AUTHOR : EMILY PATHAK

DATE : 26 / 10 / 2023

In this digital age, online transactions have become an integral part of our daily lives. Whether you’re purchasing goods, subscribing to services, or transferring funds[1], the need for secure and efficient payment gateways is paramount. This article delves into the world of payment gateway development[2], exploring its significance, key components, and also the future of online financial transactions.

Introduction

The advent of e-commerce and also the proliferation of digital services have made online payments[3] a necessity. This article explores the intricacies of payment gateway development, the backbone of secure online transactions.

What is a Payment Gateway?

A payment gateway[4] is a technology that enables online transaction[5]s by facilitating the transfer of payment information between a merchant’s website and also the acquiring bank. It plays a crucial role in authorizing and processing payments securely.

The Importance of Payment Gateways

Payment gateways serve as the guardians of online transactions. Here’s why they are indispensable:

- Security: Payment gateways employ encryption techniques to protect sensitive customer data. They are equipped with advanced security features like Secure Socket Layer (SSL) certificates and data tokenization, making it extremely challenging for cybercriminals to intercept or misuse information.

- Trust Building: In the digital realm, trust is paramount. When customers see a recognized and also secure payment gateway, it instills confidence in the transaction, resulting in higher conversion rates for businesses.

- Seamless Transactions: A well-developed payment gateway [1]ensures smooth, hassle-free transactions. Customers appreciate the convenience of quick payments, and this positive experience can lead to repeat business.

- Global Accessibility: Payment gateways are not limited by geographical boundaries. They allow businesses to accept payments from customers worldwide, opening up new horizons for e-commerce.

- Transaction Data Management: Payment gateways provide detailed reports and analytics, allowing businesses to track their financial data, monitor transaction trends, and make informed decisions.

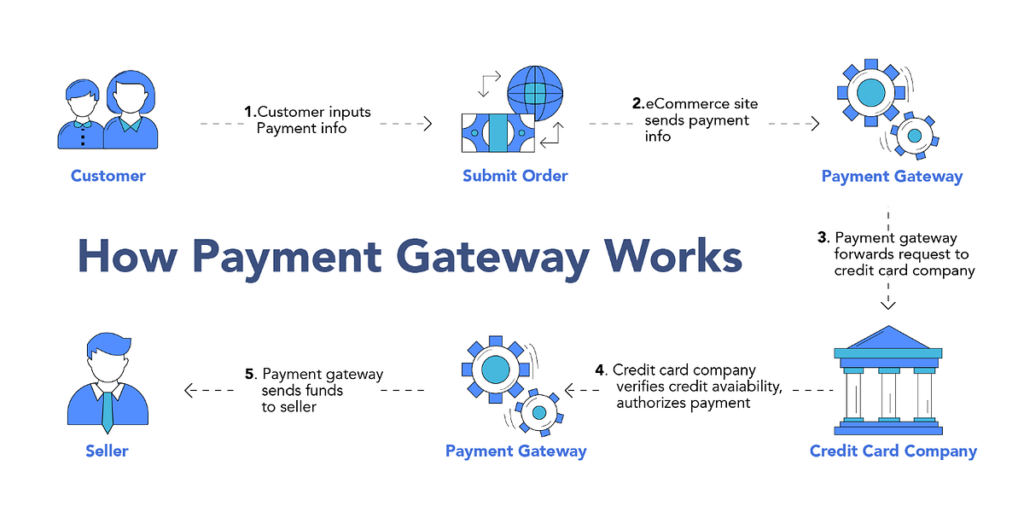

How Payment Gateways Work

The inner workings of a payment gateway involve several steps:

- Data Encryption: When a customer initiates a transaction, the payment information is encrypted. This step ensures that sensitive data is secure during transmission.

- Authorization Request: The encrypted data is sent to the payment gateway, which then forwards the request to the acquiring bank. The bank checks the validity of the customer’s account and also the availability of funds.

- Transaction Approval: If the transaction is approved, the acquiring bank sends an authorization code to the payment gateway.

This step ensures that the transaction can advance to the next stage. - Feedback to Customer: The payment gateway informs the customer of the transaction’s status. If successful, the customer receives a confirmation. If not, they are informed of the failure.

- Funds Transfer: The acquiring bank initiates[2] the transfer of funds from the customer’s account to the merchant’s account. This step is the culmination of the transaction.

Key Features of a Payment Gateway

- Encryption: Secure transmission of data.

- Tokenization: Replacing sensitive information with tokens.

- Payment Processing: Facilitating transactions in real-time.

- Reporting and Also Analytics: Providing insights on transactions.

- Multi-currency Support: Enabling global transactions.

Types of Payment Gateways

6.1 Hosted Payment Gateways

Hosted payment gateways [3]redirect customers to a secure external page for payment processing, ensuring simplicity and also security.

6.2 Self-hosted Payment Gateways

Self-hosted gateways allow merchants to collect payment information on their website, providing more control but requiring stringent security measures.

6.3 API Integrated Payment Gateways

API integrated gateways offer a seamless payment experience by integrating payment functionality directly into the website.

The Process of Payment Gateway Development

Creating a payment gateway involves several stages:

7.1 Requirement Analysis

Understanding the business’s needs and also technical requirements.

7.2 Design and Prototyping

Creating the user interface and also designing the payment flow.

7.3 Development

Writing the code and also integrating with financial institutions.

7.4 Testing

Thoroughly testing the gateway for security and also functionality.

7.5 Deployment

Making the payment gateway available to the public.

Challenges in Payment Gateway Development

Developers face challenges such as ensuring security, staying compliant with regulations, and delivering an intuitive user experience.

The Future of Payment Gateways

The future promises innovations like biometric authentication, blockchain integration, and enhanced fraud detection, making payment gateways more secure and efficient.

Security Measures in Payment Gateways

Robust security measures include encryption, SSL certificates, and two-factor authentication, safeguarding sensitive data.

User Experience and Payment Gateway Success

A user-friendly interface, quick processing, and responsive design are essential for a payment gateway’s success.

Mobile Payment Gateways

Mobile payment gateways are tailored for smartphones, enabling in-app and mobile web payments.

Internationalization of Payment Gateways

Global businesses require payment gateways that support multiple currencies and languages while adhering to international regulations.

Regulatory Compliance

Adhering to regional and in

ternational regulations is crucial for the legality and success of payment gateways.

Conclusion

Payment gateway development [4]is a cornerstone of secure and efficient online transactions. As technology evolves, these gateways will continue to play a vital role in shaping the future of digital finance.

Frequently Asked Questions (FAQs)

1. Are payment gateways safe for online transactions?

- Yes, payment gateways use encryption and security measures to protect sensitive information, making online transactions safe.

2. How long does it take to develop a payment gateway?

- The development time varies based on complexity but typically takes a few months.

3. Can I use a payment gateway for international transactions?

- Yes, many payment gateways support international transactions and multiple currencies.

4. What should I consider when choosing a payment gateway for my business?

- Factors to consider include security, ease of integration, transaction fees, and support for your target audience.

5. What is the role of regulatory compliance in payment gateway development?

- Regulatory compliance is essential to ensure that the payment gateway adheres to legal and security standards, protecting both businesses and customers.