AUTHOR : EMILY PATHAK

DATE : 18 / 10 / 2023

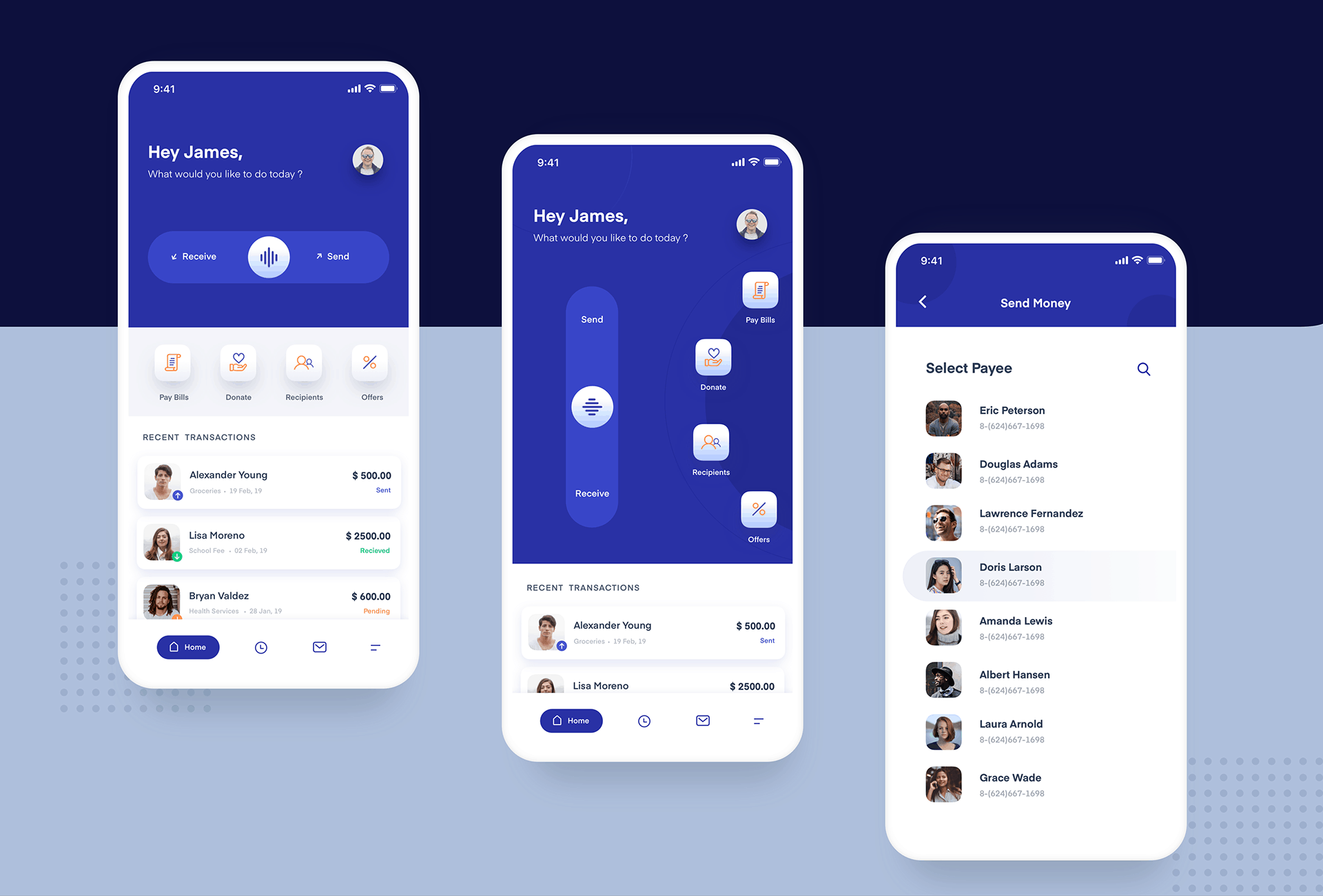

In a world driven by digitalization, the demand for convenient, efficient, and secure payment methods in mobile applications[1] is at an all-time high. Flutter, a popular open-source UI[2] software development kit, has gained prominence in recent years due to its ease of use, versatility, and cross-platform[3] capabilities. In this article, we will explore the fascinating realm of payment integration in Flutter and how it’s revolutionizing the way businesses and developers handle transactions.

What is flutter?

Before we dive into the world of payments, it’s essential to understand what Flutter[4] is. Flutter is a UI toolkit from Google that allows developers to build natively compiled applications for mobile, web, and desktop from a single codebase. It provides a fast, expressive, and flexible way to create user interfaces. This versatility makes it an ideal choice for developing applications that require payment processing[5].

