Author : Annu Chauhan

Date : 23-08-2023

In the digital age, where online transactions[1] have become the norm, having a reliable also efficient payment processing gateway[2]is essential for businesses of all sizes. A payment processing gateway[3] serves as the virtual bridge that facilitates secure and also seamless transactions[4] between customers and merchants. From e-commerce[5] stores to subscription services, the role of a payment processing gateway cannot be overstated. In this article, we will delve into the intricacies of payment processing gateways, their significance, how they work, and their benefits for both businesses and customers.

Introduction to Payment Processing Gateway

Imagine a scenario: you’ve just ordered a new gadget from an online store, and it’s time to pay. You enter your credit card details, click the “Pay Now” button, also within seconds, your transaction is complete. This seemingly simple process is made possible by a payment processing gateway. Essentially, a payment processing gateway is a software application that securely transmits payment data between a customer’s chosen payment method and the merchant’s acquiring bank.

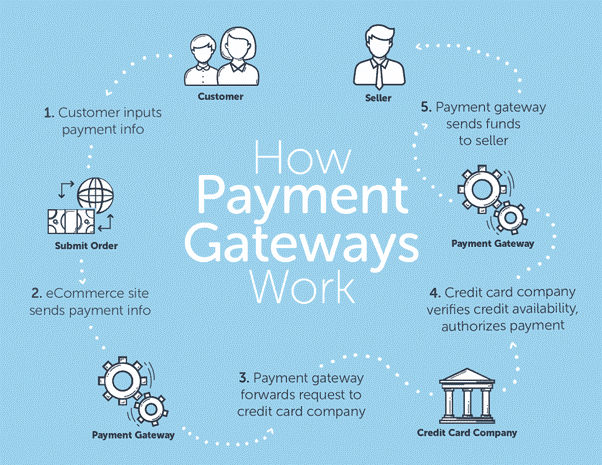

How Does a Payment Processing Gateway Work?

When a customer initiates an online payment, the payment processing gateway steps in to ensure the transaction’s success. Here’s a simplified breakdown of the process:

- Initiation: The customer selects their desired items and also proceeds to the checkout page.

- Data Encryption: The payment gateway[1] encrypts the payment data, including credit card details, to ensure the information remains confidential.

- Authorization Request: The encrypted data is sent to the payment processor[2], which then forwards it to the issuing bank (the bank that issued the customer’s credit card).

- Authorization Response: The issuing bank evaluates the transaction’s validity and available funds also. It sends an authorization or decline response back to the payment gateway.

- Transaction Confirmation: The payment gateway receives the response and relays it to the merchant’s website[3]. If authorized, the customer’s account is debited, and also the merchant is notified to proceed with the order.

- Settlement: The funds are transferred from the customer’s account to the merchant’s account through the acquiring bank, completing the transaction.

Types of Payment Processing Gateways

There are several types of payment processing gateways, each catering to different business needs. Let’s explore the three main types:

Hosted Payment Gateways

Hosted gateways redirect customers to the gateway provider’s page[4] to complete the payment. This minimizes the merchant’s security responsibilities and also provides a seamless experience for customers.

Self-hosted Payment Gateways

Self-hosted gateways allow customers to enter payment information directly on the merchant’s website. While offering more control, they require stronger security measures.

API-based Payment Gateways

API-based gateways enable merchants to fully customize the checkout experience. They integrate with the merchant’s website and offer more flexibility in design and functionality[5].

Advantages of Utilizing Payment Processing Gateways

The adoption of payment processing gateways offers numerous benefits for businesses and customers alike:

Enhanced Security

Payment gateways implement advanced security protocols, including data encryption and fraud detection, ensuring that sensitive information remains safe from cyber threats.

Wide Range of Payment Options

Customers can choose from various payment methods[6], such as credit cards, digital wallets, and even cryptocurrencies, making transactions convenient and accessible.

Improved Customer Experience

With quick and hassle-free transactions, customers enjoy a seamless shopping experience, leading to higher customer satisfaction and potentially increased sales.

Factors to Consider When Choosing a Payment Processing Gateway

Selecting the right payment processing gateway requires careful consideration of several factors:

Transaction Fees

Different gateways have varying fee structures. Merchants should assess transaction fees and choose a gateway that aligns with their business model.

Integration Ease

The gateway’s compatibility with the merchant’s e-commerce platform is crucial for smooth integration and efficient operations.

Security Measures

Security should be a top priority. Merchants must ensure the gateway complies with industry security standards to protect customer data.

