AUTHOR : ADINA XAVIER

DATE : 20/09/2023

In the fast-paced world of e-commerce[1], where convenience meets consumer demands, the payment process[2] plays a pivotal role in ensuring a seamless shopping experience. In this article, we will delve into the intricate world of payment methods[3] in e-commerce[4], exploring the various options available to both consumers and merchants. From traditional credit cards[5] to innovative digital wallets, we’ll cover it all. So, fasten your seatbelts, and let’s embark on this journey through the realm of payment e-commerce.

Introduction

E-commerce has revolutionized the way we shop, enabling us to purchase products and services from the comfort of our homes. However, behind this convenience lies a complex web of payment methods and technologies that ensure the smooth flow of transactions. In this article, we will unravel the intricacies of it, exploring its history, evolution, also the exciting trends that shape its future.

The Evolution of Payment Methods

Traditional Methods

In the early days of e-commerce, credit cards were the primary means of payment. Customers would enter their card details, also transactions were processed through payment gateways[1]. While credit cards are still widely used, the landscape has evolved to accommodate a plethora of payment options.

Digital Payment Solutions

Today, digital wallets like PayPal, Apple Pay, also Google Pay have gained popularity. These digital payment solutions offer a convenient also secure way to make online purchases. Customers can link their bank accounts or credit cards to these wallets, streamlining the checkout process.

Benefits of E-commerce Payment Solutions

This solutions offer several advantages. They facilitate quick transactions, reduce the risk of fraud, also provide customers with flexibility in choosing their preferred payment method. Moreover, these solutions offer insights into consumer behavior, helping businesses make informed decisions.

Security Concerns and Solutions

With the rise in online transactions, security concerns have become paramount. Payment service providers employ encryption, tokenization, and multi-factor authentication to safeguard sensitive data. Consumers must remain vigilant by keeping their payment information secure.

Mobile Payments: The Future of E-commerce

The proliferation of smartphones has given rise to mobile payments[2]. Apps like Venmo and Samsung Pay allow users to make purchases with a simple tap of their phone. Mobile payments are expected to dominate the e-commerce landscape in the coming years.

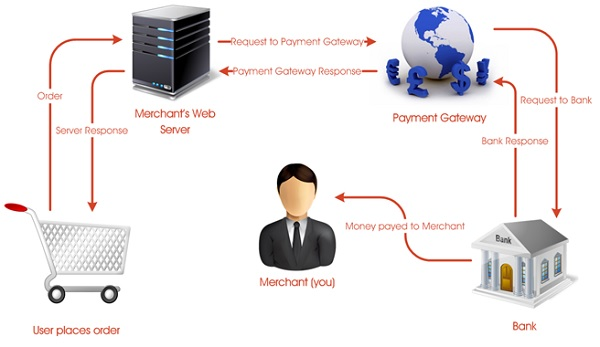

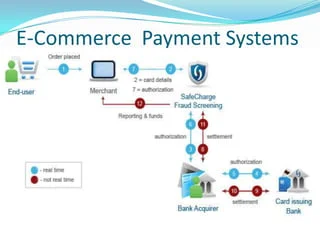

E-commerce Payment Gateways

Payment gateways act as intermediaries between e-commerce websites and financial institutions. They ensure that transactions are secure and that funds are transferred seamlessly. Popular payment gateways include Stripe, Square, and Authorize.Net.

Cryptocurrency in E-commerce

Cryptocurrency[3], such as Bitcoin and Ethereum, has gained traction in e-commerce. These digital currencies offer a decentralized and borderless payment option. However, their volatility poses challenges for both consumers and merchants.

User Experience: The Key to Successful Payment Processing

A smooth and user-friendly payment process is essential for e-commerce success. Slow-loading payment pages or complex checkout forms can lead to cart abandonment. Therefore, optimizing the user experience is crucial.

Integrating Payment Options into Your Online Store

E-commerce businesses must provide multiple payment options to cater to diverse customer preferences. Offering various methods, including credit cards, digital wallets[4], and even buy now, pay later options, can boost sales and customer satisfaction.

International Transactions and Cross-border Payments

Global e-commerce requires dealing with international transactions. Merchants must navigate currency conversions, shipping logistics, and compliance with different regulations. Payment processors specializing in international payments can simplify this process.

The Role of Payment Processors

Payment processors facilitate transactions between merchants and financial institutions. They play a critical role in ensuring the efficient movement of funds and providing support for dispute resolution.

Emerging Trends in E-commerce Payments

As technology continues to advance, new trends emerge in e-commerce payments[5]. These include the use of biometrics for authentication, the integration of voice-activated payments, and the growth of contactless payments.

Challenges in E-commerce Payments

Despite its many advantages, e-commerce payments face challenges such as cyber threats, regulatory changes, and the need for constant innovation. Businesses must adapt to these challenges to stay competitive.

Future Predictions

The future of it is exciting and dynamic. We can anticipate further innovations in payment methods, enhanced security measures, and a more personalized shopping experience for consumers.

Conclusion

Payment e-commerce is the lifeblood of online shopping, ensuring that transactions occur smoothly and securely. As the landscape continues to evolve, staying informed about the latest payment trends and technologies is essential for businesses and consumers alike.

FAQs

1. What are the most popular digital payment solutions for e-commerce?

The most popular digital payment solutions for e-commerce include PayPal, Apple Pay, and Google Pay. These platforms offer convenience and security for online transactions.

2. How can businesses enhance the security of e-commerce payments?

Businesses can enhance the security of it by implementing encryption, tokenization, and multi-factor authentication. Conducting routine security assessments and providing ongoing employee education are equally imperative.

3. What role do payment gateways play in e-commerce?

Payment gateways act as intermediaries between e-commerce websites and financial institutions. They ensure secure and seamless transactions by transmitting payment data securely.

4. Are cryptocurrencies widely accepted in e-commerce?

While cryptocurrencies like Bitcoin are gaining acceptance in e-commerce, they are not yet widely adopted due to their volatility. However, some businesses offer cryptocurrency as a payment option.

5. What does the future hold for e-commerce payments?

The future of it promises innovations in payment methods, enhanced security, and a more personalized shopping experience. Mobile payments and contactless options are expected to thrive.