AUTHOR : REHA SI

DATE : 03-11-23

In today’s fast-paced digital landscape, online businesses rely heavily on secure and efficient payment processing systems to facilitate transactions. Payment processors play a pivotal role in ensuring that online payments are processed swiftly and securely. In this article, we will explore the world of payment processors, their types, benefits, and how to choose the right one for your online business.

Types of Payment Processors

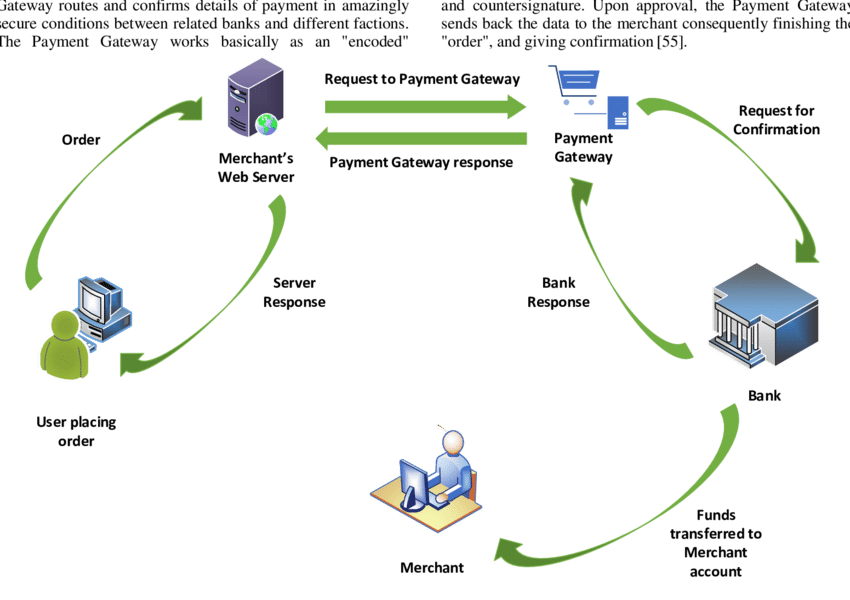

Payment processors come in various[1] forms, from traditional banks to online payment gateways. Online payment[2] processors have become increasingly popular due to their speed, security, and convenience. These processors facilitate electronic transactions, allowing businesses and customers to make and receive payments over the internet. They are the backbone of e-commerce, ensuring that payments are processed without any hitches.

Benefits of Using OPP

The benefits[3] of online payment processors are manifold. They offer quick transaction processing, robust security measures, and the convenience of making payments from anywhere in the world. These processors have become a staple for online businesses[4], making it easier for them to receive payments and expand their customer base.

Popular Online Payment Processors

Some of the most well-known online payment processors include PayPal, Stripe, and Square. PayPal is a versatile platform catering to various business sizes, while Stripe focuses on developers and offers a seamless integration process[5]. Square, on the other hand, is known for its user-friendly mobile payment solutions, making it ideal for small businesses.

How to Choose the Right Payment Processor

Choosing the appropriate payment processor for your business is an indispensable strategic choice. Factors such as transaction fees, target audience, and integration with your e-commerce platform should all be considered. Tailoring your choice to your business’s specific needs will ensure a smooth and efficient payment process.

Setting Up an Online Payment Processor

Getting started with an online payment processor involves gathering the necessary documents, setting up an account, and configuring your payment gateway. A step-by-step guide can help you navigate this process with ease.

Online Payment Security

Ensuring the security of online payments is paramount. Payment processors implement various security measures, but it’s also essential for businesses and customers to take precautions. This section will provide tips on how to protect your online transactions from potential threats.

Fees and Costs

Online payment processors come with various fees, including transaction fees, monthly fees, and chargeback fees. Understanding these costs and exploring ways to minimize expenses is essential for the financial health of your business.

Integration with E-commerce Platforms

Seamless integration with your chosen e-commerce platform is critical. It ensures that the payment process is smooth for your customers, enhancing their overall shopping experience. Compatibility with popular e-commerce systems like WooCommerce, Shopify, and Magento is essential.

Case Studies

Real-world examples of businesses that have successfully implemented online payment processors will be presented. These case studies will showcase the advantages and potential challenges faced by businesses in various industries.

International Transactions

For businesses with a global reach, navigating international transactions can be complex. This section will discuss how payment processors can simplify currency conversion and language barriers, making international transactions more accessible.

Mobile Payment Processing

With the increasing use of smartphones, mobile payment processing has gained prominence. Online payment processors are adapting to this trend, providing mobile-friendly solutions for businesses and consumers on the go.

Emerging Trends in Payment Processors

The payment processing industry is constantly evolving. This section will delve into current and future trends, including the impact of cryptocurrencies and other innovations on the online payment landscape.

Customer Support and Dispute Resolution

Responsive customer support is vital when dealing with payment-related issues. This section will guide businesses on how to handle payment disputes effectively and ensure a positive customer experience.

Conclusion

In conclusion, selecting the right online payment processor is a critical decision for any online business. It impacts transaction speed, security, and the overall customer experience. By considering the factors discussed in this article, you can make an informed choice that will benefit your business in the long run.

FAQs

Q1: Are online payment processors secure?

Online payment processors implement robust security measures to protect transactions. However, it’s essential for businesses and customers to take additional precautions, such as using strong passwords and enabling two-factor authentication.

Q2: How do I choose the right payment processor for my e-commerce store?

Choosing the right payment processor depends on factors like your target audience, transaction volume, and integration with your e-commerce platform. Carefully consider these factors to make an informed choice.

Q3: What are the common fees associated with online payment processors?

Typical charges encompass transaction costs, recurring monthly fees, and fees related to chargebacks.. The specific fees may vary among different payment processors, so it is essential to review and compare the fee structures of various processors before making a decision.

Q4: Can I use the same payment processor for international transactions?

While many payment processors offer features for international transactions, it’s important to check whether the processor supports the currencies and languages relevant to your target markets. Some processors specialize in cross-border transactions, so consider your business’s specific needs.

Q5: What is the role of mobile payment processing in today’s market?

Mobile payment processing is becoming increasingly significant as more consumers prefer to make purchases on their mobile devices. Online payment processors are adapting to this trend by offering mobile-friendly solutions, making it easier for businesses to tap into this growing market.

For further inquiries or assistance related to online payment processors, don’t hesitate to reach out to our customer support or consult the specific processor’s support resources.