Steps to Integrate a Payment Processing Gateway

Integrating a payment gateway into an e-commerce website involves several steps:

Registration and Documentation

Merchants need to register with the chosen payment gateway provider, providing necessary documentation for verification.

Integration with Website

Developers then integrate the gateway’s API into the website’s checkout process, allowing customers to select their preferred payment method.

Testing and Deployment

Thorough testing is crucial to identify and resolve any technical glitches. Once tested, the gateway is deployed for live transactions.

The Future of Payment Processing Gateways

As technology continues to evolve, payment processing gateways are poised to undergo significant advancements:

Biometric Authentication

Biometric identifiers like fingerprints and facial recognition may become integral to secure payment authorizations.

Integration with Cryptocurrencies

With the rise of cryptocurrencies, payment gateways might integrate seamless crypto payment options, expanding the realm of possibilities.

The Convenience of Mobile Payment Processing

With the proliferation of smartphones and the increasing popularity of mobile commerce, mobile payment processing has emerged as a game-changer in the world of digital transactions. In this section, we’ll explore how mobile payment processing works, its benefits for businesses and consumers, and the security measures in place to protect sensitive data.

How Mobile Payment Processing Works

Mobile payment processing leverages the capabilities of smartphones to facilitate transactions on the go. Here’s a brief overview of the process:

- Mobile Wallet Setup: Users need to download a mobile wallet app, where they can securely store their payment information, such as credit card details and bank account numbers.

- Payment Initiation: When making a purchase, users can simply open their mobile wallet app, select the payment method, and initiate the payment.

- NFC Technology: Many mobile payment methods use Near Field Communication (NFC) technology, allowing users to tap their smartphones on a compatible terminal to complete the transaction.

- Authentication: Depending on the security settings, users may need to provide a fingerprint, PIN, or facial recognition to authenticate the payment.

- Transaction Confirmation: Once authenticated, the payment is processed, and both the user and the merchant receive confirmation of the successful transaction.

Benefits of Mobile Payment Processing

Mobile payment processing offers a range of benefits for both businesses and consumers:

Convenience and Speed

Users can make payments quickly and easily, eliminating the need to carry physical wallets or cards. For businesses, this translates to shorter checkout lines and reduced waiting times.

Increased Sales Opportunities

Businesses can capitalize on impulse purchases, as mobile payments enable customers to buy products or services whenever and wherever they choose.

Enhanced Data Security

Mobile wallets use encryption and tokenization to safeguard payment information, making mobile payments arguably more secure than traditional card transactions.

Loyalty Programs and Offers

Many mobile payment apps integrate loyalty programs and special offers, incentivizing customers to make repeat purchases.

Security Measures in Mobile Payment Processing

Ensuring the security of mobile payments is paramount. Here are some measures in place:

Encryption and Tokenization

Sensitive payment data is encrypted, and tokens are used to represent the actual card data, reducing the risk of data breaches.

Biometric Authentication

Fingerprint and facial recognition add an extra layer of security, ensuring that only authorized users can access and use the mobile wallet.

Two-Factor Authentication

Some mobile payment apps require users to provide a second form of authentication, such as a PIN or a code sent to their mobile device.

The Evolution of Mobile Payment Processing

As technology continues to advance, the landscape of mobile payment processing is evolving:

Wearable Devices

Wearable devices like smartwatches are becoming payment-enabled, allowing users to make payments with a simple flick of the wrist.

Voice-Activated Payments

Virtual assistants integrated into smartphones can facilitate payments through voice commands, making the process even more seamless.

Conclusion

Mobile payment processing has revolutionized the way we conduct transactions, offering unparalleled convenience and security. From quick payments at your favorite coffee shop to seamless online shopping experiences, mobile payment methods are reshaping the future of commerce. As technology continues to evolve, we can expect even more innovative features that will further streamline and enhance the mobile payment experience.

FAQs (Frequently Asked Questions)

- Is mobile payment processing safe? Yes, mobile payment processing employs encryption, tokenization, and biometric authentication to ensure the security of payment data.

- What is NFC technology in mobile payments? Near Field Communication (NFC) technology allows users to make contactless payments by tapping their smartphones on compatible terminals.

- Can mobile payment methods be used for online purchases? Absolutely, many mobile payment apps can be used for both in-store and online transactions.

- Are mobile payment methods widely accepted? Yes, the adoption of mobile payment methods is growing, and many businesses now offer mobile payment options to their customers.

- What’s the future of mobile payment processing? The future holds possibilities like expanded use of wearable devices and voice-activated payments, making the process even more seamless and user-friendly.