AUTHOR : ADINA XAVIER

DATE : 18/10/2023

In the digital age, the importance of seamless online payment processing[1] cannot be overstated. Whether you’re an e-commerce[2] entrepreneur, a software developer, or a business owner, understanding the payment gateway requirements[3] is essential to ensure secure, convenient, and reliable financial transactions[4]. This comprehensive guide will walk you through the ins and outs of payment gateway requirements[5], providing insights, tips, and best practices.

Introduction

What is a Payment Gateway?

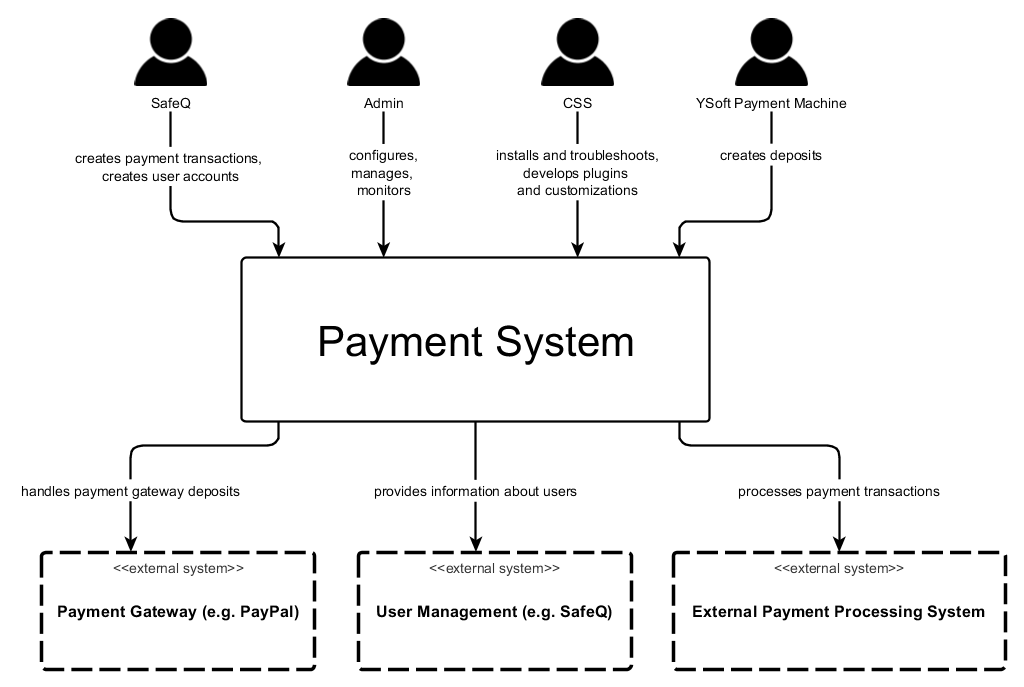

A payment gateway is a technology solution that facilitates online transactions by acting as the intermediary between the merchant’s website and the financial institutions responsible for processing payments. It ensures that customers’ payment information is securely transmitted and authorized. Without a payment gateway, online businesses would struggle to process payments effectively.

The Significance of Choosing the Right Payment Gateway

Selecting the right payment gateway is not a decision to be taken lightly. The choice of a payment gateway can significantly impact your business’s success. A well-suited payment gateway[1] will enhance the checkout experience for your customers, boost trust, and ultimately increase conversions.

Understanding Payment Gateway Basics

Payment Gateway Functionality

Payment gateways perform several crucial functions, including:

- Authorization: Verifying if the customer has sufficient funds for the transaction.

- Encryption: Safeguarding sensitive payment data.

- Routing: Directing payment data to the appropriate financial institution.

- Feedback: Providing transaction confirmation to both the customer and the merchant.

Different Types of Payment Gateways

Payment gateways come in various types, such as hosted payment gateways and API-based solutions. Each has its own set of advantages also disadvantages, making it important to choose one that aligns with your business’s specific needs.

Merchant Account Prerequisites

Setting Up a Merchant Account

To use a payment gateway, you typically need a merchant account. This account serves as a holding area for the funds you collect from customers. Setting up a merchant account[2] involves providing business information, agreeing to terms, and undergoing a verification process.

