Author : Annu Chauhan

Date : 24-08-2023

Introduction

In today’s digital world, smooth business operations greatly rely on efficient payment processing systems. With a variety of payment processing products available, it’s vital for businesses to understand their options and also pick the best fit. From traditional point-of-sale terminals to modern mobile payment apps, let’s dive into the realm of payment processing products, assisting you in making informed decisions for your business.

In our digital era, efficient payment processing systems are essential for businesses. This guide navigates the world of payment processing products, helping you choose the right fit for your needs.

What is payment processing?

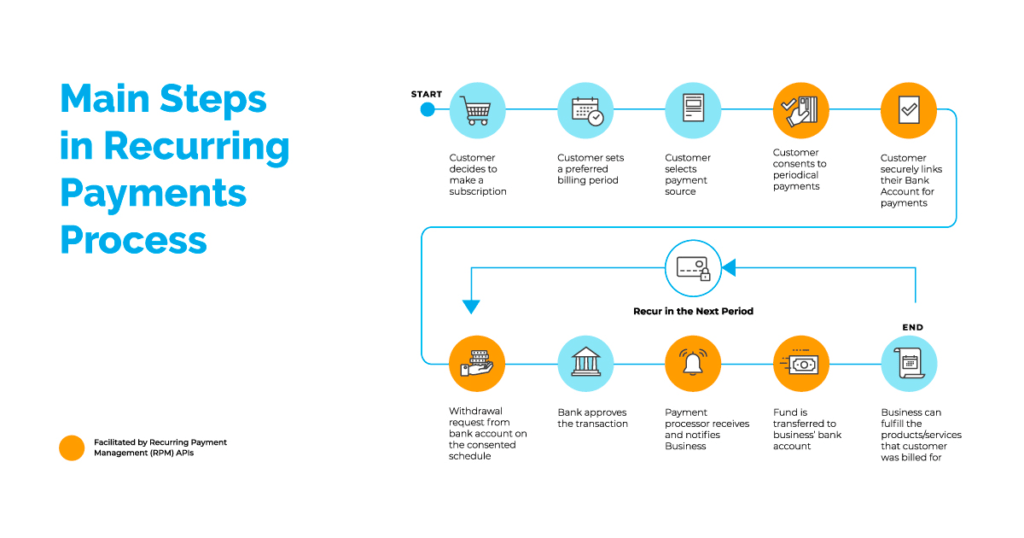

Payment processing involves handling transactions made through various methods like cards, digital wallets, and also mobile apps. It includes steps like authorization, authentication, and settlement also.

Different Payment Processing Products

Point-of-Sale (POS) Systems

POS systems are used in physical stores for card and also cash payments. They often come with inventory management features.

Mobile Payment Apps

Mobile apps turn smartphones into portable POS systems, perfect for on-the-go payments.

Online Payment Gateways

Essential for online businesses, these gateways ensure secure transactions over the internet.

Virtual Terminals

Ideal for phone or mail orders, virtual terminals allow manual payment entry.

Contactless Payment Solutions

With a simple tap, contactless payments use technologies like NFC for quick transactions.

Key Features to Consider

When choosing a payment processing product, prioritize:

Ensuring Security

Look for encryption also fraud detection features to protect customer data.

Integration Ease

Choose a product that smoothly integrates with your existing systems.

Reports and Analytics also

Opt for solutions that offer insightful data for better business decisions.

Adaptable Scalability

Select a product that can grow with your business without disruptions.

How to Choose the Right Payment Processing Product

Assess your business needs, transaction volume, and also customer preferences to make the right choice.

Advantages for Businesses

The right payment processing product improves efficiency, cash flow, and customer experience also.

Future Trends in Payment Processing

Trends like biometric authentication and also AI-driven fraud prevention shape the future.

Addressing Security Concerns

With digital transactions on the rise, robust security measures are crucial.

Impact on Customer Experience

Smooth transactions enhance trust also loyalty, while complications lead to dissatisfaction.

The Role of Payment Processors

Payment processors ensure authorized also secure transactions.

Cost Comparison: Traditional vs. Modern Solutions

Analyze costs also benefits of different solutions, considering long-term expenses.

Real-Life Cases: Successful Implementations

Learn from businesses that effectively adopted payment processing products.

Top Considerations for Small Businesses

Small businesses should focus on affordability, ease of use, and customer support.

Access Now and Embrace Efficient Payments

If you’re ready to enhance your business’s payment processing, now’s the time to take action. Embracing modern payment processing products can revolutionize your operations and also customer experience.

Exploring Advanced Solutions

Today’s payment processing landscape offers a range of advanced solutions that cater to diverse business needs. Whether you’re a small coffee shop or a thriving e-commerce platform, there’s a product that fits your requirements.

Seamlessly Transact with Mobile Payment Apps

Mobile payment apps have changed the game by allowing businesses to accept payments virtually anywhere. With a simple download and setup also, you can transform your smartphone into a powerful payment tool. Say goodbye to the limitations of cash-only transactions and welcome a new level of convenience.

Secure Your Online Transactions with Gateways

For online businesses, security is paramount. Online payment gateways provide a secure bridge between your website and your customers’ payment methods. The encryption ensures that sensitive data is transmitted safely, building trust and also confidence in your online store.

Elevate In-Store Experience with POS Systems

Traditional doesn’t have to mean outdated. Point-of-sale (POS) systems have evolved to become versatile tools that not only process payments but also manage inventory, track sales, and generate insightful reports. Create a seamless in-store experience that leaves your customers satisfied and coming back for more.

A Glance into the Future

As technology advances, payment processing is poised to become even more innovative. Imagine completing transactions with a mere glance, thanks to biometric authentication. Picture AI systems that swiftly detect and prevent fraudulent activities, safeguarding both you and your customers. The future holds exciting possibilities, and by staying informed and open to these changes, you can stay ahead in the game.

Your Customized Path to Success

Every business is unique, and so is its path to success. Choosing the right payment processing product is a crucial step in this journey. It’s not just about the transactions; it’s about the experience you provide to your customers. Simplify their lives, streamline your operations, and build a reputation for reliability and efficiency.

Conclusion

Choosing the right payment processing product is pivotal for business success. By understanding available options and key features, you ensure smooth transactions for you and your customers.

FAQs About Payment Processing Products

- Are mobile payment apps secure? Absolutely, they use encryption to protect data.

- Can I use multiple payment processing products together? Yes, businesses often use a mix for different preferences.

- Do online gateways support international transactions? Yes, they accommodate various countries, but check specifics.

- What’s the future of contactless payments? It’s growing due to convenience and speed.

- How to ensure PCI compliance? Follow payment processors’ guidelines for security standards.