Author : Helly khan

Date : 01- 11- 2023

Payment systems are the backbone of the modern financial world[1]. They facilitate the transfer of funds between individuals, businesses, and financial institutions, making transactions smooth and efficient. In this article, we’ll explore the world of payment systems, from traditional cash payments[2]

to the latest digital innovations.

Introduction to Payment Systems

Payment systems, in essence, are the methods and tools that enable the exchange of value between parties. These systems have evolved over time, adapting to technological advancements[3] and changing consumer preferences. They play a pivotal role in economic activities[4], both on a national and international scale.

Importance of Payment Systems

Efficient payment systems are crucial for the functioning of any economy. They ensure that money flows[5] seamlessly, enabling businesses to operate and individuals to make purchases. An effective payment system fosters economic growth, reduces the cost of financial transactions, and enhances financial stability.

Types of Payment Systems

Cash Payments

Cash transactions involve physical currency, such as banknotes and coins. While digital payments are on the rise, cash is still widely used for small-scale, face-to-face transactions.

Credit and Debit Cards

Credit and debit cards have revolutionized the way we make payments. They offer convenience, security, and the ability to make purchases without carrying cash. Credit cards allow users to borrow money for purchases, while debit cards deduct funds directly from the user’s bank account.

Online Payment Methods

Online payment systems, such as PayPal, Stripe, and Square, have become the go-to choice for e-commerce. They enable businesses and consumers to send and receive money over the internet securely.

Mobile Wallets

Mobile wallets like Apple Pay, Google Pay, and Samsung Pay store payment information on a mobile device, allowing users to make contactless payments at physical stores. They have gained popularity for their convenience and security.

Traditional Payment Systems vs. Modern Payment Systems

Traditional payment Platforms, like cash and checks, have been supplemented by modern digital alternatives. While traditional methods remain relevant, modern systems offer greater convenience and speed.

Benefits of Modern Payment Systems

Modern payment Platforms offer several advantages, including speed, convenience, security, and the ability to track transactions digitally. They also facilitate international transactions, making it easier for businesses to operate on a global scale.

Security in Payment Systems

Security is a paramount concern in payment Platforms. Modern systems employ encryption and authentication methods to protect sensitive financial information. Users can also set up additional security measures like PINs and biometric verification.

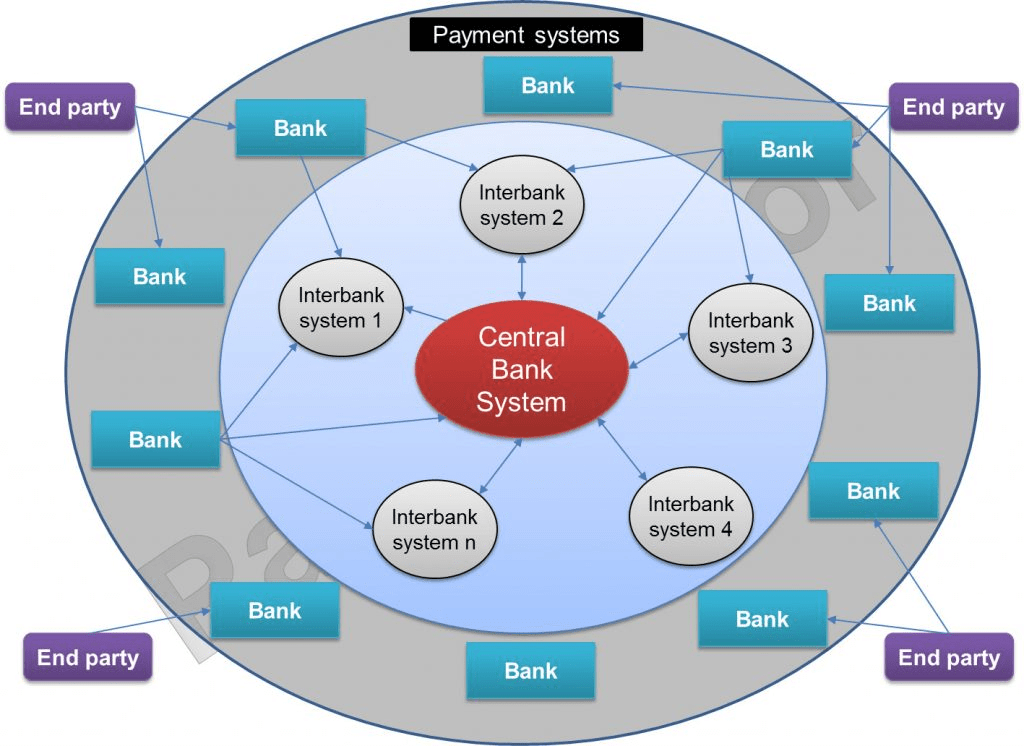

The Role of Banks in Payment Systems

Banks play a significant role in payment Platformsas intermediaries. They provide accounts, issue cards, and operate payment gateways. Banks also ensure that transactions adhere to regulations and security standards.

Emerging Trends in Payment Systems

The payment landscape continues to evolve. Emerging trends include blockchain-based payments, peer-to-peer (P2P) transfers, and the use of cryptocurrencies like Bitcoin for transactions. These innovations are reshaping the way we handle payments.

Challenges in Payment Systems

Despite their numerous advantages, payment Platforms face challenges such as cybersecurity threats, fraud, and the need for standardization. Addressing these issues is essential for the continued growth of payment Platforms.

The Future of Payment Systems

The future of payment Platforms is exciting. We can expect increased integration of technology, enhanced security measures, and a shift towards cashless societies in many parts of the world. payment Platforms will continue to adapt to meet the changing needs of consumers and businesses.

Conclusion

Payment Platforms are the lifeblood of the modern economy. They have come a long way from traditional cash transactions to the digital wonders of today. As technology advances, payment Platforms will keep evolving to meet the demands of a fast-paced world.

FAQs

How do contactless payments work?

Contactless payments use near-field communication (NFC) technology to enable transactions. A compatible card or device is held near a card reader, and the transaction is processed without physical contact.

Are mobile wallets safe for transactions?

Yes, mobile wallets are generally safe. They use multiple layers of security, including encryption and biometric authentication, to protect your payment information.

What are the advantages of online Payment systems?

Online payment Platforms offer convenience, speed, and the ability to make payments from anywhere with an internet connection. They also provide digital records of transactions for easy tracking.

How do payment gateways ensure secure transactions?

Payment gateways use encryption to protect sensitive information during the transaction process. They also perform fraud detection and offer additional security features to prevent unauthorized access.