AUTHOR : ANNU CHAUHAN

DATE : 02-09-2023

In today’s digital age, having a website with payment processing capabilities is essential for businesses furthermore individuals alike. Whether you’re an e-commerce entrepreneur, a freelancer, or a nonprofit organization, the ability to accept online payments can significantly enhance your online presence and streamline financial transactions. In this article, we’ll delve into the world of website payment processing, exploring the fundamentals, benefits, and best practices for creating a seamless online platform that caters to your payment needs.

Introduction: The Importance of Payment Processing

In a world where e-commerce and online transactions have become the norm, having a functional and also secure payment processing system on your website is indispensable. Payment processing involves the handling of financial transactions made by customers through credit cards, debit cards, digital wallets, and other online payment methods also. It serves as the bridge that connects your website to your bank account, ensuring that you receive payments seamlessly.

Understanding Payment Gateways

What is a Payment Gateway?

A payment gateway is a technology that authorizes and processes online payments between a customer and a merchant also. It acts as a virtual point-of-sale terminal, securely transmitting payment data from the customer to the merchant’s bank.

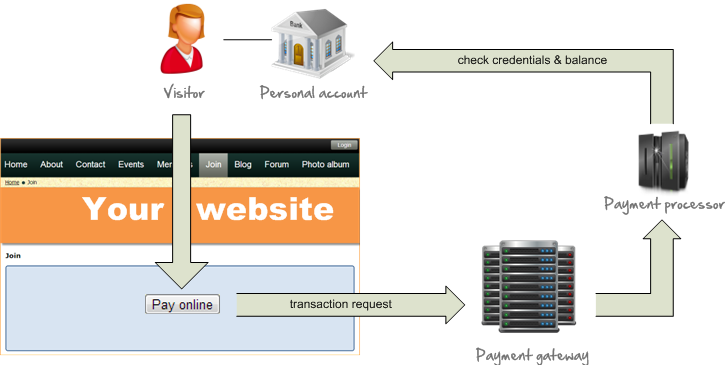

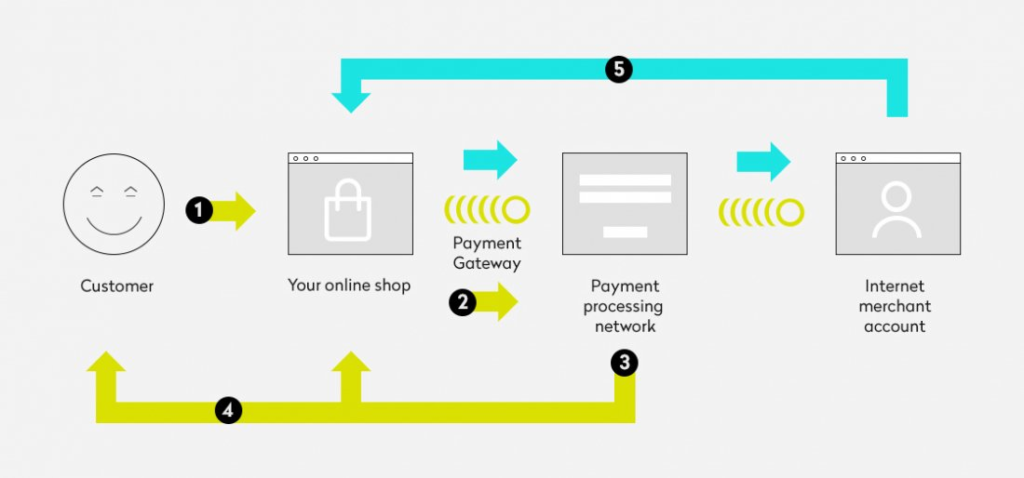

How Payment Gateways Work

Payment gateways work in a straightforward manner. When a customer makes a purchase on a website, the payment gateway performs several essential tasks:

- It encrypts the customer’s payment data to ensure security.

- It verifies the customer’s payment information with the issuing bank.

- It authorizes or declines the transaction based on the bank’s response.

- It facilitates the transfer of funds from the customer’s account to the merchant’s account.

Types of Payment Gateways

Payment gateways come in two main types: hosted payment gateways and also self-hosted payment gateways.

Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure third-party page to complete the payment process. This type is easier to set up but may lead to a less seamless user experience.

Self-Hosted Payment Gateways

Self-hosted payment gateways allow customers to complete transactions directly on the merchant’s website. While providing more control and customization also, they require stricter security measures.

Choosing the Right Payment Gateway

Selecting the appropriate payment gateway is a crucial decision in creating a website with payment processing capabilities. Several factors should influence your choice:

Factors to Consider

- Transaction Fees

- Accepted Payment Methods

- Security Features

- Integration Complexity

- Reputation and Support also

Popular Payment Gateway Providers

Some of the most widely used payment gateway providers include PayPal, Stripe, Square, and Authorize.net. Each has its own set of features and pricing, so careful evaluation is essential.

