AUTHOR : PUMPKIN KORE

DATE : 31/10/2023

In a world dominated by digital transactions, payment processing companies play a crucial role in facilitating the smooth transfer of funds. This article will delve into the landscape of payment processing companies in the United States, shedding light on their significance, services, and the role they play in shaping the economy.

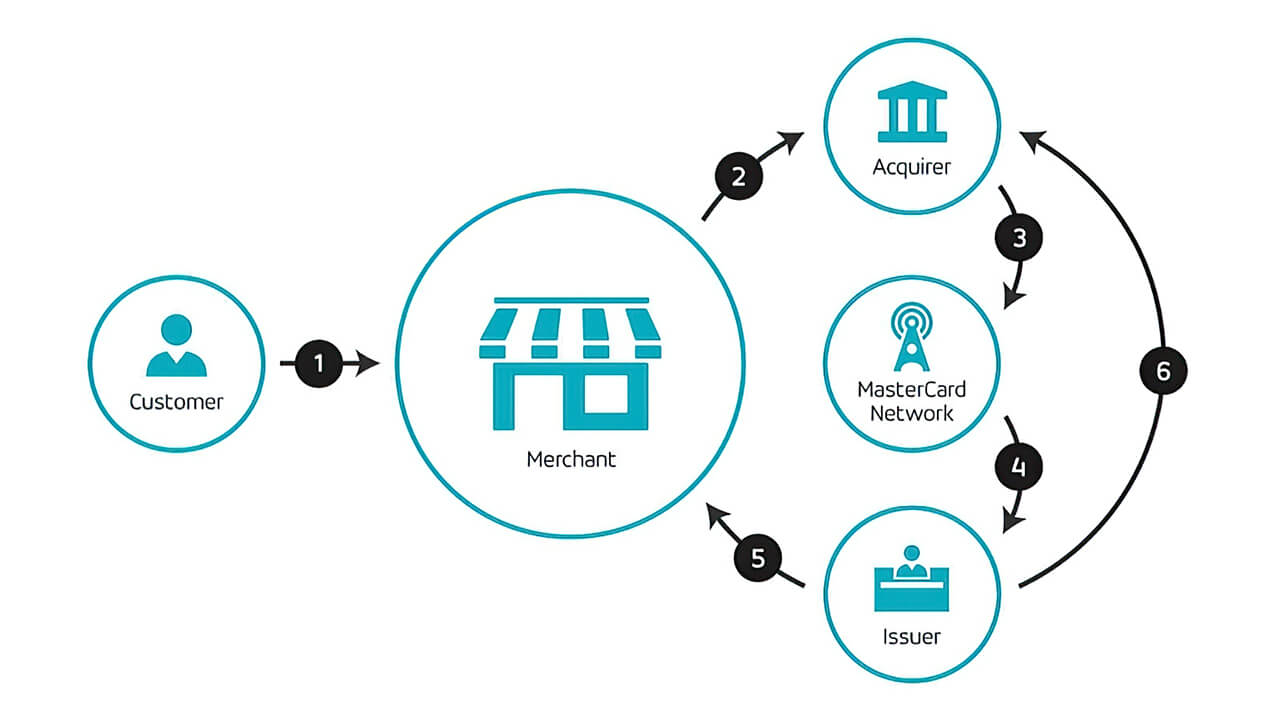

Understanding Payment Processing

Before we dive into the specifics, let’s get a fundamental understanding of what payment processing entails. Payment processing refers to the steps involved in a transaction, from the moment a customer initiates payment to the moment the funds reach the merchant’s account. These transactions can occur through various methods, such as credit cards, mobile wallets, and online bank transfers.

The Importance of Payment Processing Companies

Payment processing companies are the backbone of the modern financial world. Their role in facilitating secure, swift, and efficient transactions[1] cannot be overstated. Here are some key points that highlight their significance:

1. Ensuring Security

Payment processors implement robust security measures to protect sensitive financial data. This includes encryption and fraud detection systems to safeguard[2] against unauthorized transactions.

