AUTHOR : EMILY PATHAK

DATHE : 20 / 10 /2023

In the fast-paced digital era, the payment industry has evolved tremendously. With the surge in online transactions[1], it has become more crucial than ever to adhere to payment industry standards to ensure trust, security, and efficiency in financial transactions[2]. In this article, we will delve into the world of payment industry[3] standards, exploring the various aspects and key components that make this industry the backbone of modern finance.

The Evolution of Payment Industry

The history of payments dates back to barter and also trade, where goods were exchanged for goods. Over time, the world moved from a barter system to using cash, checks, credit cards, and now digital currencies[4] and contactless payments[5].

The Significance of Payment Standards

Payment standards are the rules and protocols that govern payment transactions. They play a vital role in ensuring that transactions are secure, efficient, and reliable. These standards provide a common language for the different entities involved in a payment transaction.

Regulatory Framework and Compliance

To maintain trust and security, governments and regulatory bodies have introduced a plethora of rules and regulations to govern the payment industry.[1] Compliance with these regulations is vital to maintaining the integrity of the financial system.

Security Measures in Payment Transactions

Security is paramount in the payment industry. We’ll discuss various security measures, such as encryption, tokenization, and multi-factor authentication, that safeguard transactions.

Payment Card Industry Data Security Standard (PCI DSS)

PCI DSS sets the standards for securing payment card data. Understanding these standards is crucial for any business handling card transactions.

EMV Chip Technology

EMV chip technology revolutionized card payments, making them more secure. We’ll explore the workings of EMV chips and their impact on payment industry standards[2].

Real-Time Payments

The demand for instant transactions is growing. Real-time payments and their standards are reshaping the industry.

Cryptocurrency and Blockchain in Payments

The rise of cryptocurrencies[3] and blockchain technology is changing the landscape of payment industry standards. We’ll delve into their implications.

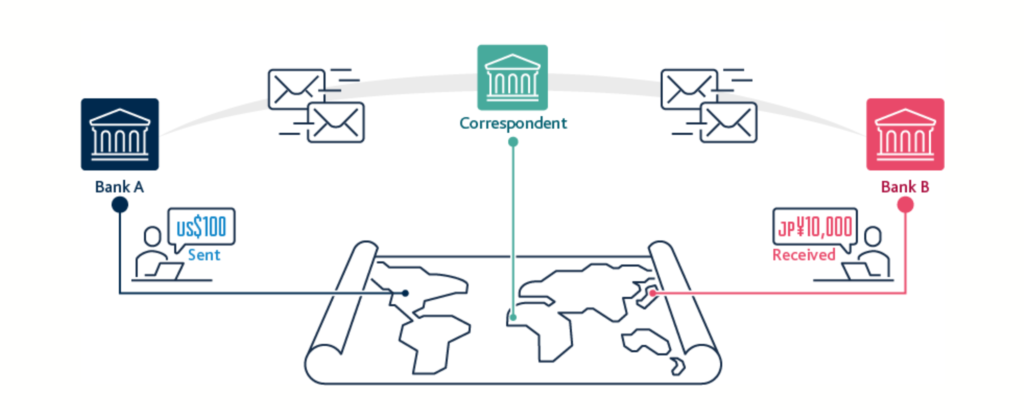

Cross-Border Payment Standards

Global commerce relies on cross-border payments[4]. Discover the standards and also challenges associated with international transactions.

Mobile Wallets and NFC Technology

Mobile wallets and Near Field Communication (NFC) are making payments more convenient. We’ll explore the standards behind these technologies.

The Role of Fintech in Payment Industry Standards

Fintech companies are disrupting traditional finance. We’ll discuss their role in shaping payment standards.

Challenges and Risks in Payment Standards

While payment standards provide security, they also face challenges and risks. We’ll address these issues and their impact on the industry.

Future Trends in Payment Industry Standards

The payment industry is continuously evolving. We’ll look at the future trends that will shape the standards in the years to come.

6. How does EMV chip technology enhance payment security?

The EMV chip technology enhances payment security by generating a unique transaction code for every purchase, making it extremely difficult for fraudsters to duplicate card information.

