AUTHOR : SAYYED NUZAT

DATE: 25-08-2023

In today’s fast-paced business landscape, payment processing has become a crucial aspect of every transaction. As businesses [1]continue to expand globally, the need for efficient and secure payment [2]processing solutions has grown exponentially. This article[3] delves into the world of payment processing software companies, exploring their significance[4], key players, and the transformative impact they’ve had on modern commerce[5].

Introduction

In a world where time is money, payment processing software companies have emerged as essential players in facilitating seamless financial transactions. These companies offer innovative solutions that enable businesses to handle payments efficiently, securely, and conveniently.

The Evolution of Payment Processing

The journey of payment processing has evolved significantly over the years. From traditional cash transactions to electronic payment methods, the landscape has witnessed a radical transformation. Payment processing software companies have been at the forefront of this evolution, driving the shift from physical point-of-sale terminals to digital platforms.

Key Features of Payment Processing Software

Modern payment processing software comes equipped with a range of features designed to streamline transactions. These include real-time transaction monitoring, fraud detection, customizable payment options, and also integration capabilities with other business tools.

Top Payment Processing Software Companies

Several notable companies dominate the payment processing software[1] industry. PayPal[2], known for its user-friendly interface, Stripe, with its developer-focused approach, Square[3], specializing in small businesses, and also Adyen, offering global payment solutions, are among the top players.

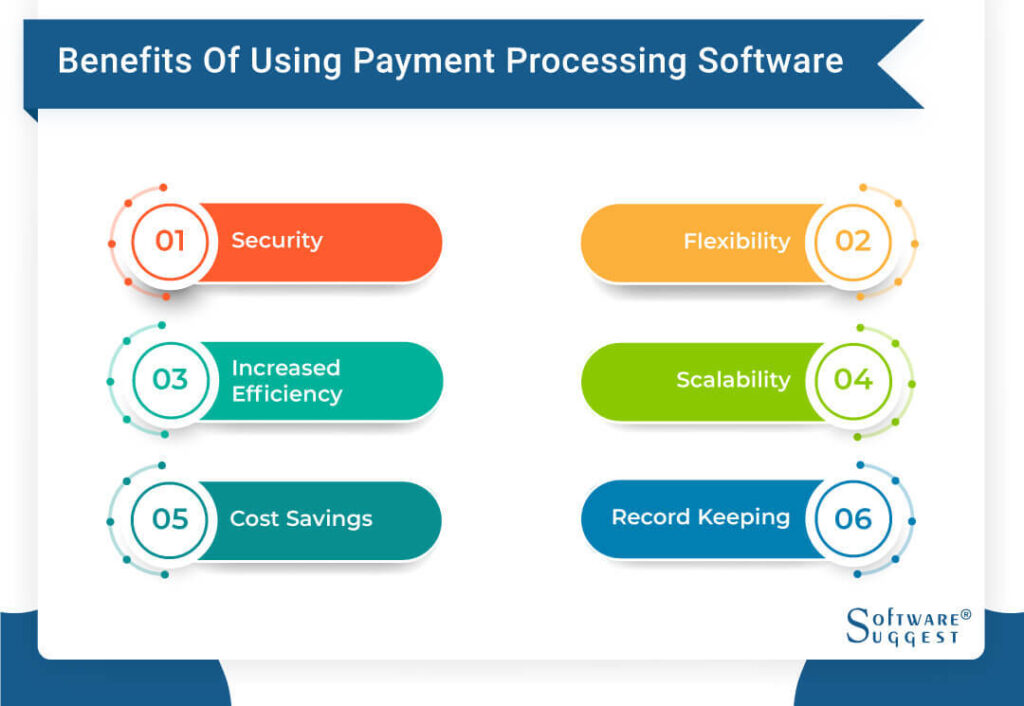

How Payment Processing Software Benefits Businesses

The adoption of payment processing software translates to tangible benefits for businesses. It enhances the customer experience, reduces the risk of errors, and accelerates the payment cycle, consequently improving cash flow.

Security and Compliance in Payment Processing

Security[4] is paramount in payment processing, and software companies prioritize incorporating robust security measures. Encryption, tokenization, and also compliance with Payment Card Industry Data Security Standard (PCI DSS) are some ways they ensure secure[5] transactions.

