Author : Annu Chauhan

Date : 23-08-2023

In today’s digital age, where convenience also speed are paramount, payment processing networks play a crucial role in facilitating seamless financial transactions. Let’s dive into the world of payment processing networks, exploring their functions, benefits and also the technology behind their seamless operations.

Introduction

In an era where swift also secure financial transactions are essential, payment processing networks have become the backbone of modern commerce. These networks facilitate the exchange of funds between consumers, merchants, also financial institutions, ensuring that payments are processed accurately and efficiently also.

The Basics of Payment Processing Networks

What Are Payment Processing Networks?

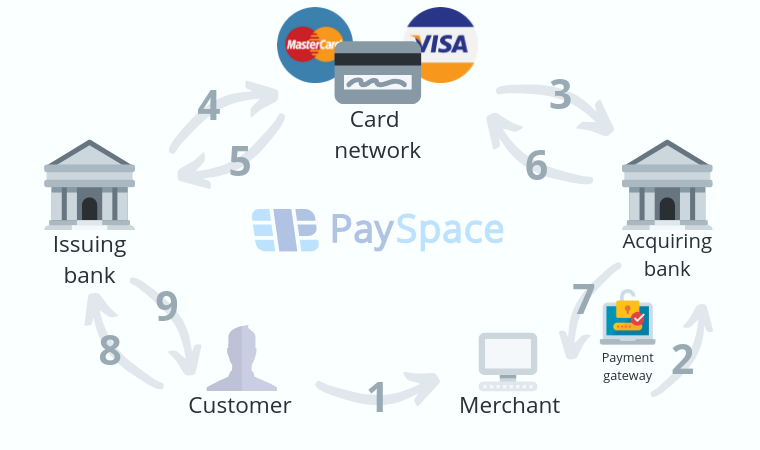

Payment processing networks are intricate systems that connect various stakeholders involved in a financial transaction. These stakeholders include customers, merchants, payment processors, issuing banks, and acquiring banks also. The primary goal of these networks is to securely transmit payment information from the customer’s account to the merchant’s account.

How Do They Work?

When a customer initiates a transaction, such as making an online purchase, the payment processing network springs into action. The network securely captures the payment details, encrypts them to prevent unauthorized access, also transmits the encrypted data to the respective banks for approval.

Importance of Secure Transactions

Security is paramount in payment processing networks. With the increasing prevalence of cyber threats, these networks employ advanced encryption techniques and also multi-layered authentication to safeguard sensitive financial data.

Key Players in Payment Processing

Payment Processors

Payment processors act as intermediaries between merchants and also financial institutions. They handle the authorization and settlement of transactions, ensuring that funds are transferred smoothly.

Issuing Banks

Issuing banks provide customers with credit or debit cards. They are responsible for authorizing transactions and also ensuring the availability of funds in the customer’s account.

Acquiring Banks

Acquiring banks represent merchants and work in tandem with payment processors. They receive funds from successful transactions also deposit them into the merchant’s account.

Types of Payment Processing Networks

Credit Card Networks

Credit card networks, such as Visa, MasterCard, and American Express, are renowned examples. They enable customers to make purchases on credit and pay the issuing bank later.

Debit Card Networks

Debit card networks, like Maestro and Visa Debit, allow customers to make transactions directly from their bank accounts, ensuring real-time fund deduction.

Online Payment Gateways

Online payment gateways like PayPal and Stripe facilitate e-commerce transactions by securely connecting online stores with payment processors.

Advantages of Efficient Payment Processing

Speed and Convenience

One of the most significant advantages of payment processing networks is the speed and convenience they offer. Transactions are completed within seconds, enabling customers to swiftly finalize their purchases.

Global Accessibility

These networks have transcended geographical boundaries, allowing customers to make purchases from anywhere in the world without worrying about currency conversions.

Fraud Protection Measures

Advanced fraud detection mechanisms, such as transaction monitoring and two-factor authentication, add layers of security, protecting both customers and merchants.

The Technology Behind Payment Networks

Encryption and Tokenization

To prevent unauthorized access to payment data, encryption and tokenization techniques are employed. This ensures that even if intercepted, the intercepted data is useless to malicious actors.

Point-of-Sale (POS) Systems

POS systems enable merchants to accept payments in physical stores. Modern POS systems are integrated with payment processing networks for swift authorization.

Mobile Wallets

Mobile wallets like Apple Pay and Google Pay use near-field communication (NFC) technology to enable contactless payments through smartphones.

Challenges in Payment Processing

Data Breaches and Security Concerns

As payment processing involves sensitive financial data, the risk of data breaches and identity theft remains a significant challenge.

Transaction Failures and Delays

Technical glitches and communication breakdowns can lead to transaction failures or delays, causing inconvenience to both customers and merchants.

Innovations in Payment Processing

Contactless Payments

Contactless payment methods, using RFID or NFC technology, have gained popularity due to their convenience and speed.

Biometric Verification

Fingerprint and facial recognition technologies are being integrated into payment systems, adding an extra layer of security.

Cryptocurrency Integration

Some payment processing networks are exploring the integration of cryptocurrencies, allowing users to make transactions using digital assets.

Choosing the Right Payment Processor

Consideration Factors

When selecting a payment processor, factors like transaction fees, security features, and customer support should be carefully evaluated.

Scalability and Customization

For businesses, choosing a payment processor that can scale with their growth and offers customization options is essential.

The Future of Payment Processing Networks

AI and Machine Learning

The integration of AI and machine learning will further enhance fraud detection and prediction capabilities.

Enhanced User Experience

Payment processing networks will continue to focus on providing a seamless and user-friendly payment experience.

Conclusion

In the dynamic landscape of finance and commerce, it have revolutionized the way transactions occur. Their ability to combine security, speed, and accessibility has reshaped the global economy. As technology continues to advance, these networks will play an even more pivotal role in shaping the future of financial interactions.

FAQs

- Q: Are payment processing networks secure?

- A: Yes, payment processing networks employ advanced encryption and security measures to protect sensitive financial data.

- Q: Can I use my mobile phone for contactless payments?

- A: Absolutely, mobile wallets enable convenient and secure contactless payments using NFC technology.

- Q: How do payment processors make money?

- A: Payment processors typically charge merchants a small fee per transaction for their services.

- Q: What is the role of issuing banks in payment processing?

- A: Issuing banks provide customers with payment cards and authorize transactions on their accounts.

- Q: Will cryptocurrency payments become mainstream?

- A: While it’s gaining traction, cryptocurrency integration.