AUTHOR : EMILY PATHAK

DATE : 18 / 10 / 2023

Introduction

Payment systems[1] in India have undergone a significant transformation[2] in recent years. The country, known for its rich history and diverse culture, has embraced digital payment methods[3], making transactions more convenient and accessible for its billion-plus population. In this article, we will explore the evolution of payment methods [4]in India and delve into the various digital payment[5] options available.

The Evolution of Payments in India

India’s payment landscape has evolved considerably over the years. Traditionally, the Indian economy heavily relied on cash transactions. However, the advent of technology and government initiatives have paved the way for digital payments to become the norm.

Digital Payment Methods

UPI (Unified Payments Interface)

One of the most revolutionary developments in Indian payments is the Unified Payments Interface (UPI). UPI allows users to make instant and secure payments directly from their bank accounts using mobile phones. It has gained widespread acceptance and is supported by numerous banks and apps.

Mobile Wallets

Mobile wallets like Paytm, PhonePe, and Google Pay have gained immense popularity. Users can load money into these wallets and also make a variety of transactions, from recharging mobile phones to paying bills and shopping online.

Debit and Credit Cards

Debit and credit cards are widely used in India for both online and offline transactions. With a growing number of people owning bank accounts, the use of cards has become common.

Online Banking

Online banking provides a convenient way to manage and transfer funds. Users can access their bank accounts, check balances, and initiate transactions from the comfort of their homes.

Payment Gateways

Payment gateways are essential for e-commerce [1]and online businesses. They facilitate secure transactions by connecting merchants, customers, and banks. Popular payment gateways in India include Razorpay and Instamojo.

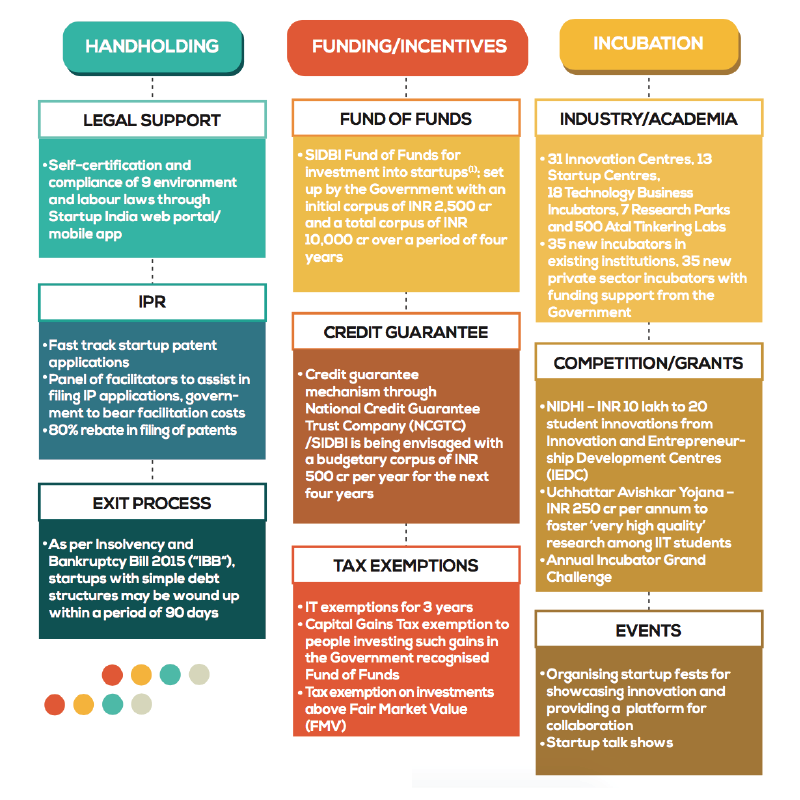

Government Initiatives

Pradhan Mantri Jan-Dhan Yojana

The Pradhan Mantri Jan-Dhan Yojana, launched in 2014, aimed to provide access to financial services to the underprivileged. This initiative has significantly increased the number of bank accounts in India.

Digital India

The Digital India campaign has been pivotal in promoting digital literacy and encouraging citizens to adopt digital payment methods.

E-commerce and Payments

The e-commerce industry has experienced exponential growth in India. Payment gateways and digital[2] wallets have played a crucial role in facilitating online transactions, making it convenient for consumers to shop online.

Regulatory Changes

The payment industry[3] is subject to regulatory changes that can impact the way transactions are conducted. Staying updated with these regulations is crucial for businesses and consumers.

The Future of Payments in India

The future of payments in India holds exciting possibilities. As technology advances and infrastructure improves, the payment ecosystem will become even more seamless and secure. India is well on its way to becoming a cashless society.

