AUTHOR : KYLIE SCOTT

DATE : 01/11/2023

In today’s digital world, seamless payment processing is essential for businesses of all sizes. In Canada, a country[1] known for its thriving economy and diverse business landscape, payment processing plays a vital role in facilitating financial transactions. This article will delve into the intricacies of payment processing in Canada, providing insights into various payment methods, regulations, and also challenges faced by businesses. So, let’s embark on a journey[2] through the Canadian payment processing landscape.

Payment processing is the lifeblood of any business, ensuring that financial transactions[3] are executed seamlessly and securely. In Canada, the payment landscape is diverse, offering a wide array of options for both businesses and consumers. This article will shed light on the different aspects of payment processing in Canada, helping you understand its significance and the factors you should consider when choosing the right payment processor for your business[4].

The Importance of Payment Processing

Efficient payment[5] processing is crucial for businesses operating in Canada, as it affects their cash flow, customer satisfaction, and overall success. It’s the mechanism that enables customers to make purchases, and for businesses to receive payments for products and services. Without a reliable payment processing system, businesses may encounter challenges in receiving funds, resulting in financial instability.

Popular Payment Methods in Canada

Canadian consumers have a variety of payment methods at their disposal, including credit and also debit cards, e-transfers, mobile wallets, and direct debit.

Credit and Debit Cards

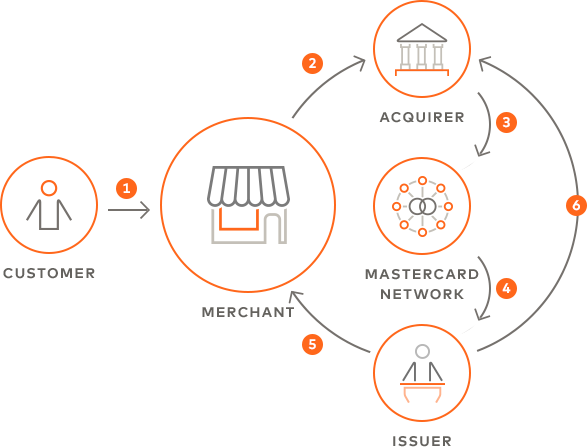

Credit and debit cards are widely accepted in Canada, making them a convenient choice for both businesses and consumers. Major card networks like Visa, MasterCard, and American Express are prevalent.

E-Transfers

E-transfers are a preferred choice for many Canadians when making peer-to-peer payments or transferring money to family and friends. They offer a quick and secure way to send and receive funds.

Mobile Wallets

Mobile wallet apps, such as Apple Pay and Google Pay have gained popularity, allowing users to make contactless payments using their smartphones.

Direct Debit

Direct debit is commonly used for recurring payments, such as utility bills andenrollments, and offers a hassle-free way to manage finances.

Regulations and Compliance

To ensure secure payment processing in Canada, businesses must adhere to various regulations and also compliance standards. Two key regulations include:

Payment Card Industry Data Security Standard

often referred to as PCI DSS, is a set of security regulations and guidelines established to safeguard sensitive payment card data.

PCI DSS is essential for businesses that handle credit card transactions. Compliance with these security standards is crucial to protect sensitive customer data and prevent data breaches.

PIPEDA, officially known as the Personal Information Protection and Electronic Documents Act.

PIPEDA oversees the gathering, utilization, and divulgence of personal data. Businesses must comply with PIPEDA when handling customer data.

Challenges in Payment Processing

While payment processing in Canada offers numerous benefits, it also presents some challenges that businesses must address.

Currency Exchange

For international transactions, businesses need to consider currency exchange rates, which can impact the final amount received.

Fraud Prevention

Protecting against fraud is a constant concern in payment processing. Businesses need robust security measures to safeguard their financial transactions.

Benefits of Reliable Payment Processing

A robust payment processing system offers several advantages, including improved cash flow, increased sales, and enhanced customer trust.

How to Choose the Right Payment Processor

Selecting the right payment processor is crucial for a business’s success. Factors to consider include integration and security, cost and fees and the range of payment methods supported.

Integration and Security

Ensure that the payment processor integrates seamlessly with your business operations and provides top-notch security measures to protect sensitive data.

Cost and Fees

Understand the pricing structure and fees associated with your chosen payment processor to manage your budget effectively.

Case Studies: Successful Payment Processing in Canada

Explore real-life examples of businesses in Canada that have achieved success through efficient payment processing.

Emerging Trends in Payment Processing

Discover the latest trends in payment processing, such as the rise of contactless payments, mobile banking, and cryptocurrency adoption.

The Future of Payment Processing in Canada

As technology continues to evolve, the future of payment processing in Canada promises even more convenience and security for businesses and consumers.

Conclusion

Payment processing is the backbone of modern commerce in Canada. To thrive in this dynamic landscape, businesses must adopt efficient, secure, and customer-friendly payment processing solutions. By staying informed about the latest trends and adhering to regulatory standards, businesses can navigate the Canadian payment landscape successfully.

FAQs

- How do currency exchange rates affect international transactions in Canada?

- Currency exchange rates can impact the final amount received in international

- transactions. It’s essential to monitor and choose favorable rates to maximize revenue.

- What is PCI DSS compliance, and why is it important for payment processors?

- PCI DSS compliance is a set of security standards that protect customer data during credit card transactions. Compliance is crucial to prevent data breaches and maintain customer trust.

- Can businesses in Canada accept cryptocurrencies as a form of payment?

- Yes, some businesses in Canada accept cryptocurrencies as a form of payment, but it’s not yet mainstream. The acceptance of cryptocurrencies may vary by industry and region.

- How can small businesses in Canada benefit from mobile wallet payment options?

- Mobile wallet payment options offer small businesses a convenient and secure way to accept payments, enhance customer experience, and streamline transactions.

- What are the advantages of choosing a local payment processor in Canada?

- Opting for a local payment processor can provide personalized support, a better understanding of the local market, and potential cost savings for businesses.