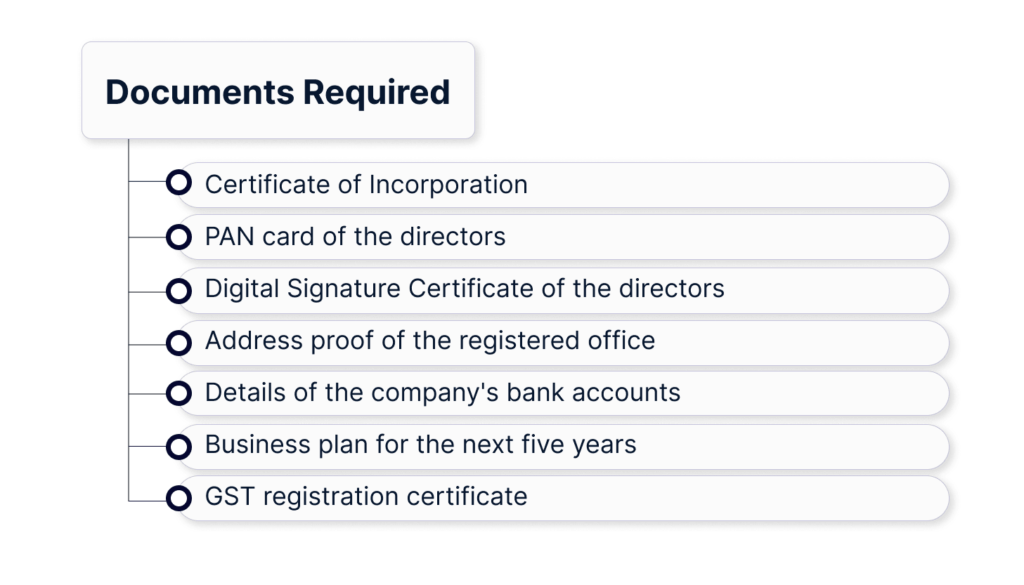

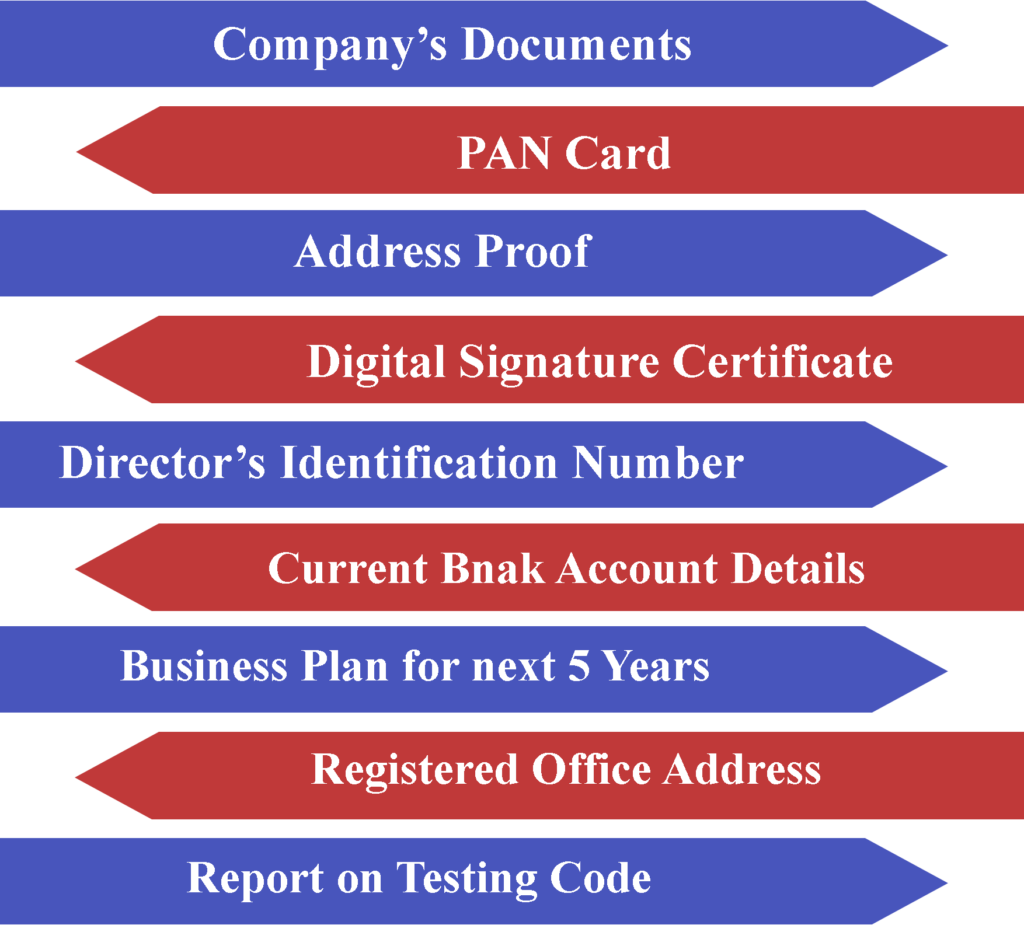

KYC and Verification Procedures

Know Your Customer (KYC) procedures are a standard part of setting up a merchant account. These procedures require you to provide identification also business documents to verify your identity and legitimacy as a business.

Security Protocols and Compliance

PCI DSS Compliance

It ensures that your payment processes adhere to strict security standards, protecting both your customers and your business from data breaches.

SSL Certificates and Data Encryption

Secure Sockets Layer (SSL) certificates are fundamental for encrypting payment data during transmission. Using SSL certificates adds an additional layer of security, instilling confidence in your customers.

User-Friendly Checkout Experience

Responsive Payment Pages

Your payment gateway should offer responsive payment pages that adapt to various screen sizes also devices, ensuring a smooth and user-friendly experience for customers.

Payment Gateway Customization

Customizing your payment gateway can enhance branding and trust. A well-branded payment page can make customers feel like they haven’t left your website.

Cross-Border Payments

Currency Support

If your business caters to international customers, your payment gateway[3] must support multiple currencies. This feature eliminates the friction of currency conversion for your customers.

International Payment Gateway Considerations

Cross-border transactions often involve different regulations also payment preferences. Understanding these variances and selecting a gateway that accommodates them is crucial for international success.

Payment Gateway Fees

Transaction Fees

Transaction fees can significantly affect your profitability. It’s essential to understand the fee structure of your chosen payment gateway, including transaction fees and any hidden costs.

Hidden Costs to Watch Out For

In addition to transaction fees[4], some gateways may have hidden costs, such as setup fees, chargeback fees, or monthly service charges. Being aware of these costs upfront can prevent unexpected financial burdens.