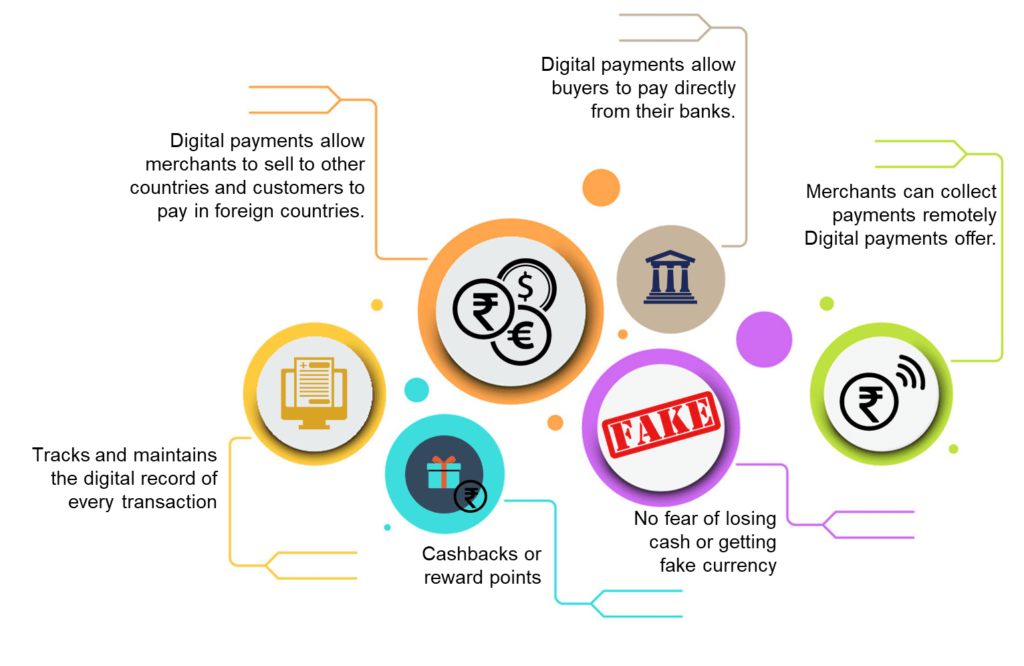

The Convenience of Digital Payments

The convenience of digital payments in India cannot be overstated. With the touch of a button on your smartphone or a few clicks on your computer, you can pay bills, shop, book tickets, and also send money to friends and also family. The days of standing in long queues at banks or ATMs are gradually becoming a thing of the past.

Cashback and Discounts

Digital payment platforms often offer enticing cashback offers and discounts. Whether it’s cashback on mobile recharges, discounts on shopping, or special deals on movie tickets, these incentives encourage people to use digital payment methods. It’s a win-win situation for both consumers and businesses.

The Impact of Demonetization

India experienced a watershed moment in 2016 when the government demonetized high-value currency notes. This move accelerated the adoption of digital payments as people sought alternative ways to carry out transactions. The demonetization drive significantly boosted the usage of mobile wallets, UPIs, and online banking.

Global Recognition

India’s progress in the digital payment space has garnered international recognition. Fintech companies and startups have sprung up to provide innovative payment solutions not only for domestic use but also for global transactions.[4] The international community is closely watching India’s transformation into a cashless economy.

Rural India and Digital Inclusion

While urban areas have embraced digital payments, rural India presents a unique set of challenges. Digital inclusion remains a priority, with efforts to educate and empower the rural population. Initiatives like Digital India aim to bridge the digital divide by providing digital [5]infrastructure and training.

Innovations in Payment Technology

The payment industry in India is marked by continuous innovation. From contactless payments using NFC (near field communication) technology to biometric authentication for secure transactions, the future holds exciting possibilities. Indian consumers can expect a seamless and secure payment experience.

QR Code Payments

One noteworthy development is the widespread use of QR (Quick Response) code payments. Merchants display QR codes, and customers can scan them using their mobile apps to make payments. This method is not only convenient but also cost-effective for businesses, making it a preferred choice for many small vendors.

Government Initiatives and Financial Inclusion

The Indian government remains committed to financial inclusion. Initiatives like the Pradhan Mantri Jan-Dhan Yojana have led to millions of unbanked citizens gaining access to the formal banking system, thereby becoming part of the digital payment ecosystem.

Digital Literacy and Also Awareness

A critical aspect of the transition to digital payments is raising digital literacy and awareness. To ensure that all sections of society can benefit from digital transactions, it is essential to educate individuals about the advantages and also precautions of digital payments.

The Road Ahead

The future of payments in India is undeniably digital. As more people embrace digital wallets, UPI, and other payment methods, the country will continue to reduce its reliance on cash. The security and convenience of digital payments make them an attractive choice for both individuals and businesses.

Conclusion

In conclusion, India has witnessed a remarkable transformation in its payment landscape. The country has shifted from a cash-driven economy to a digital payment powerhouse. With the government’s initiatives, the proliferation of digital wallets, and the growth of e-commerce, the future looks promising for digital payments in India.

FAQs

1. What is UPI, and how do I set it up on my mobile?

- UPI, or Unified Payments Interface, lets you transfer money directly from your bank account via your mobile phone.

2. Can I use mobile wallets for international transactions?

- Mobile wallets are primarily for domestic transactions. While some allow international payments, they have restrictions. Check with your mobile wallet provider for specifics.

3. How do I protect my digital payments from fraud?

- Protect your digital payments with these tips:

- Use strong, unique passwords and PINs.

- Enable two-factor authentication (2FA).

4. What is the future of cryptocurrency in India’s payment ecosystem?

- Cryptocurrency’s future in India is uncertain. While interest in Bitcoin and other digital currencie s is growing, the government has concerns about their impact.

5. Are there government incentives for promoting digital payments in rural areas?

- Yes, the Indian government, through initiatives like Digital India and the Pradhan Mantri Jan-Dhan Yojana, promotes digital payments in rural areas.