AUTHOR: KAJAL TIWARI

DATE:28/10/23

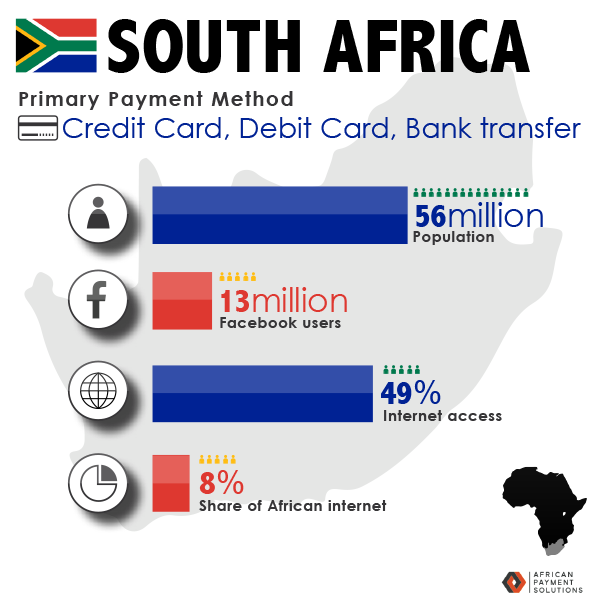

In the age of digitalization,[1] South Africa has witnessed a significant surge in the use of payment platforms.[2] This article delves into the world of payment platforms[3] in South Africa, exploring their impact on the economy[4], the most popular[5] choices, and what the future holds for these fintech solutions.

Introduction

South Africa, often referred to as the rainbow nation, is not only diverse in culture but also in its approach to financial technology. Payment platforms have become increasingly popular, reshaping the way South Africans handle their finances. This article will guide you through the landscape of payment platforms

The Digital Transformation

A Rapid Shift to Digital Payments

In recent years, South Africa has seen a dramatic shift from traditional cash transactions to digital payments. This transition is primarily driven by the convenience, security, and accessibility offered by digital payment platforms.

Impact on the Economy

The adoption of digital payment platforms has had a profound impact on South Africa’s economy. It has led to increased financial inclusion, reduced transaction costs, and improved transparency in financial transactions.

Popular Payment Platforms in South Africa

1. PayPal: A Global Giant

PayPal[1] is one of the most widely recognized payment platforms globally, and its presence in South Africa is no different. It offers secure and reliable online transactions[2] for both consumers and businesses.

2. SnapScan: The South African Pride

SnapScan is a homegrown payment platform tailored to the South African market. It allows users to make payments through a mobile app, making it convenient for local businesses.

3. Yoco: Empowering Small Businesses

Yoco is a payment platform that specifically targets small and medium-sized businesses. It offers card payment solutions, making it easier for entrepreneurs[3] to accept card payments.

The Future of Payment Platforms

1. Expanding Mobile Payment Solutions

The future of payment platforms in South Africa lies in expanding mobile payment solutions. With a growing smartphone[4] user base, more services will be available through mobile apps.

2. Enhanced Security Measures

To gain users’ trust, payment platforms are continually enhancing their security measures. Biometric [5]authentication authentication and advanced encryption will also become more common.

3. Collaboration with Traditional Banks

Expect to see more collaborations between payment platforms and traditional banks to provide a wider array of financial services.

The Role of Regulation

As the use of payment platforms increases, so does the importance of regulatory oversight. The South African government and the Reserve Bank are continuously working to ensure that these platforms adhere to robust security and compliance standards. This is crucial to maintaining user trust and protecting the financial ecosystem.

Financial Inclusion and Accessibility

One of the significant advantages of payment platforms in South Africa is their role in enhancing financial inclusion. These platforms provide a means for the unbanked and underbanked populations to access financial services. This is especially important in a country with a wide economic disparity.

The Power of Convenience

The convenience factor offered by payment platforms cannot be overstated. South Africans no longer need to carry large sums of cash or wait in long bank queues. Whether you’re paying for your groceries, splitting a restaurant bill, or contributing to a charity, payment platforms make transactions quick and hassle-free.

The Rise of Cryptocurrencies

In recent years, South Africa has witnessed the growing popularity of cryptocurrencies. Bitcoin, Ethereum, and other digital currencies have found a place in the country’s financial landscape. Payment platforms are beginning to integrate these cryptocurrencies into their services, allowing users to buy, sell, and store digital assets.

Building Trust in the Digital Age

To ensure the continued growth of payment platforms, building trust is paramount. South Africans should feel confident that their financial transactions are secure and that their data is protected. Payment platforms are investing in cutting-edge security measures, educating users about safe practices, and cooperating with law enforcement to combat fraud.

The Challenges Ahead

While payment platforms have brought significant benefits, they also face challenges. Cybersecurity threats, data breaches, and the potential for fraud are persistent concerns. Payment platforms need to stay ahead of these threats through ongoing innovation and robust security measures.

In Conclusion

The world of payment platforms in South Africa is evolving rapidly. With a diverse range of options and a promising future, these platforms are set to play a crucial role in the nation’s financial landscape. As South Africa continues to bridge the digital divide, payment platforms will be at the forefront of this transformation.

Frequently Asked Questions

- Are payment platforms safe to use in South Africa?

- Yes, payment platforms in South Africa prioritize security to protect users’ financial information.

- What benefits can you reap from utilizing mobile payment solutions in South Africa?

- Which payment platform is best for small businesses in South Africa?

- Yoco is a great choice for small businesses looking for reliable card payment solutions.

- How do payment platforms benefit the South African economy?

- Payment platforms enhance financial inclusion, reduce transaction costs, and promote transparency, positively impacting the economy.

- What should I look for when choosing a payment platform in South Africa?

- Consider factors like security features, transaction fees, and compatibility with your financial needs.