Payment Gateway Providers

Top Payment Gateway Providers

There are numerous payment gateway providers in the market, including PayPal, Stripe, and Square. Research and compare these providers to find the one that best suits your business.

Factors to Consider When Choosing a Provider

Consider factors such as ease of integration, available features, customer support, and fee structures when selecting a payment gateway provider.

Conclusion

In conclusion, payment gateway requirements are the backbone of smooth online transactions. Choosing the right payment gateway, ensuring security, and optimizing the checkout process are vital for your business’s success. With the right payment gateway, you can offer a seamless payment experience that builds trust and encourages customer loyalty.

FAQs

1. What role does a payment gateway play in facilitating online transactions?

A payment gateway acts as the intermediary between a merchant’s website and the financial institutions[5] responsible for processing payments, ensuring secure and efficient online transactions.

2. How do I ensure the security of payment data when using a payment gateway?

To ensure the security of payment data, make sure your payment gateway is PCI DSS compliant and uses SSL certificates for data encryption.

3. What should I consider when choosing a payment gateway provider?

When selecting a payment gateway provider, consider factors like ease of integration, available features, customer support, and fee structures to find the best fit for your business.

4. How can I handle chargebacks effectively?

Handling chargebacks effectively requires using the chargeback management tools provided by your payment gateway and following best practices for dispute resolution.

5. Is it essential to have 24/7 customer support from a payment gateway provider?

Having access to 24/7 customer support is crucial for resolving any payment-related issues promptly and ensuring uninterrupted business operations.