AUTHOR : ANNU CHAUHAN

DATE : 28-10-2023

The Philippines[1] is experiencing a digital revolution[2], and with it comes the need for robust and efficient payment solutions[3]. In this article, we will explore the world of payment solutions[4] in the Philippines, discussing their importance, types, benefits[5], challenges, and more.

1. Introduction

The digital landscape in the Philippines has rapidly evolved, pushing businesses and customers to embrace innovative payment solutions. In this article, we will delve into the dynamics of payment solutions in the Philippines.

2. The Importance of Payment Solutions in the Philippines

Payment solutions have become a lifeline for businesses and customers in that country. The need for convenience and security in financial deal has led to the widespread adoption of various payment methods.

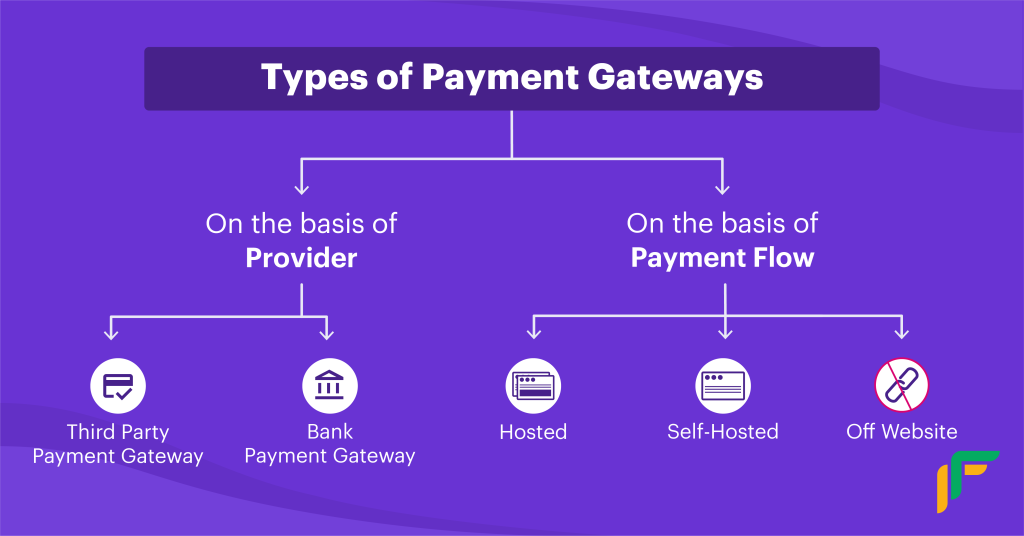

3. Types of Payment Solutions

Payment solutions[1] come in various forms, including mobile wallets, credit card processing, online banking, and more. We’ll explore each type’s advantages and disadvantages.

