AUTHOR : HANIYA SMITH

DATE : 27/09/2023

Introduction

In the current era of digital advancements, the practice of online shopping has firmly entrenched itself into the fabric of our daily existence. With the convenience of purchasing products and services from the comfort of our homes, it’s no wonder that e-commerce has seen tremendous growth. However, behind the scenes, there’s a crucial element that makes these transactions possible: payment gateways. This article delves into the world of payment gateways,[1] explaining what they are, how they work, and why they are essential for seamless online shopping experiences.

Understanding Payment Gateways

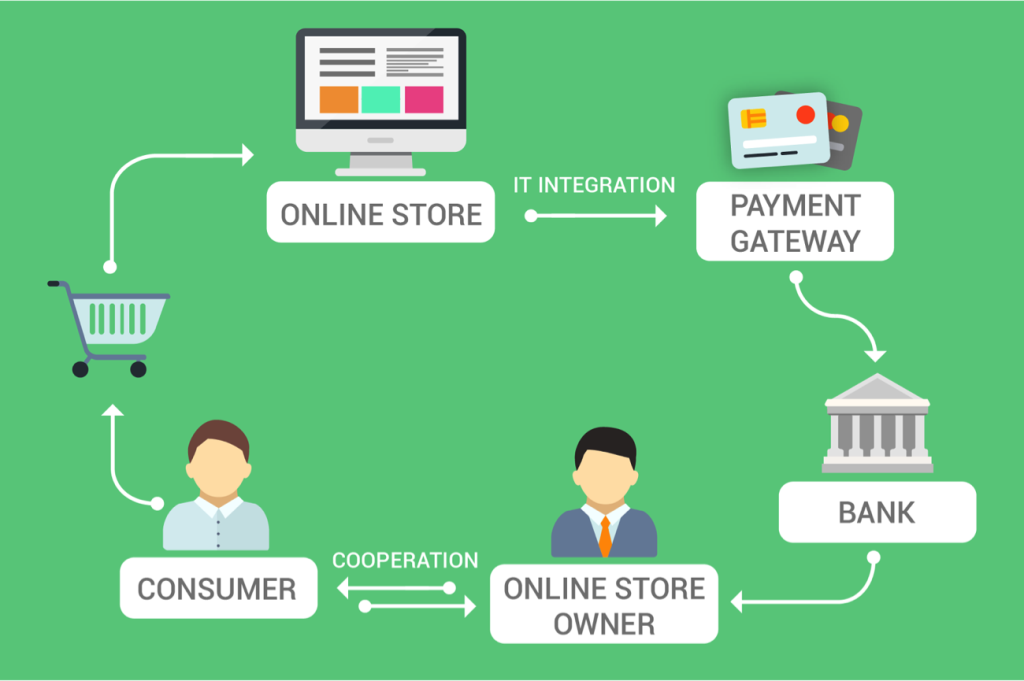

Payment gateways are online tools that enable e-commerce[2] websites to accept payments from customers. They serve as intermediaries between the customer’s bank and the merchant’s website[3], ensuring secure and efficient transactions. These gateways play a pivotal role in the e-commerce ecosystem by encrypting sensitive information,[4] verifying transactions, and also facilitating the transfer of funds.

Types of Payment Gateways

- Hosted Payment Gateways: In this setup, customers are redirected to a secure payment page hosted by the gateway provider. Popular hosted gateways include PayPal[5] and Stripe.

- Integrated Payment Gateways: These gateways allow customers to complete the transaction without leaving the merchant’s website. Examples include Authorize.Net and Square.

How Payment Gateways Work

When a customer makes a purchase online, several steps occur behind the scenes to ensure a smooth transaction:

Step 1: The customer initiates payment.

The customer selects their desired products or services and also proceeds to checkout. At this point, they are presented with payment options.

Step 2: Payment Information Entry

The customer enters their payment details, such as credit card information or digital wallet credentials. This data is transmitted with the utmost security to the payment gateway.

Step 3: Payment Gateway Authorization

The payment gateway encrypts the customer’s data and also sends it to the respective bank or financial institution for authorization.

Step 4: Authorization Response

The bank reviews the transaction and also checks for available funds. If approved, the bank sends an authorization code to the payment gateway.

Step 5: Transaction Completion

Upon receiving the authorization code, the payment gateway informs the merchant’s website,[1] allowing the order to be processed and confirmed.

Why Payment Gateways Matter

Payment gateways offer numerous benefits to both customers and merchants.

Enhanced Security

Payment gateways employ advanced encryption techniques to protect customer data, reducing the risk of fraud and identity theft.

Global Accessibility

Merchants can reach customers worldwide, as payment gateways support various [2]currencies and payment methods.

Convenience

Customers can make quick and hassle-free transactions without the need to share sensitive information directly with the merchant.

Reliable Transactions

Payment gateways ensure that funds are available before processing transactions, reducing the likelihood of chargebacks.

The Future of Payment Gateways

As technology continues to evolve, payment gateways are expected to become even more seamless and secure. Features such as biometric authentication and one-click payments are becoming increasingly popular, making online shopping faster and more convenient than ever.

Exploring Payment Gateway Features

Payment gateways come with a range of features that enhance the online shopping experience. Let’s dive deeper into some of these key elements:

1. Multiple Payment Options

Payment gateways support various payment methods, including credit cards, debit cards, digital wallets like PayPal, and even cryptocurrency in some cases. This versatility ensures that customers can choose the payment option that suits them best.

2. Mobile Compatibility

As mobile shopping becomes increasingly popular, payment gateways have adapted to mobile devices. They offer responsive designs and mobile apps, allowing customers to make purchases on smartphones and tablets with ease.

3. Security Measures

Security is paramount in online transactions.[3] Payment gateways employ robust security protocols, such as SSL encryption, to safeguard customer data. Additionally, they often have fraud prevention tools in place to detect and prevent fraudulent activities.

4. Recurring Payments

For subscription-based services or memberships, payment gateways enable recurring payments. This feature automates billing at regular intervals, ensuring a seamless experience for both customers and merchants.

5. Currency Conversion

For international e-commerce, payment gateways offer currency conversion services. This allows customers to view prices in their local currency and also make payments in a familiar monetary unit.

Conclusion

In the world of e-commerce, payment gateways are the unsung heroes that enable secure and efficient online transactions. Their role in simplifying payments cannot be overstated. As online shopping continues to grow, payment gateways will continue to evolve, providing customers with a seamless and secure shopping experience.

FAQs

- Are payment gateways safe for online shopping?

Yes, payment gateways[4] employ advanced encryption and security measures to protect your payment information. - Is it necessary to possess a merchant account when utilizing a payment gateway?

While certain payment gateways mandate a merchant account, others do not impose this requirement. It depends on the gateway provider. - Is it feasible to employ multiple payment gateways on my e-commerce platform?

Yes, many e-commerce platforms allow you to integrate multiple payment gateways to offer customers more options. - How long does it take for a payment to be processed through a gateway?

Payment processing times can vary, but most transactions are completed within seconds.