AUTHOR : ANNU CHAUHAN

DATE : 02-09-2023

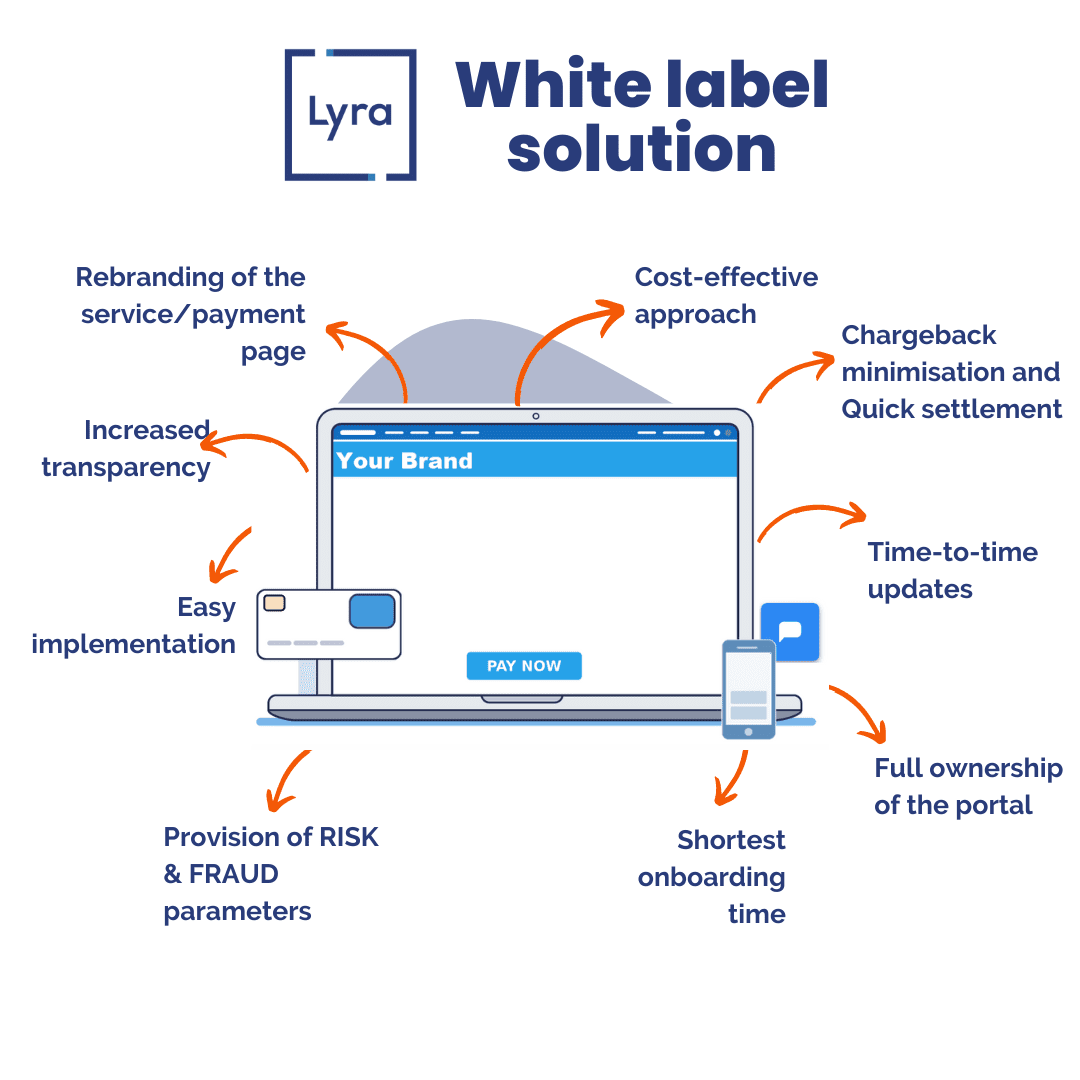

In today’s fast-paced digital world[1], businesses are constantly seeking innovative ways to streamline[2] their operations, enhance customer experiences, and boost revenue[3] also. One such solution has gained significant traction in recent years. This comprehensive article will delve deep into the world of white label gateway solutions[4], uncovering what they are, how they work, and also the myriad benefits they offer to businesses across industries[5].

Understanding

What Are White Label Gateway Solutions?

This, often referred to simply as gateway solutions, are essential tools that facilitate online payment processing. These solutions allow businesses to accept payments from customers through various channels, such as credit cards, debit cards, digital wallets, and more. What sets white label gateway solutions apart is their ability to be rebranded and also integrated seamlessly into a business’s existing infrastructure.

How Do They Work?

White label gateway solutions operate as intermediaries between the merchant, the customer, and the financial institutions. When a customer makes a payment, the gateway securely transmits the transaction data to the payment processor, which then communicates with the customer’s bank to authorize and process the payment. This process occurs in a matter of seconds, ensuring a smooth and efficient payment experience.