7. What are some notable challenges to cross-border payment standards?

Challenges in cross-border payment standards include varying regulations, exchange rate fluctuations, and the need for efficient currency conversion.

8. How can individuals and businesses adapt to the changing payment landscape?

Adapting to the changing payment landscape involves staying updated on the latest payment methods, security practices, and also complying with industry standards.

9. What role does mobile wallet technology play in modern payments?

Mobile wallet technology simplifies payments by allowing users to store their payment information securely on their smartphones, providing quick and easy access to their funds.

10. How can businesses leverage fintech innovations to improve their payment processes?

Businesses can leverage fintech innovations to streamline payment processes, enhance user experiences, and stay competitive in the digital era.

In this digital age, staying informed about payment industry standards is not just a recommendation; it’s a necessity. As payment methods continue to evolve, understanding the intricacies of industry standards ensures that your financial transactions remain secure, efficient, and reliable.

Contactless Payments and NFC Technology

One of the most significant shifts in recent years has been the rise of contactless payments and Near Field Communication (NFC) technology. With a simple tap of a card or smartphone, transactions can be completed swiftly. This technology not only enhances convenience but also reduces physical contact, a significant benefit during a global pandemic.

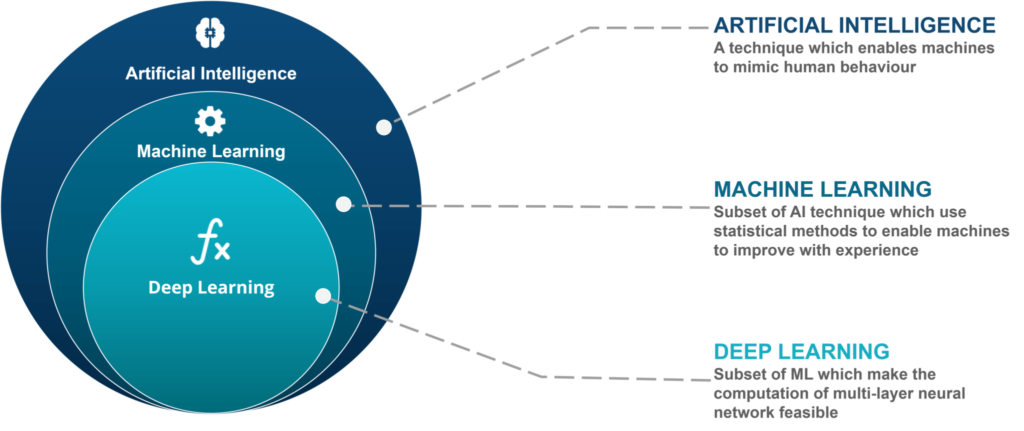

The Role of AI and Machine Learning

Artificial intelligence and also machine learning are revolutionizing the payment industry. These technologies are used to detect and prevent fraud, improve customer service, and also personalize payment experiences. AI-driven chatbots and virtual assistants have become integral in addressing customer inquiries efficiently.

Conclusion

In conclusion, payment industry standards are the backbone of secure and also efficient financial transactions. Adhering to these standards ensures trust and reliability, making the modern financial world function seamlessly.

FAQs

1. What is the primary goal of payment industry standards?

Payment industry standards aim to ensure secure, efficient, and also reliable financial transactions for individuals, businesses, and financial institutions.

2. How do regulatory bodies contribute to payment standards?

Regulatory bodies establish rules and also regulations to govern the payment industry, promoting compliance and also integrity.

3. What are the key security measures in payment transactions?

Key security measures include encryption, tokenization, and also multi-factor authentication, among others.

4. How are cryptocurrencies and blockchain impacting payment standards?

Cryptocurrencies and also blockchain are reshaping payment standards by introducing decentralized and secure methods of conducting transactions.

5. What does the future hold for payment industry standards?

The future of payment standards is marked by real-time transactions, innovative technologies, and also evolving regulations to keep up with the dynamic finandscape.