AUTHOR : ANNU CHAUHAN

DATE : 11-09-2023

In the contemporary era[1], the realm of e-commerce[2] has seamlessly woven itself into the fabric of our daily existence. While it offers convenience and accessibility[3], it also comes with its fair share of challenges. One such challenge that online businesses[4] face is chargebacks. In this article, we will delve deep into the world of high chargeback merchant accounts[5], exploring what they are, why they matter, and also how to effectively manage them.

Understanding Chargebacks

What Are Chargebacks?

Chargebacks, also known as payment reversals, occur when a customer disputes a transaction made with their credit or debit card. This results in the funds being returned to the customer, and also the merchant is left to cover the cost. Chargebacks are typically initiated for reasons such as unauthorized transactions, product dissatisfaction, or billing errors.

Why Do Chargebacks Occur?

Chargebacks can happen for various reasons. Customers may not recognize a transaction on their statement, leading them to believe it’s fraudulent. In some cases, they might not have received the purchased item or service. Additionally, credit card fraud can also lead to chargebacks.

Consequences of High Chargebacks

High chargeback rates can be detrimental to businesses. They can result in financial losses, damage to a merchant’s reputation, and also increased processing fees. Moreover, excessive chargebacks may lead to a merchant’s account being labeled as high risk.

The Importance of a Merchant Account

What Is a Merchant Account?

A merchant account is a financial arrangement that allows businesses to accept payments through credit and debit cards also. It serves as an intermediary between the merchant, the customer, and the payment processor.

How Does It Work?

When a customer makes a card payment, the funds are first deposited into the merchant account. From there, they are transferred to the business’s bank account after deducting processing fees.

Types of Merchant Accounts

There are various types of merchant accounts, including standard, high risk, and offshore. High-risk merchant accounts are specifically designed for businesses facing a higher risk of chargebacks.

High Chargebacks: Causes and Consequences also

Common Reasons for High Chargebacks

Several factors can contribute to high chargeback rates, including poor customer service, misleading product descriptions, and inadequate fraud prevention measures.

Impact on Businesses

High chargebacks can lead to financial strain, increased operational costs, and even the termination of merchant accounts. It’s essential for businesses to address these issues promptly.

The Role of Payment Processors

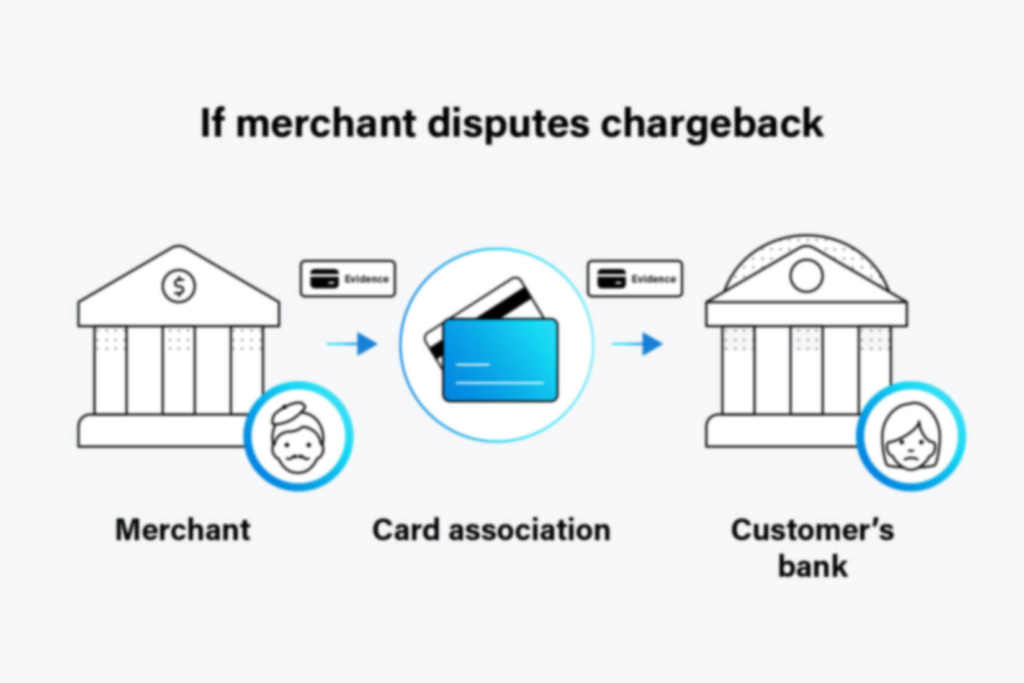

How Payment Processors Handle Chargebacks

Payment processors play a crucial role in mediating chargeback disputes between merchants and customers. They review evidence and determine whether a chargeback is valid.

