AUTHOR : ADINA XAVIER

DATE : 10/10/2023

In today’s digital age, the gig economy is thriving, with more and more individuals choosing the path of freelancing[1] to harness their skills and talents. However, one aspect that often perplexes freelancers is how to manage their payments[2] efficiently. This article aims to guide freelancers through the world of payment gateways[3], helping them choose the right platform to streamline their financial transactions[4].

Introduction

Freelancers, often working independently or remotely, require a reliable and convenient method to receive payments from clients around the world. This is where the significance of payment gateways[5] becomes evident. Let’s dive into the world of payment gateways also explore how they can benefit freelancers.

Understanding Payment Gateways

2.1 What is a Payment Gateway?

A payment gateway is a technology that facilitates the transfer of funds from a customer to a merchant, ensuring secure and efficient transactions. It acts as a bridge between the client’s payment source, such as a credit card or digital wallet, and the freelancer’s bank account.

2.2 How Does a Payment Gateway Work?

Payment gateways[1] encrypt and securely transmit payment information between the client, the freelancer, and the financial institutions involved. This ensures that sensitive data remains confidential and protected during the transaction process.

3 Importance for Freelancers

Freelancers rely on payment gateways to receive payments for their services promptly. By offering various payment options to clients, freelancers can attract a broader clientele also enhance their professional image.

Features to Look for

4.1 Security Measures

When choosing a payment gateway, prioritize security features such as SSL encryption, fraud prevention[2], and two-factor authentication to safeguard your transactions.

4.2 Transaction Fees

Different payment gateways have varying fee structures. Be sure to understand these fees, including transaction fees and currency conversion costs, to manage your earnings effectively.

4.3 Currency Support

For international freelancers, having a payment gateway that supports multiple currencies is essential. It allows you to receive payments in different currencies without hefty conversion fees.

4.4 Integration Options

Consider whether the payment gateway can be seamlessly integrated into your website or freelancing platform to provide a smooth payment experience for your clients.

Popular Payment Gateways for Freelancers

5.1 PayPal

PayPal is a widely recognized payment gateway known for its ease of use and global reach. It allows freelancers to receive payments in multiple currencies also offers a user-friendly interface.

5.2 Stripe

Stripe is another popular choice, offering a robust set of features and customization options. It’s known for its developer-friendly tools and supports various payment methods.

5.3 TransferWise (now Wise)

Wise specializes in international money transfers, making it an excellent choice for freelancers working with clients worldwide. It provides attractive exchange rates and clearly disclosed fees.

Setting Up Your Payment Gateway Account

To get started, sign up for a payment gateway account of your choice. Complete the necessary verification steps, link your bank account, also configure your settings to start accepting payments.

Accepting Payments

Once your payment gateway is set up, share your payment details with clients. They can then make payments conveniently using credit cards, digital wallets, or other supported methods.

Handling International Transactions

For freelancers working across borders, payment gateways that support multiple currencies are invaluable. It simplifies the process of receiving payments from clients worldwide.

Taxation and Reporting

Freelancers should keep track of their earnings also understand the tax implications of their income. Payment gateways often provide reports that can be helpful for tax purposes.

Tips for Choosing the Right Payment Gateway

Consider factors like your target audience, transaction volume, and preferred features when selecting a payment gateway. Don’t forget to read user reviews also compare fees to make an informed choice.

Case Study: Freelancer Success Story

Explore a real-life success story of a freelancer who effectively used a payment gateway to grow their business and simplify their financial transactions[3].

Common Pitfalls to Avoid

Learn about common mistakes freelancers make when using payment gateways and how to avoid them to ensure a smooth payment experience.

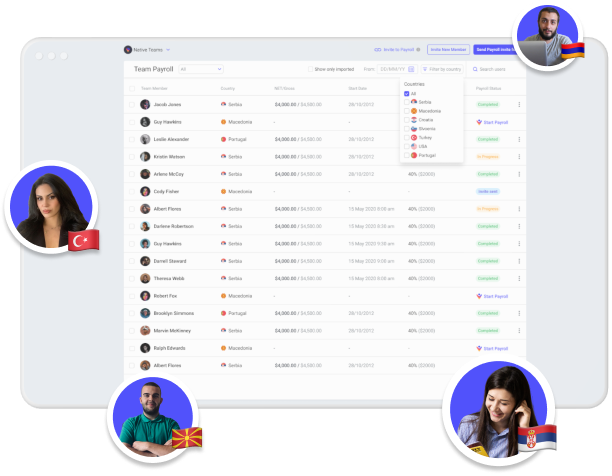

Integrating with Freelance Platforms

Many freelance platforms, such as Upwork and Fiverr, integrate seamlessly with payment gateways. This integration streamlines the payment process, making it easier for clients to pay for services, and for freelancers to receive funds.

Managing Your Finances

Payment gateways often provide tools for managing finances, such as tracking expenses, generating financial reports, and setting up automatic transfers to your bank account. These features can help freelancers maintain a clear overview of their financial health.

Staying Compliant with Regulations

Freelancers must adhere to financial regulations and tax laws. Payment gateways often assist with compliance by providing documentation[4] and reports that simplify tax reporting, making it easier to fulfill your legal obligations.

Diversifying Payment Options

Offering a variety of payment options can attract more clients. Payment gateways support credit and debit card payments, digital wallets, and even cryptocurrency transactions, allowing you to cater to a broader clientele.

Conclusion

In the freelance world, choosing the right payment gateway is crucial for a hassle-free payment experience. With the right choice, you can focus on what you do best while leaving the financial aspects to a reliable platform.

FAQs

1. Are payment gateways safe for freelancers?

Yes, payment gateways employ advanced security measures to protect your transactions and personal information.

2. Is it possible to utilize multiple payment gateways for my freelance venture?

Yes, you can use multiple payment gateways to offer more options to your clients.

3. How do I handle chargebacks with a payment gateway?

Most payment gateways[5] provide guidelines on handling chargebacks. Follow their procedures to resolve disputes.

4. Is it necessary to have a business account to use payment gateways?

While not always required, having a separate business account can help you manage your finances more effectively.

5. What should I do if my payment gateway account gets suspended?

If your account is suspended, contact the payment gateway’s support team to address the issue and resolve any concerns promptly.