AUTHOR : EMILY PATHAK

DATE : 13/10/2023

In the digital age, online transactions are becoming increasingly common. Payment gateways[1] play a pivotal role in facilitating these transactions, but what if you don’t have a website? Can you still benefit from a payment gateway[2]? This article delves into the world of payment gateways without websites[3], exploring their advantages, disadvantages, and also how to make the most of them.

Introduction

Payment gateways[4] are the digital bridges that connect customers and businesses during online transactions. They ensure that the customer’s payment is securely processed and transferred to the merchant. But traditionally, payment gateways have been closely associated with e-commerce websites. What if you want to accept online payments but don’t have a website? Is it possible? The answer is a resounding yes.

What Is a Payment Gateway?

Before we dive into the world of payment gateways without websites[5], let’s first understand what a payment gateway is. A payment gateway is a software application that allows merchants to accept electronic payments, including credit card transactions. It acts as a bridge between the customer, the merchant, and the financial institutions involved, ensuring a smooth and secure payment process.

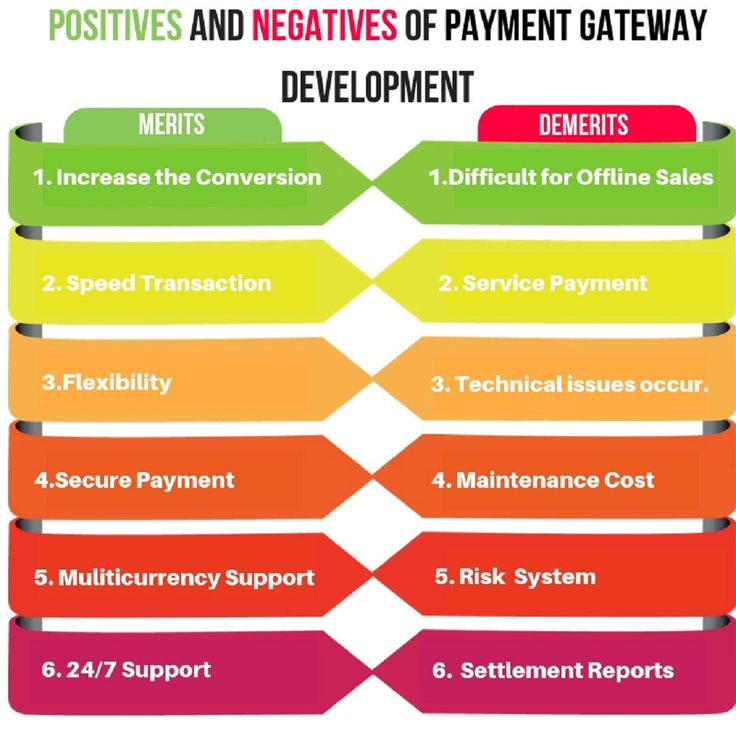

Advantages of a Payment Gateway Without Website

Easy Integration

Payment gateways without websites are known for their ease of integration. Whether you’re selling products on social media platforms or through a mobile app, integrating a payment gateway [1]is typically straightforward. This simplifies the process of accepting payments and opens up new sales channels for your business.

Expanded Customer Reach

When you rely solely on a website, you limit your customer reach to those who visit your site. However, with a payment gateway[2] that can be integrated into various platforms, you can reach potential customers on social media, mobile apps, or even in-person sales. This broader reach can lead to increased sales and brand exposure.

Disadvantages of a Payment Gateway Without Website

Limited Brand Control

One of the downsides of not having a website is the limited control over your brand’s online presence. With a website, you have complete control over the design, content, and user experience. When using external platforms, your brand’s identity may be less consistent.

Security Concerns

Security is a critical aspect of online transactions.[3] Payment gateways without websites must ensure the same level of security as traditional gateways. This can be challenging, and if not implemented correctly, it can lead to vulnerabilities in your payment process.