Choosing the Right Payment Processor

Selecting a reliable payment processor is critical for businesses. It’s important to partner with a processor that has experience in managing chargebacks effectively.

Strategies for Preventing Chargebacks

Implementing Stringent Verification Processes

By implementing robust identity verification processes, businesses can reduce the likelihood of unauthorized transactions and chargebacks.

Enhancing Customer Support

Excellent customer support can address issues promptly and prevent disputes from escalating into chargebacks.

Effective Communication

Clear communication with customers about billing, refunds, and product deliveries can minimize misunderstandings and disputes also.

Managing High Chargeback Ratios

Monitoring and Reporting also

Regularly monitoring chargeback ratios and also reporting them to payment processors is essential for managing high-risk merchant accounts.

Dispute Resolution

Efficient dispute resolution involves gathering evidence and presenting a compelling case to challenge invalid chargebacks.

Chargeback Representment

Chargeback representment is the process of appealing a chargeback decision. It requires merchants to provide compelling evidence to prove the transaction’s legitimacy.

The Benefits of a High-Risk Merchant Account

Who Needs a High-Risk Merchant Account?

Businesses with high chargeback ratios or those operating in industries prone to chargebacks, such as online gaming or travel, can benefit from high-risk merchant accounts.

How to Apply for One

Applying for a high-risk merchant account involves providing detailed information about your business and its risk factors also.

High-Risk Merchant Account Providers

Several payment processors specialize in high-risk merchant accounts, offering tailored solutions to meet the unique needs of these businesses.

Mitigating Risk and Improving Business Operations

Fraud Detection and Prevention also

Implementing robust fraud detection and prevention measures can significantly reduce the risk of chargebacks.

Customer Relationship Management

Maintaining positive relationships with customers can lead to fewer disputes and chargebacks.

Continuous Improvement

Regularly assessing and improving business operations can help minimize chargebacks in the long run.

Industry-Specific Challenges

E-commerce

E-commerce businesses face unique challenges related to chargebacks, including online fraud and delivery disputes.

Travel and Hospitality

The travel and hospitality industry often deals with chargebacks due to booking cancellations and service quality issues.

Subscription Services

Subscription-based businesses need to manage chargebacks resulting from billing disputes and subscription cancellations.

Legal and Regulatory Considerations

Consumer Protection Laws

Understanding and complying with consumer protection laws is essential for mitigating chargeback risks.

Compliance Requirements

Adhering to industry-specific compliance requirements can help businesses avoid chargebacks related to regulatory issues.

Data Security

Protecting customer data is crucial for reducing the risk of data breaches and chargebacks related to fraud.

Case Studies

Success Stories

Explore real-life success stories of businesses that effectively managed high chargeback ratios and improved their operations.

Lessons Learned

Learn valuable lessons from businesses that faced chargeback challenges and emerged stronger.

The Future of High Chargeback Merchant Accounts

Technological Advances

Advancements in technology, such as blockchain and AI, hold the potential to reshape how businesses manage chargebacks.

Changing Consumer Behavior

As consumer behavior evolves, businesses must adapt their strategies to reduce chargeback risks.

Adaptation and Innovation

The ability to adapt and innovate in response to changing chargeback trends will be crucial for future success.

Expert Insights and Advice

Interviews with Industry Experts

Gain insights from experts in the field who offer guidance on chargeback prevention and management.

Best Practices

Discover best practices and strategies for effectively managing chargebacks in your business.

Conclusion

In conclusion, high chargeback merchant accounts are a significant concern for businesses, especially in the e-commerce and high-risk sectors. However, with the right strategies in place, businesses can mitigate the risks associated with chargebacks and ensure smoother operations.

5 Unique FAQs

- What is the most common reason for chargebacks in e-commerce?

- Chargebacks in e-commerce are often initiated due to customers not recognizing a transaction on their statement, leading to concerns about fraud.

- How can businesses improve their chargeback prevention measures?

- Businesses can enhance their chargeback prevention measures by implementing robust fraud detection, clear communication with customers, and efficient dispute resolution processes.

- What industries are more prone to high chargeback ratios?

- Industries such as online gaming, travel, and subscription services are often more prone to high chargeback ratios due to their specific challenges.

- What legal considerations should businesses be aware of regarding chargebacks?

- Businesses should be aware of consumer protection laws, compliance requirements, and data security regulations to avoid chargebacks related to legal issues.

- How can technological advances like blockchain help reduce chargebacks?

- Technological advances like blockchain can enhance transaction security and transparency, reducing the risk of fraudulent chargebacks.