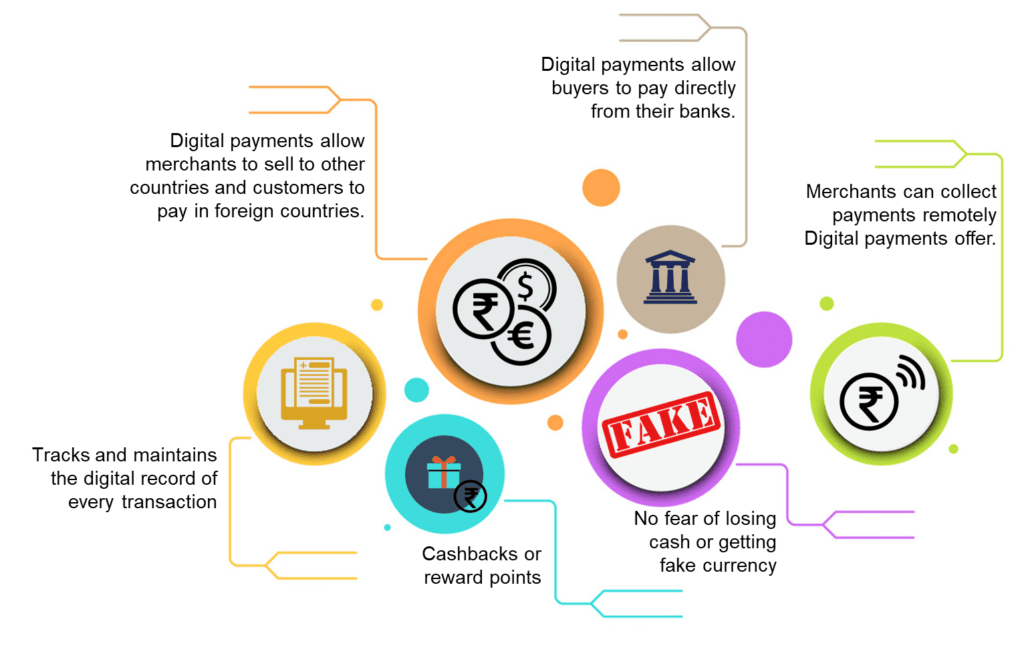

4. Benefits of Payment Solutions

Discover the numerous benefits of payment solutions, such as increased efficiency, reduced operational costs, and enhanced customer satisfaction.

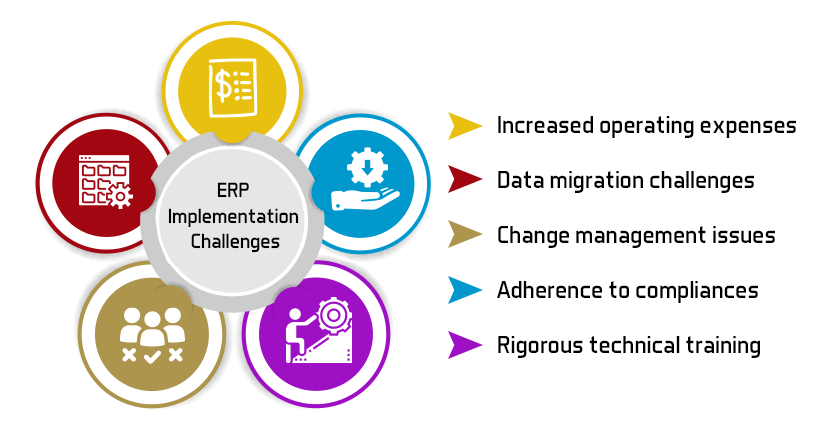

5. Challenges in Implementing Payment Solutions

While payment solutions[2] offer numerous advantages, there are also challenges, including security concerns, infrastructure limitations, and the need for user education.

6. Choosing the Right Payment Solution

Selecting the most suitable payment solution for your business[3] can be a daunting task. We’ll provide insights into how to make the right choice.

7. How to Set Up Payment Solutions

Learn the steps involved in setting up payment solutions for your business, ensuring a seamless dealn experience for your customers.

8. Security in Payment Solutions

Security is paramount in the world of payments[4]. We’ll discuss the measures in place to protect both businesses and customers in the Philippines.

9. Mobile Payment Solutions

The rise of mobile payment solutions has transformed how deals are conducted. Explore the impact of mobile wallets and apps on the Filipino market.

10. E-commerce and Payment Solutions

With the growth of e-commerce[5], payment solutions have become integral for online businesses. Understand how payment methods are shaping the e-commerce landscape.

11. Payment Solutions for Businesses

Payment solutions aren’t limited to large corporations. Small businesses can also benefit from streamlined deals and increased revenue.

12. The Future of Payment Solutions

What does the future hold for payment solutions in the Philippines? We’ll look at emerging trends and technologies.

13. Case Studies

Real-world examples of businesses in the country successfully implementing payment solutions, highlighting their impact on growth and customer satisfaction.

14. Conclusion

In conclusion, payment solutions have become a vital part of the Philippines’ financial ecosystem. Businesses and customers alike are reaping the rewards of efficient, secure, and convenient payment methods.

15. FAQs

Q1. Are payment solutions safe in the Philippines?

Yes, payment solutions in the Philippines prioritize security, employing robust measures to protect deal.

Q2. How can I choose the right payment solution for my business?

Consider your business’s specific needs, customer preferences, and deal volume when selecting a payment solution.

Q3. Do small businesses in the Philippines benefit from payment solutions?

Absolutely. Payment solutions can help small businesses grow by offering convenient payment options to their customers.

Q4. What is the role of mobile payment solutions in the Filipino market?

Mobile payment solutions have gained popularity, making deals more accessible and convenient for consumers.

Q5. What should we expect in the future of payment solutions in the Philippines?

The future holds innovations like contactless payments and enhanced security features, making deals even smoother.