AUTHOR : REHA SI

DATE : 31-10-23

In this digital[1] age, understanding the payment process is vital, whether you’re a customer. or a business owner The payment scenery has evolved significantly, with various methods available for dealings. This article will provide an thorough look at the payment process, clarifying the basics and also emphasizing the latest trends.

Introduction

The way we make payments[2] has changed over the years. From traditional cash dealings to the digital age, the payment process COM now includes various[3] methods that cater to different needs. This article will explore these methods and also provide[4] you with understandings[5] into choosing the right payment process.

Types of Payment Methods

Credit and Debit Cards

Credit and debit cards have been a staple in payment processing. They offer convenience and security, making them a top choice for many consumers. We’ll delve into how these cards work and their advantages.

Mobile Payments

The rise of smartphones has given birth to mobile payments. Learn how you can make payments with just a tap on your phone and the security measures in place to protect your transactions.

E-Wallets

E-wallets are gaining prevalence for their ease of use. Discover how these digital wallets function and why they are becoming a favorable method for online shopping.

Bank Transfers

Traditional bank transfers remain a dependable method for many. We’ll discuss the process and why some still prefer this method despite the digital alternatives.

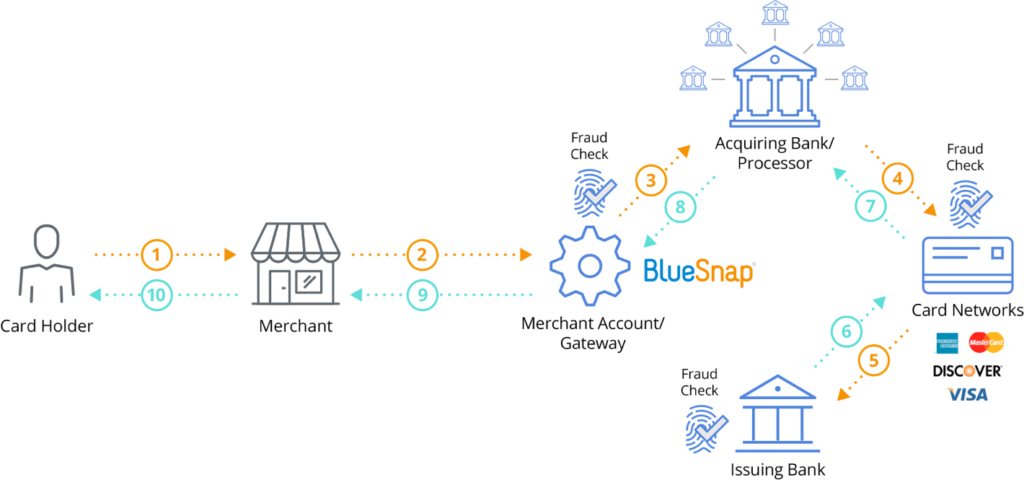

Payment Gateways

Payment gateways are crucial for online businesses. Find out how these gateways enable seamless online transactions and the key features to consider when choosing one.

Online vs. Offline Payments

In this section, we’ll compare online and offline payment methods, highlighting the benefits and limitations of each.

Security in Payment Transactions

Ensuring the security of your payment process is paramount. Learn about the various security measures in place to protect your financial transactions.

The Role of Cryptocurrency

Cryptocurrency is a revolutionary addition to the payment landscape. Explore its impact and why some businesses are now accepting digital currencies.

Payment Processing for Businesses

For business owners, understanding payment processing is vital. We’ll cover the steps involved in receiving payments and the role of payment processors.

Payment Processors

Payment processors play a significant role in facilitating transactions. We’ll explain how they work and their importance in the payment ecosystem.

The Future of Payment Process

What does the future hold for payment methods? This section will provide insights into upcoming trends and innovations.

Benefits and Challenges of Different Payment Methods

Every payment method has its pros and cons. We’ll break down the advantages and challenges of various payment options.

Selecting the most suitable payment method for your business can be a pivotal decision, potentially transforming your financial operations.

Selecting the right payment method for your business can impact its success.We will provide you with valuable assistance to ensure you make a well-informed choice.

Consumer Insights: What Customers Expect

Understanding consumer expectations is crucial for businesses. Discover what customers expect in terms of payment convenience and security.

Regulations in the Payment Industry

The payment industry is subject to regulations. Learn about the legal framework that governs payment processes.

Global Payment Trends

Payment methods are continually evolving globally. We’ll provide an overview of payment trends worldwide.

Benefits and Challenges of Different Payment Methods

Every payment method has its own set of advantages and challenges. Understanding these can help you choose the method that best suits your needs or the needs of your business.

For instance, credit and debit cards offer convenience and often come with fraud protection. They are widely accepted and offer easy record-keeping. However, some may find themselves burdened by high-interest rates if they don’t pay off their credit card balances in full.

Mobile payments, on the other hand, provide speed and simplicity. You can make transactions with a simple tap on your smartphone. Nevertheless, concerns about security and data breaches have raised questions about the safety of these methods.

E-wallets are favored for their seamless integration with online shopping. They offer a centralized platform for various payment methods. Yet, not all businesses accept e-wallets, which can limit their usability.

Conclusion

The payment process is an integral part of our daily lives. Whether you’re a consumer or a business owner, staying informed about the evolving landscape is essential. We hope this article has provided valuable insights into the payment process, helping you make informed decisions.

FAQs

- Is it safe to use mobile payment apps for transactions?

- Mobile payment apps are generally safe when they have robust security measures in place. However, it’s essential to follow best practices, like using strong passwords and enabling two-factor authentication, to enhance security.

- What are the advantages of cryptocurrency payments for businesses?

- Cryptocurrency payments offer low transaction fees, faster international transactions, and increased security due to blockchain technology. They can also attract a tech-savvy customer base and open new markets.

- What steps can I take to guarantee the safety of my online financial transactions?

- To secure your online payments, use trusted and secure payment methods, keep your devices and software up-to-date, and be cautious about sharing personal information online. Also, regularly review your transaction history for any suspicious activity.

- What factors should I consider when choosing a payment gateway for my e-commerce website?

- When selecting a payment gateway, consider factors such as transaction fees, security features, ease of integration with your website, and the range of payment methods it supports.

- Are there any upcoming payment trends that could revolutionize the industry?

- Yes, upcoming payment trends include the use of biometrics for authentication, the integration of Internet of Things (IoT) devices in payments, and the continued expansion of contactless and mobile payment options.