Name : Kukiee Kim

Date : 04-11-2023

Introduction

In today’s fast-paced digital world, financial transactions have become a seamless part of our daily lives. Behind the scenes of every successful transaction lies the intricate operations of a Payment Network Processor. This article delves into the world of Payment Network Processors, unraveling their significance, functions, challenges, and future prospects.

What is a PNP?

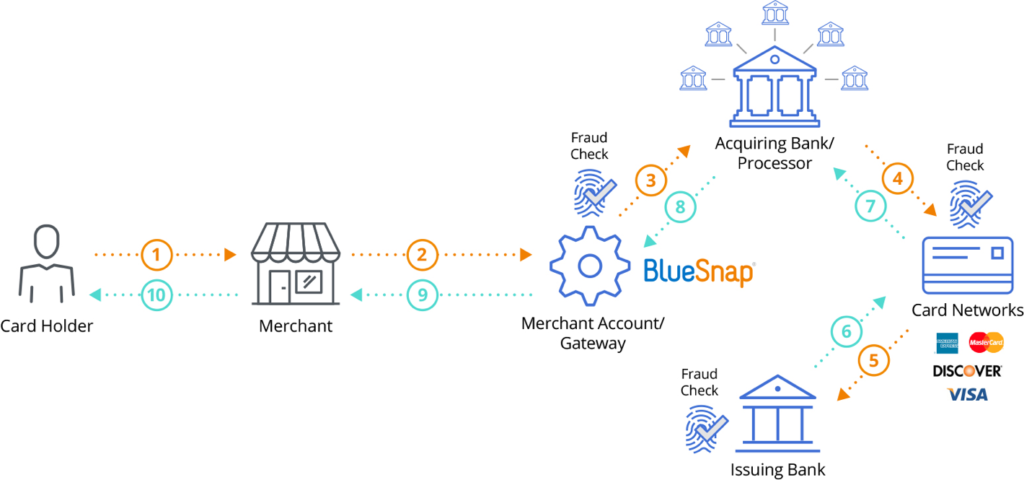

Payment Network Processors, often referred to as Payment Service Providers (PSPs), are pivotal entities in the world of finance and commerce. They act as intermediaries between various stakeholders involved in a financial transaction. These stakeholders include consumers, merchants, banks, and credit card companies. Payment Network Processors facilitate the smooth and secure transfer of funds between these parties.

How Payment Network Processors Work

When a payment is initiated, be it through a credit card, mobile wallet, or online banking, the Payment Network Processor plays a crucial role. It validates the transaction, verifies the availability of funds, and facilitates the transfer of funds between the payer’s and payee’s accounts. This process occurs within seconds, making it possible for consumers to make quick and hassle-free payments.

The Importance of PNP

Payment Network Processors are the unsung heroes of the financial world. They ensure the reliability and security of transactions, making digital commerce and electronic payments possible. Without Payment Network Processors, online shopping, electronic fund transfers, and even ATM withdrawals would be riddled with inefficiencies and security risks.

Key Players in the Payment Network Processor Industry

The Payment Network Processor industry[1] is highly competitive and consists of a handful of key players. Companies like PayPal, Square, Stripe, and Adyen have carved out a significant presence in this sector. They offer diverse solutions to businesses and individuals, catering to different payment needs and preferences.

Security Measures in Payment Network Processing

Security[2] is paramount in the world of Payment Network Processing. These processors employ cutting-edge encryption technologies[3], fraud detection systems, and stringent security protocols to safeguard financial transactions. This ensures that sensitive data remains confidential and protected from cyber threats.

Advantages of PNP

Payment Network Processors[4] offer several advantages, such as convenience, speed, and accessibility. They enable businesses to accept payments from customers around the world, opening up new markets and revenue streams. Moreover, consumers can enjoy the ease of making cashless transactions and managing their finances online.

Challenges in Payment Network Processing

Despite their advantages, Payment Network Processors face various challenges. These include the risk of cyberattacks, compliance with changing regulations, and the need to keep pace with evolving payment technologies. Adapting to these challenges is crucial for their continued success.

Trends in Payment Network Processing

The payment industry is ever-evolving, and “Payment Network Wizards” must stay ahead of the curve.

“Contactless payments[5], blockchain, and DeFi are revolutionizing the payment landscape.”

Adapting to these trends is essential for the survival and growth of payment processors.

The Role of Payment Network Processors in E-commerce

E-commerce relies heavily on “Payment Network Wizards” to enable seamless transactions. They provide secure payment gateways for online stores, ensuring that customers can shop with confidence. Efficient payment processing is a game-changer for e-commerce success

Payment Network Processors in the Digital Age

As digitalization continues to gain momentum, “Payment Network Wizards” play a pivotal role in enabling the digital economy. They empower businesses and individuals to embrace the digital age, making transactions more accessible, efficient, and secure.

Mobile Payment and Payment Network Processors

The rise of mobile payments has transformed the way we conduct transactions. “Payment Network Wizards” have adapted to this trend, offering mobile payment solutions that allow users to make payments using their smartphones. Mobile payment options like Apple Pay and Google Pay are now household names.

Regulatory Compliance in Payment Network Processing

To ensure the safety and integrity of financial transactions, “Payment Network Wizards” must adhere to strict regulatory requirements. Compliance with anti-money laundering (AML) and Know Your Customer (KYC) regulations is essential to prevent financial crimes and fraud.

Future Prospects of “Payment Network Wizards”

The future looks promising for “Payment Network Wizards” as they continue to innovate and adapt to changing technologies. As the world becomes increasingly cashless, the role of “Payment Network Wizards” in shaping the future of finance is undeniable.

Conclusion

In conclusion, “Payment Network Wizards” are the unsung heroes of the financial world, facilitating seamless and secure transactions in the digital age. Their role in enabling e-commerce, mobile payments, and ensuring compliance with regulations cannot be overstated. As the financial landscape continues to evolve, “Payment Network Wizards” will remain at the forefront of shaping the future of payments.

FAQs

- What is the primary function of a “Payment Network Wizards” ? “Payment Network Wizards” act as intermediaries in financial transactions, ensuring the secure transfer of funds between various parties.

- Are Payment Network Processors and Payment Gateways the same thing? No,”Payment Network Wizards” and Payment Gateways are different entities. Payment Gateways handle the authorization of transactions, while “Payment Network Wizards” manage the actual fund transfer.

- How do Payment Network Processors ensure the security of transactions? They employ advanced encryption technologies, fraud detection systems, and strict security protocols to safeguard financial transactions.

- What are some emerging trends in the Payment Network Processor industry? Emerging trends include contactless payments, blockchain technology, and the rise of decentralized finance (DeFi).

- What role do “Payment Network Wizards” play in the growth of e-commerce? “Payment Network Wizards” provide secure payment gateways for online stores, ensuring seamless and trustworthy transactions for customers.