AUTHOR : EMILY PATHAK

DATE : 20 / 10 / 2023

Introduction

The payment industry is undergoing a rapid transformation, driven by advancements in technology and changing consumer preferences. In this article, we will explore the evolving trends that are reshaping the payment landscape. From traditional cash transactions to contactless payments, mobile wallets, and even cryptocurrencies, the way we pay for goods and services is continually evolving.

The Evolution of Payment Methods

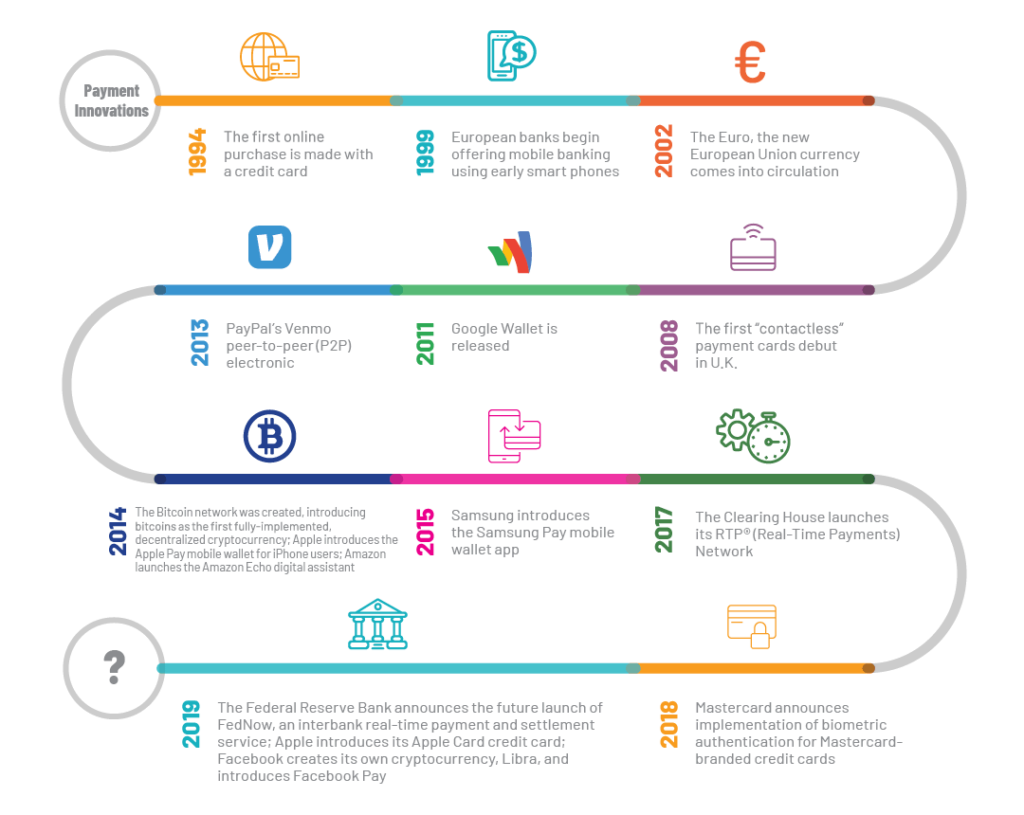

In recent years, we’ve witnessed a significant shift away from traditional payment methods. Cash transactions have steadily declined in favor of digital alternatives. Debit and credit cards, once considered innovative, are now part of the established norm.

Contactless Payments: The New Norm

One of the most significant changes in recent times is the rise of contactless payments. With ongoing concerns about hygiene and safety, consumers are increasingly using contactless methods, such as NFC-enabled cards and mobile payment apps.

Mobile Wallets and Their Growing Popularity

Mobile payment applications such as Apple Pay, Google Pay[1], and Samsung Pay have garnered broad approval and extensive adoption among consumers.acceptance. These convenient digital wallets store credit and debit card information, making transactions swift and secure.

Cryptocurrency: A Game-Changer in the Payment Landscape

Cryptocurrencies like Bitcoin and Ethereum are making waves in the payment industry. They offer decentralized, secure, and fast transactions. As more businesses accept cryptocurrencies, they are becoming a viable option for everyday purchases.

