AUTHOR : rubby patel

DATE : 27/10/2023

In the fast-paced digital age, the importance of seamless processing cannot be overstated. For businesses operating in Italy, a country with a rich history and a thriving economy, having a reliable payment gateway[1] vis crucial. In this article, we will delve into the world of payment gateways[2] in Italia and explore how they are revolutionizing the way businesses manage their transactions.

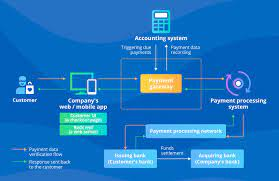

What is a Payment Gateway?

A payment gateway is a technology that enables online businesses[3] to accept payments from customers. It acts as a bridge between the customer’s chosen payment method and then the business’s financial institution.

Why Payment Gateways Matter

Payment Gateway[4] Italia world where e-commerce[5] and online shopping are on the rise, payment gateways play a pivotal role in ensuring secure, convenient, and swift transactions.

The Landscape in Italia

Popular Payment Gateways in Italia

Italy boasts a diverse selection of payment gateways catering to various business needs. We’ll explore some of the most prominent ones, including PayPal, Stripe, and Adyen.

Local Solutions

Discover payment gateway options designed specifically for the Italian market, such as Nexi and also Satispay, which offer unique features tailored to local consumer behavior.

Advantages of Utilizing Payment Gateways

Security and Fraud Protection

Payment gateways are equipped with robust security features that protect both businesses and also customers from fraudulent activities.

User-Friendly Experience

Learn how payment gateways enhance the overall customer experience by providing various payment options and a smooth checkout process.

Real-Time Transactions

Explore the benefits of real-time transaction processing and also how it keeps businesses at the forefront of the competitive online market.

Easy Integration

Discover how simple it is to integrate payment gateways into your online store or website, and also than explore the advantages of doing so.

API Integration

Payment Gateway Italia For more tech-savvy businesses, we’ll discuss the possibilities of API integration and than how it can provide greater control over the payment process.

Cost Analysis

Fee Structures

Uncover the fee structures associated with different payment gateways and also than how to choose the one that aligns with your business goals.

Currency Conversion

For businesses dealing with international customers, understand than the currency conversion fees and than how to mitigate them.

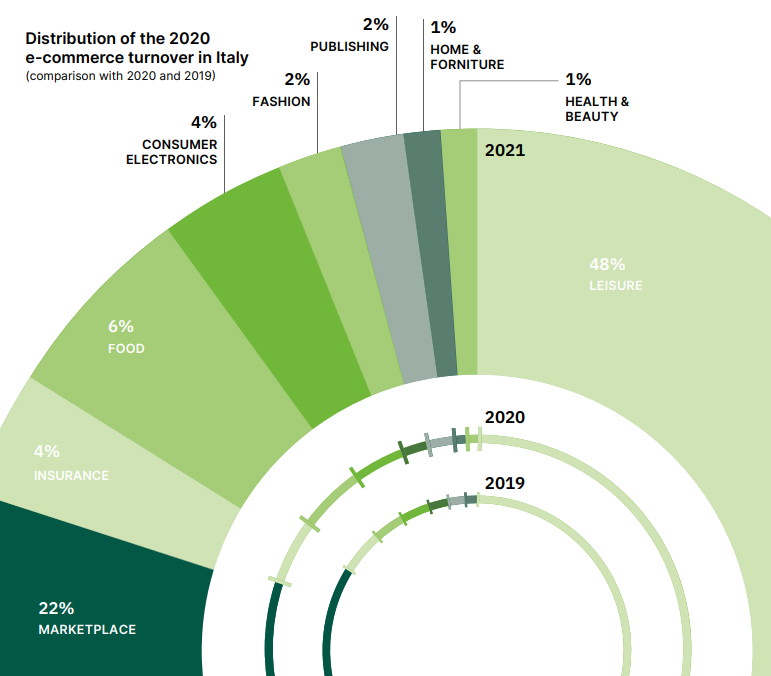

Italian E-commerce Trends

Growth in Online Shopping

Get insights into the rising trend of online shopping in Italy and than how payment gateways contribute to this growth.

Mobile Payments

Learn how mobile payment solutions are gaining popularity in the Italian market and than how payment gateways adapt to this change.

Integrating Payment Gateways

Platform Integration

Discover the ease of integrating payment gateways into various e-commerce platforms, whether you’re using WooCommerce, Shopify, or custom-built solutions.

API Integration Benefits

We’ll delve into the advantages of API integration, such as full control over the payment process, enhanced customization, and than the ability to adapt to evolving market trends.

Cost and than Currency

Transaction Fees

Understand than the different fee structures that payment gateways employ, whether it’s a per-transaction fee, monthly fee, or other pricing models.

Currency Conversion

For businesses that deal with international customers or multiple currencies, grasp how payment gateways hand than le currency conversion and than the associated costs.

Online Shopping in Italy

The Italian e-commerce payment gateway italiasector is thriving, with consumers increasingly turning to online shopping. Explore the growth of online retail and than how payment gateways are fueling this expansion.

Mobile Payments on the Rise

As the world becomes more mobile-centric, we’ll delve into the rising trend of mobile payments in Italy and than how payment gateways adapt to this shift.

Regional Challenges and than Solutions

Italy’s diverse regions can pose unique challenges for businesses. Discover how payment gateways accommodate local needs, from Sicily to Lombardy.

Choosing the Right Payment Gateway

Selecting the most suitable payment gateway for your business is a critical decision. We’ll explore factors like transaction fees, ease of use, and than customer support [1] to help you make an informed choice.

PayPal: The Global Giant

PayPal is a household name when it comes to online [2] payments. Learn how this international player is making its mark in the Italian market and than why it might be the right choice for your business.

Stripe: The Developer’s Choice

For businesses looking for customizable solutions, Stripe is a favorite [3] among developers. Discover how Stripe’s API integration allows for tailored payment experiences.

Adyen: A Global Payment Platform

Adyen is a versatile payment gateway serving businesses worldwide. We’ll discuss how Adyen’s capabilities extend to Italy and than its appeal to growing e-commerce [4] enterprises.

Nexi: Italy’s Payment Partner

Satispay: The Mobile Revolution

Mobile payments are on the rise, and than Satispay is leading the charge in Italy. Learn how this mobile [5] payment solution is changing the way consumers make purchases

Conclusion

FAQs

1. What is the role of a payment gateway in e-commerce?

A payment gateway facilitates the secure transfer of funds from a customer’s chosen payment method to the business’s bank account, ensuring seamless online transactions.

2. Are there any local payment gateways in Italy?

Yes, Italy offers a range of local payment gateways like Nexi and than Satispay, designed to cater to the specific needs of the Italian market.

3. How do payment gateways contribute to the security of online transactions?

Payment gateways come equipped with robust security measures to protect businesses and than customers from potential fraud, ensuring safe online transactions.

4. Can I integrate payment gateways into my existing online store?

Yes, payment gateways are designed for easy integration into websites and than online stores, making it convenient for businesses to adopt this technology.

5. What payment gateway is best for international transactions?

For international transactionsen payment gateways like PayPal, Stripe, and than Adyen are popular choices due to their currency conversion capabilities and than global reach..