The Importance of Payment Integration

Payment integration is a crucial aspect of any application that involves monetary transactions. Whether you’re running an e-commerce platform, a food delivery service, or a financial app, the seamless processing of payments is vital. Flutter’s ability to integrate payment gateways makes it an excellent choice for developers who want to provide users with a smooth payment experience.

Payment Gateways for Flutter

Flutter supports various payment gateways, each with its own set of features and capabilities. Here are some popular choices:

Stripe

Stripe is a widely-used payment gateway [1]known for its flexibility and developer-friendly APIs. It enables enterprises to receive payments seamlessly, both through web interfaces and mobile applications. Integrating Stripe with Flutter is relatively straightforward, thanks to the availability of plugins and documentation.

PayPal

PayPal is a trusted name in online payments. With Flutter, you can offer users the option to pay with their PayPal accounts, credit cards, or other payment methods. The PayPal Flutter package simplifies the integration process.

Square

Square is known for its point-of-sale solutions, and it also offers a Flutter SDK that enables businesses to accept in-person payments with ease. This is particularly beneficial for retailers and small businesses.

Braintree

Braintree, a subsidiary of PayPal, is another excellent option for payment processing in Flutter apps. It provides a secure and scalable way to handle transactions.

Setting Up Payment Integration in Flutter

To set up payment integration in your Flutter app, follow these steps:

Installing Dependencies

Start by adding the necessary dependencies for your chosen payment gateway to your file. This file is where you declare all your app’s dependencies.

Creating Payment Forms

Design user-friendly payment forms that allow customers to enter their payment information securely. Flutter offers numerous widgets for creating a seamless user experience.

Handling Transactions

Implement the logic to handle transactions. Ensure that your app communicates with the selected payment gateway to process payments smoothly.

Security Considerations

Security is paramount when dealing with payments. Ensure that your Flutter app follows best practices for data encryption, secure connections, and protecting sensitive customer information.

Testing Payment Integration

Before deploying your app, thoroughly test the payment integration [2]to identify and resolve any issues. Conduct both unit and end-to-end testing to guarantee a smooth user experience.

Benefits of Using Flutter for Payments

Using Flutter for payment integration offers several advantages:

- Cross-platform compatibility

- A single codebase for multiple platforms

- A wide range of plugins and libraries

- Excellent community support

- Intuitive and visually appealing user interfaces

Challenges in Payment Integration

While Flutter simplifies payment integration, some challenges can arise, such as:

- Compatibility issues with specific payment gateway[3]

- Complex UI design for payment forms

- Security concerns

Future of Payment in Flutter

As Flutter continues to evolve, we can expect even more sophisticated payment solutions and enhancements. The community and developers are constantly working to improve payment[4] integration within the framework.

The Developer Community

One of the strengths of Flutter lies in its robust developer community. This community continually creates and updates packages, plugins, and resources for payment integration. Engaging with this community can provide valuable insights, solutions to common issues, and updates on the latest trends in payment processing.

Adhering to Regulatory Requirements

As you embark on your journey of payment integration in Flutter[5], it’s essential to stay compliant with regulatory requirements. Different regions and industries may have specific rules and regulations regarding payment processing, data protection, and user privacy. Here are some guidelines to consider:

- Data Protection: Adhere to data protection laws, such as GDPR in Europe, by securing and handling customer data appropriately. Payment information is sensitive, and protecting it is paramount.

- PCI Compliance: If your app deals with credit card payments, ensure it complies with Payment Card Industry Data Security Standard (PCI DSS) requirements. This standard sets security standards for handling cardholder information.

- Local Regulations: Be aware of and comply with local regulations related to payment processing. These can vary from country to country and may include tax rules and consumer protection laws.

- User Consent: Obtain clear and informed consent from users regarding their payment data. This transparency builds trust and ensures that users are aware of how their information is being used.

Conclusion

In conclusion, payment integration in Flutter opens up a world of possibilities for developers and businesses. It allows for the creation of user-friendly and secure payment experiences, making it a valuable addition to any mobile or web application. By following best practices and staying updated with the latest developments, developers can harness the full potential of Flutter for payment processing.

Frequently Asked Questions

Is Flutter a secure platform for payment integration?

Yes, Flutter is a secure platform, provided developers follow best practices for security, encryption, and data protection.

What are the advantages of using Stripe with Flutter?

Stripe offers flexibility and developer-friendly APIs, making it an excellent choice for payment integration in Flutter.

How do I test payment integration in my Flutter app?

You can test payment integration by conducting thorough unit and end-to-end testing to ensure a smooth user experience.

Are there any limitations to using Flutter for payments?

While Flutter simplifies payment integration, compatibility issues with specific gateways and complex UI design can be challenging.

What should I consider when choosing a payment gateway for my Flutter app?

Consider factors like security, ease of integration, customer support, and transaction fees when selecting a payment gateway for your Flutter app.