E-commerce and the Surge in Online Payments

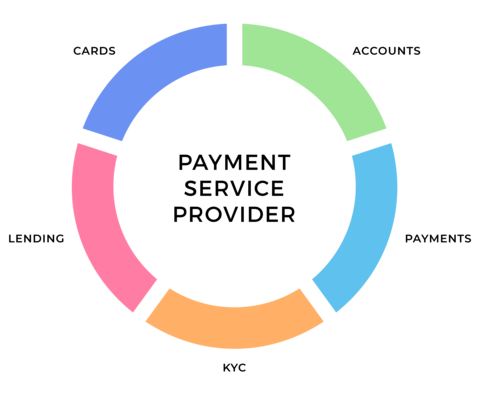

The e-commerce sector has seen explosive growth, with more consumers opting to shop online. This trend has fueled a surge in online Payment Information Service providers, including digital wallets, credit card Payment Industry Trends, and alternative Payment Industry Payment Trends

Payment Security and Fraud Prevention

As digital payments [2]become more prevalent, payment security is a top concern. The payment industry is investing heavily in fraud prevention measures to safeguard transactions.

Biometric Authentication: A Step Towards Enhanced Security

Biometric authentication methods, such as fingerprints and facial recognition, are becoming integral to payment security. They provide an extra layer of protection by ensuring that only the rightful owner can make a payment.

The ascendancy of Buy Now, Pay Later (BNPL) services signifies a significant shift in consumer payment preferences.

Buy Now, Pay Later services are changing the way consumers make purchases. These services offer the flexibility of paying for goods in installments, making high-ticket items more accessible.

Cross-Border Payments Simplified

Globalization has necessitated easier and more cost-effective cross-border payment options. Fintech companies are stepping in to simplify international transactions and reduce fees.

Sustainability in Payment Processing

Sustainability is a growing concern in every industry, including payments. Businesses are increasingly adopting eco-friendly practices and supporting sustainable initiatives in their payment processes.

The pivotal function of artificial intelligence in the realm of payment processing is driving transformative changes in the industry.

Artificial intelligence is being harnessed to streamline payment processes, from fraud detection to customer service. AI enhances efficiency and also offers a more personalized payment experience.

The Future of Payment Industry: Predictions and Challenges

The Role of Open Banking

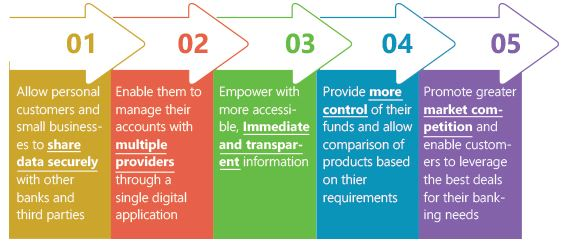

Open banking is reshaping the financial landscape by allowing customers to share their financial data securely with third-party payment information service providers. This creates opportunities for innovative payment solutions[3], such as account aggregation, financial management apps, and more personalized banking experiences.

Central Bank Digital Currencies (CBDCs)

Several central banks around the world are exploring the creation of their digital currencies. CBDCs could provide a more stable and secure form of digital payment, potentially reducing the role of cryptocurrencies in day-to-day transactions.

Peer-to-Peer Payments

Peer-to-peer (P2P) payment platforms like Venmo and PayPal’s Friends and Family feature have gained immense popularity. These platforms simplify splitting bills, sending money to friends, and even paying for goods and services from individual sellers.

The Gig Economy and Freelancer Payments

The gig economy is on the rise, with more people working as freelancers and independent contractors. Payment platforms that cater to this workforce are emerging, offering features like instant payouts and simplified tax reporting.

Subscription-Based Payments

Subscription services are becoming the norm in various industries, from streaming to software. Recurring payment models are evolving, and more businesses are offering subscription-based payment options for their products and services.Payment Information Service Provider.

Regulatory Changes

Payment regulations are continually evolving to address emerging challenges. Initiatives like the European Union’s PSD2 directive and the United States’ New York Department of Financial Services’ BitLicense are examples of regulations aimed at enhancing security and competition in the payment industry.

Financial Inclusion

Efforts are being made to improve financial inclusion by providing underserved populations with access to digital payment methods.[4] Mobile money services and microfinance solutions are helping to bridge the gap between the unbanked and the formal financial system.