Integrating Payment Processing into Your Website

Now that you understand the basics of payment gateways, let’s explore the steps involved in integrating payment processing into your website.

Step 1: Register for a Merchant Account

To get started, you’ll need to set up a merchant account with a bank or a payment service provider. This account will be the destination for the funds you receive from customers.

Step 2: Selecting the Appropriate Payment Gateway

Choose a payment gateway that aligns with your business needs and budget. Consider factors like transaction fees, payment methods, and security features.

Step 3: Implementing Payment Gateway APIs

Integrate the selected payment gateway into your website using their APIs (Application Programming Interfaces). This allows your website to communicate with the payment gateway for transaction processing.

Ensuring Security in Payment Processing

Security is paramount when it comes to payment processing on your website. Customers trust you with their sensitive financial information, and it’s your responsibility to keep it safe.

SSL Certificates and HTTPS

Implement Secure Sockets Layer (SSL) certificates on your website to encrypt data transmitted between your site and the customer’s browser. Ensuring the confidentiality of sensitive information is of paramount importance, guaranteeing the utmost security for users’ data.

PCI DSS Compliance

Comply with Payment Card Industry Data Security Standard (PCI DSS) requirements to safeguard cardholder data. Neglecting to adhere to these criteria may lead to significant repercussions with potentially dire consequences.

User-Friendly Payment Forms

Simplicity and convenience are key when designing payment forms on your website.

Simplifying the Checkout Process

Minimize the number of steps required for customers to complete a transaction. A simplified checkout procedure has the potential to diminish instances of cart abandonment, thus improving the overall shopping experience for customers.

Mobile Optimization

With the increasing use of smartphones for online shopping, ensure that your payment forms are mobile-friendly. A responsive design is essential for a seamless mobile experience.

Testing and Quality Assurance

Before launching your website with payment processing, thoroughly test the payment system to identify and resolve any issues.

The Importance of Test Transactions

Conduct test transactions using different payment methods to ensure that everything functions as expected. This helps prevent real transaction failures.

Monitoring and Analytics

After implementing payment processing, monitor and analyze transaction data to gain insights into your customers’ behavior.

Tracking Transactions

Keep a close eye on all transactions, including successful payments, chargebacks, and refunds also. This data can inform business decisions.

Understanding Customer Behavior

Analyze customer behavior during the payment process. Identify any friction points that may cause customers to abandon their carts.

Payment Processing Challenges and Solutions

Despite your best efforts, challenges may arise in the payment processing journey. Let’s explore some prevalent challenges and also effective strategies for resolving them.

Dealing with Chargebacks

Chargebacks occur when customers dispute a transaction. Be prepared to provide evidence of the transaction’s legitimacy to resolve disputes.

Handling Failed Transactions

Sometimes, transactions fail for various reasons. Implement clear error messages and offer alternative payment methods to prevent frustration.

Enhancing User Trust

Building trust with your customers is essential for successful payment processing.

Trust Seals and Certifications also

Display trust seals and certifications on your website to assure customers of secure payment processing.

Transparent Policies

Clearly communicate your refund, return, and privacy policies to customers. Transparency builds trust.

Optimizing for Mobile Payments

As mobile shopping continues to rise, optimizing your website for mobile payments is crucial.

Mobile Wallet Integration

Support popular mobile wallets like Apple Pay and Google Pay to cater to mobile users.

International Payment Considerations

If your audience is global, consider the complexities of international payment processing.

Currency Conversion and Multi-Currency Support

Offer currency conversion options and support multiple currencies to accommodate international customers.

Legal and Compliance Aspects

Ensure that your website complies with legal and regulatory requirements in your region and for your industry.

Privacy and Data Protection

Adhere to data protection laws like GDPR to safeguard customer information.

Taxation and Reporting

Understand the tax implications of online transactions and report income accurately.

Conclusion: Unlocking the Power of Online Payments

In conclusion, having a website with payment processing capabilities can transform your online presence and boost your revenue. By understanding payment gateways, ensuring security, and also optimizing user experience, you can create a seamless payment process that instills trust in your customers.

FAQS

- Could you explain the distinction between a payment gateway and a merchant account?

- A payment gateway is a technology that facilitates online transactions, while a merchant account is a bank account where the funds from these transactions are deposited.

- How can I choose the right payment gateway for my business?

- Consider factors such as transaction fees, accepted payment methods, security features, and integration complexity when selecting a payment gateway.

- What are some common security measures to protect payment data?

- Implement SSL certificates, comply with PCI DSS standards, and also regularly update your security protocols.

- What strategies can I employ to minimize cart abandonment rates in the checkout process effectively?

- Simplify the checkout process, offer multiple payment options, and ensure mobile optimization for a smooth user experience.

- What should I do if I encounter a chargeback from a customer?

- Provide evidence of the transaction’s legitimacy and be prepared to engage in the dispute resolution process with the payment gateway.