How to Choose the Right Payment Gateway

Choosing the right payment gateway without a website is essential. Consider factors like integration options, security features, transaction fees, and also customer support. It’s crucial to select a payment gateway that aligns with your business goals and also customer preferences.

Setting Up a Payment Gateway Without a Website

Setting up a payment gateway without a website [4]involves several steps. You’ll need to create an account with a payment gateway provider, configure your payment options, and integrate the gateway with your chosen platform. Detailed guidance on this process should be provided by the payment gateway provider.

Security Measures

Security is paramount when dealing with online payments. If you’re using a payment gateway without a website, ensure that the platform offers robust security measures. Look for features like encryption, fraud detection, and compliance with industry standards.

Popular Payment Gateways for E-commerce

Several They cater to businesses without websites. Some popular options include PayPal, Square, and Stripe. Each of these gateways offers a range of features and integration options to suit various business needs.

Mobile Payment Solutions

In today’s mobile-driven world, mobile payment solutions are gaining traction. You can accept payments via mobile apps, QR codes, or mobile wallets. These methods are user-friendly and can provide a seamless payment experience for your customers.

Alternatives to Traditional Payment Gateways

Aside from traditional payment gateways, there are alternative methods to consider. Peer-to-peer payment apps like Venmo and Cash App, as well as cryptocurrency options, can be used to accept payments without a website. Assess which alternatives best match your business model.

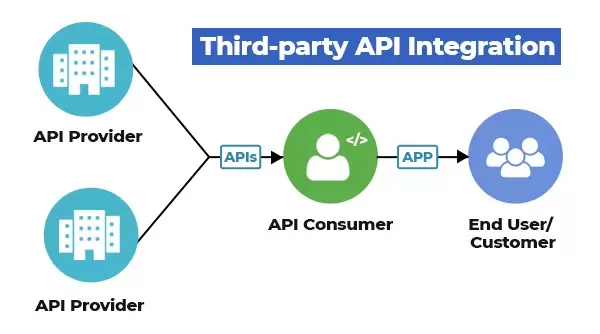

Integrating Payment Gateways with Third-Party Apps

Many businesses rely on third-party apps for various functions, such as point-of-sale systems or accounting software. Ensure that your chosen payment gateway can integrate seamlessly with these apps to streamline your business operations.

Fees and Costs

Payment gateways come with various fees, including transaction fees and monthly charges. Compare the pricing structures of different gateways to determine which one offers the best value for your business.

Real-World Use Cases

To illustrate the practicality of payment gateways without websites, let’s consider a few real-world use cases. These examples will demonstrate how businesses can leverage this technology to boost sales and enhance the customer experience.

Conclusion

In conclusion, payment gateways without websites open up new possibilities for businesses seeking to expand their online presence. They offer flexibility, broader customer reach, and the ability to tap into various online and offline sales channels. However, it’s essential to be mindful of the potential disadvantages and prioritize security. By choosing the right payment gateway and integrating it effectively, you can simplify online transactions and improve your business’s bottom line.

FAQs

Can I use a payment gateway without a website for my small business?

Yes, small businesses can benefit from payment gateways without websites. These gateways provide flexibility and can be integrated into various platforms, helping small businesses accept online payments.

Are there specific payment gateways designed for businesses without websites?

Yes, there are payment gateways like Square and PayPal that cater to businesses without websites. These gateways offer user-friendly integration options.

What security measures should I look for when using a payment gateway without a website?

Look for encryption, fraud detection, and compliance with industry standards to ensure the security of your online transactions.

Can I integrate a payment gateway without a website with my social media profiles?

Yes, many payment gateways can be integrated with social media platforms, allowing you to accept payments directly through your social media profiles.

Are there any extra costs associated with using payment gateways without websites?

Payment gateways typically have transaction fees and may have monthly charges. It’s essential to understand the pricing structure of the gateway you choose to avoid unexpected costs.