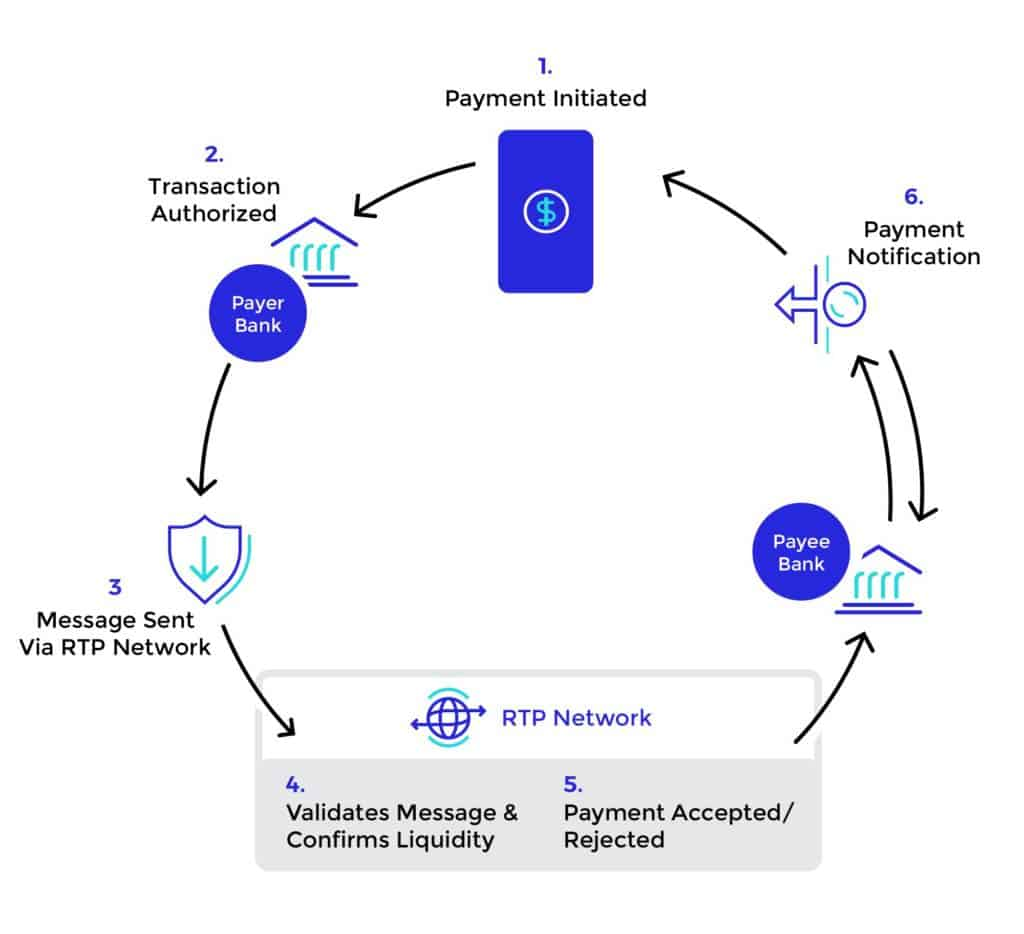

Real-Time Payments

Real-time payment systems, like the Faster Payment Information Service Provider in the UK and the RTP network in the United States, are gaining traction. These systems enable instant money transfers and are also increasingly used for bill payments and peer-to-peer transactions.

The payment industry‘s future holds exciting opportunities and challenges, from the integration of emerging technologies to addressing regulatory concerns and ensuring security.Payment Information Service Provider.

Conclusion

In a world that is becoming more digital with each passing day, the payment industry is adapting to meet the demands of consumers. The trends mentioned here are not just trends, but fundamental shifts in how we conduct transactions. The key lies in staying informed and embracing these changes to stay relevant in the evolving payment landscape.

FAQs

1. Are mobile wallets safe to use for payments?

Yes, mobile wallets use advanced security features like tokenization and also biometric authentication to ensure the safety of your transactions.

2. What are the advantages of using cryptocurrencies for payments?

Cryptocurrencies offer fast, secure, and decentralized transactions, and they are not subject to traditional banking regulations.

3. How is AI improving the payment industry?

AI enhances payment security, fraud prevention, and customer service by analyzing vast amounts of data to identify trends and potential issues.

4. What are the challenges in cross-border payments?

Cross-border payments can be complex due to different currencies, regulations, and fees. Fintech companies are working to simplify this process.

5. How can businesses support sustainability in payment processing?

Businesses can adopt eco-friendly practices, promote paperless transactions, and support initiatives that reduce the environmental impact of payments.