The Key Components

To better comprehend the functioning of white label gateway solutions, let’s break down their key components:

Payment Gateway

The payment gateway itself is the core component. It acts as the bridge between the customer’s payment information and the merchant’s website or application.

Payment Processor

The payment processor plays a vital role in verifying and authorizing transactions. It communicates with the customer’s bank to ensure there are sufficient funds and then facilitates the transfer of funds to the merchant’s account.

Security Protocols

Security is paramount in online transactions. It is incorporate robust encryption and security protocols to safeguard sensitive customer data, reducing the risk of fraud and data breaches.

The Advantages of White Label Gateway Solutions

Now that we have a solid understanding of what white label gateway solutions are and how they operate, let’s explore the numerous advantages they bring to businesses:

1. Brand Customization

White label gateway solutions offer businesses the freedom to customize the payment process fully. This means that the payment page can be designed to align seamlessly with the brand’s identity, enhancing the overall customer experience.

2. Improved Security

With data breaches and cyber threats on the rise, the security of online transactions is non-negotiable. This come equipped with advanced security measures, giving customers peace of mind when making payments.

3. Diverse Payment Options

White label gateway solutions support a wide array of payment options, including credit and debit cards, digital wallets, and even cryptocurrencies, catering to a broader customer base.

4. Streamlined Operations

By automating the payment process, reduce manual workload and minimize the chances of errors. This results in increased operational efficiency and reduced administrative costs.

5. Scalability

As businesses grow, their payment processing needs evolve. These are highly scalable, allowing businesses to easily adapt to changing demands without overhauling their payment infrastructure.

6. Real-time Analytics

Access to real-time transaction data and analytics empowers businesses to make informed decisions, optimize their payment processes, and identify potential revenue-generating opportunities.

Exploring the Integration Process

Seamless Integration

Integrating into your website or application can seem like a daunting task, but it doesn’t have to be. Reputable solution providers offer comprehensive support and documentation to help businesses seamlessly integrate their gateway solutions. This process typically involves the following steps:

- Consultation: Start by discussing your business’s specific needs and requirements with the solution provider. They will help you choose the right white label gateway solution tailored to your industry and clientele.

- Technical Assistance: The provider’s technical team will guide your development team through the integration process. This includes providing code snippets, APIs, and SDKs for smooth implementation.

- Testing: Rigorous testing ensures that the gateway solution works seamlessly with your website or application. This step helps identify and address any potential issues before going live.

- Customization: Take advantage of the solution’s customization options to ensure that the payment process aligns with your brand’s aesthetics and user experience.

- Go Live: Once testing is successful and you’re satisfied with the setup, it’s time to go live and start accepting payments.

User-Friendly Interface

One of the primary goals of is to provide a user-friendly payment experience. The payment interface should be intuitive, making it easy for customers to complete transactions without unnecessary complications. This simplicity not only enhances customer satisfaction but also reduces the likelihood of cart abandonment.

Cost Considerations

Transparent Pricing Models

When considering the adoption of a white label gateway solution, it’s essential to understand the associated costs. Reputable providers offer transparent pricing models that are easy to comprehend. These models typically include fees for transactions, monthly service charges, and also any additional services or features you choose to add.

Return on Investment (ROI)

While there are costs involved in implementing , it’s crucial to evaluate the potential return on investment. Consider factors such as increased sales, reduced payment processing errors, and improved customer satisfaction. Many businesses find that the benefits far outweigh the costs over time.

Industry Applications

E-Commerce

White label gateway solutions have found widespread application in the e-commerce sector. Online retailers can provide customers with a secure and convenient payment experience, leading to higher conversion rates and customer retention.

Subscription Services

Businesses offering subscription-based services can leverage to manage recurring payments efficiently. This is particularly useful for streaming services, SaaS companies, and subscription box businesses.

Hospitality and Travel

In the hospitality and travel industry, simplify booking and payment processes. Hotels, airlines, and travel agencies can enhance the customer experience by offering a seamless payment journey.

Conclusion

In conclusion, white label gateway solutions are indispensable tools for modern businesses looking to enhance their payment processing capabilities. With their ability to customize, secure, and streamline payment processes, they contribute significantly to improved customer satisfaction and operational efficiency. As the digital landscape continues to evolve, embracing is a strategic move that can position businesses for long-term success.

FAQs

1. How do I integrate a white label gateway solution into my website or application?

Integrating a typically involves working closely with the provider’s technical team. They will guide you through the integration process, ensuring a seamless and secure setup.

2. Are white label gateway solutions suitable for small businesses?

Yes, white label gateway solutions are adaptable to businesses of all sizes. They can be particularly beneficial for small businesses looking to establish a professional and secure online payment process.

3. Can I switch to a different white label gateway solution if needed?

Yes, most white label gateway solutions offer flexibility, allowing businesses to switch providers if necessary. However, it’s essential to assess the potential costs and technical challenges of such a transition.

4. How can white label gateway solutions contribute to revenue growth?

White label gateway solutions can enhance the customer payment experience, reducing cart abandonment rates and increasing successful transactions. This, in turn, can lead to higher revenue for businesses.