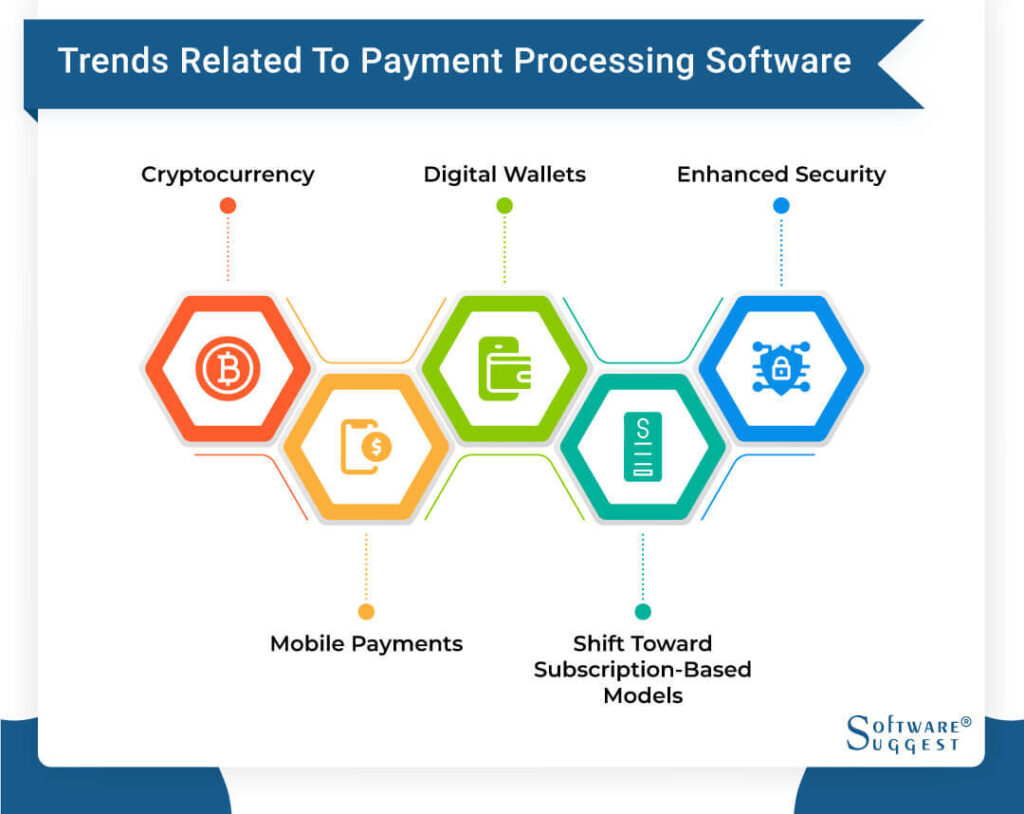

Future Trends in Payment Processing

The future holds exciting possibilities for payment processing software. The integration of artificial intelligence, blockchain technology, and biometric authentication are poised to revolutionize the industry, making transactions even more secure and convenient.

Integration and User Experience

Payment processing software is often integrated with other business software, such as accounting and customer relationship management systems. This integration enhances user experience by providing a unified platform for various operations.

Selecting the Right Payment Processing Software

Choosing the right software involves assessing factors like business size, transaction volume, and also integration needs. Conducting thorough research and also seeking recommendations can help businesses make informed decisions.

Case Studies: Successful Implementations

Numerous businesses have reaped the benefits of payment processing software. Case studies highlight how companies across industries have streamlined their payment processes, leading to improved operational efficiency and also customer satisfaction.

Mobile Payment Processing Solutions

With the proliferation of smartphones, mobile payment processing solutions have gained prominence. Companies offering mobile payment options provide convenience to both businesses and customers, fostering quick and secure transactions.

The Cost Factor: Pricing Models Explained

Payment processing software companies offer different pricing models, including flat-rate, interchange-plus, and subscription-based models. Understanding these models is crucial for businesses and also to choose the one that aligns with their financial goals.

Customer Support and Service

Efficient customer support is vital in the world of payment processing. Leading software companies offer responsive customer service to address any issues promptly, ensuring uninterrupted payment operations.

Navigating Challenges in Payment Processing

While payment processing software has transformed the way businesses transact, challenges such as cybersecurity threats, technical glitches, and regulatory changes persist. Staying informed and also proactive is essential to overcome these hurdles.

Conclusion

Payment processing software companies have revolutionized the way commerce is conducted in the digital age. With their innovative solutions, businesses can offer seamless payment experiences to their customers while streamlining their internal financial operations.

FAQs

- What is payment processing software? Payment processing software refers to technology solutions that facilitate electronic transactions, allowing businesses to accept payments securely and also efficiently.

- How do I choose the right payment processing software for my business? Consider factors like your business size, transaction volume, integration needs, and budget. Research different options and read reviews to make an informed decision.

- What security measures are implemented by payment processing software companies? Payment processing software companies use encryption, tokenization, and adhere to security standards like PCI DSS to ensure secure transactions.