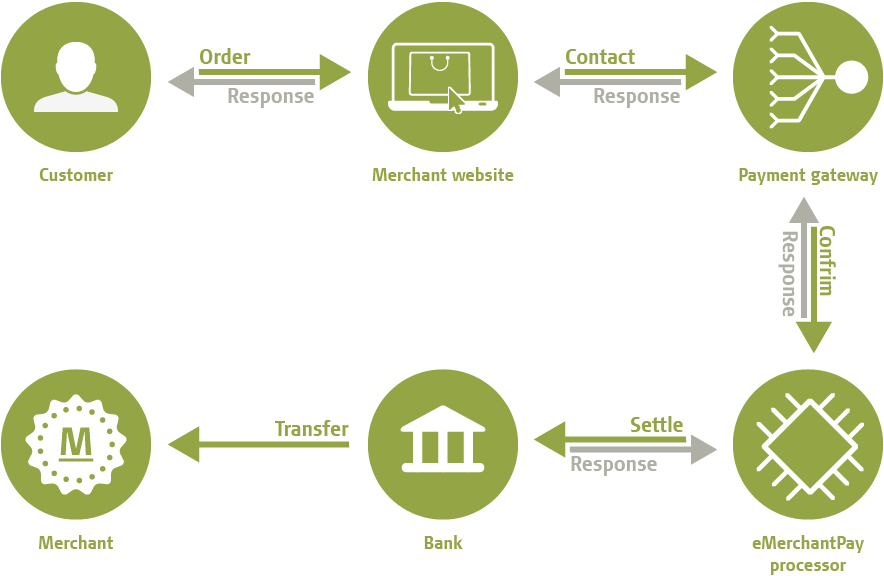

Understanding Payment Gateways

Payment gateways are the digital bridges that enable online transactions, allowing your money to flow from your bank account to the seller’s account securely. These gateways facilitate the transfer of financial information between the customer, merchant, and financial institutions.

The Significance of Payment Gateway Security

Security is paramount when it comes to payment gateways. Any vulnerability in this system can lead to data breaches, financial loss, also compromised personal information. As a result, it is crucial to understand and implement robust security measures.

Key Threats in Payment Gateway Transactions

Before delving into security measures, it’s essential to identify the potential threats. These include hacking, phishing attacks, data breaches, and unauthorized access to payment information.

SSL Encryption: The First Line of Defense

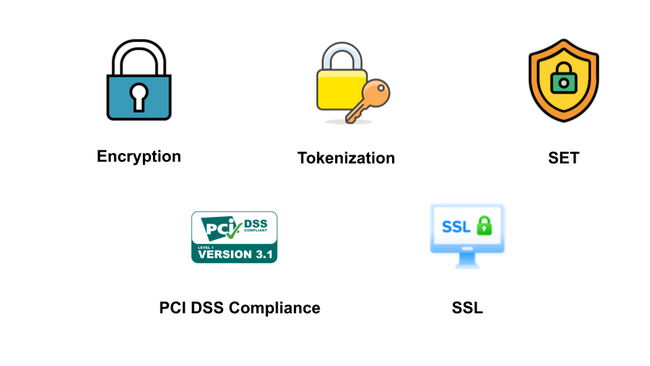

SSL encryption acts as a digital padlock for your data, ensuring that the information transmitted between your device also the payment gateway remains confidential. This secure connection is essential for secure online transactions.

Tokenization: Securing Sensitive Data

Tokenization replaces sensitive information with tokens, rendering the data useless to cybercriminals[1]. Even if a hacker intercepts the token, it’s practically impossible to reverse-engineer it into the original data.

Firewalls: Building Digital Barriers

Firewalls act as digital barriers, monitoring also filtering network traffic. They are crucial in preventing unauthorized access to payment gateway systems.

Regular Security Audits

Regular security audits assess the vulnerabilities in payment gateway systems, identifying weak points also rectifying them promptly.

Secure Socket Layer (SSL) Certificates

SSL certificates ensure that the connection between your device also the payment gateway[2] is legitimate and secure.

The Significance of the Payment Card Industry Data Security Standard (PCI DSS)

PCI DSS sets the standard for payment gateway security, providing guidelines and best practices for safeguarding financial data.

Fraud Detection Systems

Sophisticated fraud detection systems monitor transactions in real time, flagging suspicious activities and mitigating risks.

Biometrics: The Future of Payment Security

Biometric authentication methods like fingerprint and facial recognition are making headway in enhancing payment gateway security.

Mobile Payment Security

With the proliferation of mobile payments, ensuring the security of transactions[3] on mobile devices is of utmost importance.

User Education: The Human Element

Educating users about safe online practices is critical. A well-informed user is less likely to fall victim to online threats.

The Future of Payment Gateway Security

The landscape of payment gateway security is ever-evolving. Staying ahead of these threats is an ongoing challenge for security experts.

Mobile Payment Security

Mobile payments[4] have become increasingly popular, with the convenience of making transactions using our smartphones. However, this convenience also raises concerns about the security of these transactions. To ensure mobile payment security, here are some best practices:

- Keep Your Device Secure: Lock your device with a PIN, password, or biometric authentication. This is your first line of defense, and it’s crucial to keep your device safe from unauthorized access.

- Use Secure Networks: Avoid making mobile payments on public Wi-Fi networks. These networks are often less secure and can be a breeding ground for hackers. Stick to secure, private networks when making transactions.

- Two-Factor Authentication (2FA): If available, enable 2FA for your mobile payment apps. This means that even if someone gets hold of your device, they’ll need an additional verification step to access your payment information.

- Choose Reputable Apps: Only download and use mobile payment[5] apps from reputable sources like the App Store or Google Play Store. Be cautious of third-party apps, as they may not have the same level of security.

CONCLUSION

In conclusion, payment gateway security is a critical component of our increasingly digital financial world. By understanding the threats and employing robust security measures, we can continue to enjoy the convenience of online transactions without compromising our financial well-being.

Frequently Asked Questions

- What is a payment gateway? A payment gateway is a digital service that facilitates online financial transactions between customers and merchants.

- Why is payment gateway security important? Payment gateway security is essential to protect financial information and prevent data breaches and fraud.

- What Does SSL Encryption Entail, and How Is Its Mechanism Functioning? SSL encryption is a security protocol that ensures secure data transmission by encrypting information between a user’s device and the payment gateway.

- What is tokenization in payment gateway security? Tokenization is a method of replacing sensitive information with tokens, rendering the data useless to potential cybercriminals.

- How can I ensure the security of my mobile payments? To secure mobile payments, ensure your device is up to date, use secure networks, and enable biometric authentication when available.