2. Expanding Payment Options

These companies enable businesses to accept a wide range of payment methods, from credit and debit cards to newer technologies like mobile payments and cryptocurrencies.

3. Accelerating Transactions

By streamlining the payment process, payment processors reduce waiting times and also ensure that merchants receive funds promptly.

4. Enhancing Customer Experience

Smooth and secure transactions are essential for customer satisfaction, and payment processing companies contribute significantly to this aspect.

Major Payment Processing Companies in the USA

Now that we’ve established the importance of payment processing companies, let’s take a closer look at some of the major players in the United States:

1. PayPal

PayPal[3] is a household name in the world of online payments. It provides a platform for individuals and businesses to send and receive money securely. With its user-friendly interface and wide acceptance, PayPal remains a top choice.

2. Square

Square[4] is known for its point-of-sale (POS) solutions, making it easier for businesses to accept card payments. Square’s hardware and software options have gained immense popularity.

3. Stripe

Stripe[5] focuses on simplifying the online payment process for e-commerce businesses. It offers a range of tools to handle payment transactions and is also popular among tech-savvy entrepreneurs.

4. Authorize.Net

Authorize.Net specializes in providing payment gateway services and connecting online merchants to banking networks. It’s a trusted name in the e-commerce industry.

5. Braintree

A subsidiary of PayPal, Braintree offers a developer-friendly platform that enables businesses to integrate multiple payment methods seamlessly. This makes it a preferred choice for businesses with complex payment needs.

The Future of Payment Processing

With the continuous evolution of technology and consumer preferences, the payment processing industry is set to witness significant changes. Here’s a glimpse of what the future holds:

1. Contactless Payment

As contactless payment methods gain traction, payment processors will focus on enhancing these technologies to make transactions even faster and more secure.

2. Cryptocurrency Integration

The acceptance of cryptocurrencies as a payment method is on the rise. Payment processing companies will need to adapt to this trend by offering seamless cryptocurrency processing.

3. Enhanced Security

Cybersecurity threats will continue to evolve, prompting payment processors to invest in advanced security measures to protect both businesses and consumers.

The Future of Payment Processing

As we look to the future, payment processing companies will continue to evolve. Here are a few trends to watch out for:

1. Biometric Authentication

Expect to see more biometric authentication methods, such as fingerprint and facial recognition, becoming mainstream for secure payments.

2. IoT Payments

With the growth of the Internet of Things (IoT), payments will become more integrated into everyday devices and appliances, making transactions even more convenient.

3. Instant Payments

Consumers and businesses are increasingly demanding faster payment processing. Companies will need to adapt to provide near-instant payment solutions.

In a rapidly evolving digital landscape, payment processing companies in the USA are the unsung heroes of the financial world. They enable the seamless flow of funds and also make transactions safer and more convenient for all.

Conclusion

In a world driven by digital commerce, payment processing companies in the USA are at the forefront of financial innovation. They ensure that transactions are safe, convenient, and efficient. As technology continues to evolve, these companies will play a pivotal role in shaping the future of payments.

FAQs

1. How do payment processing companies make money?

Payment processing companies charge a fee for their services, typically a percentage of the transaction amount. They also earn revenue through various value-added services, such as fraud prevention and data analytics.

2. Are payment-processing companies regulated?

Yes, payment processing companies are subject to various regulations to ensure the security and integrity of financial transactions. They must comply with industry standards and government regulations.

3. Can I use payment processing companies for my e-commerce business?

Absolutely. Payment processing companies offer solutions tailored to e-commerce businesses, making it easier to accept online payments securely.

4. What should I consider when choosing a payment processing company for my business?

Consider factors like transaction fees, security features, ease of integration, and the range of payment methods supported when selecting a payment processing company.

5. Is it safe to use payment processing companies for personal transactions?

Yes, reputable payment processing companies invest heavily in security measures to protect personal and financial information. However, it’s essential to follow best practices for online security when making personal transactions.