AUTHOR : ADINA XAVIER

DATE : 28/10/2023

In this digital age, where online shopping has become the norm, payment gateway settlement processes are the unsung heroes that enable seamless financial transactions. If you’ve ever wondered how your online payment is processed securely and efficiently, this article will unravel the mysteries behind payment gateway settlements. We’ll delve into the intricacies of this financial backbone of e-commerce and explain it in simple terms. Let’s embark on this enlightening journey.

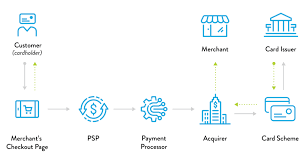

Before we dive into the payment gateway settlement process, let’s clarify what a payment gateway is. A payment gateway is a technology that facilitates online transactions by connecting the merchant, the customer, and the financial institutions involved.

The Role of Payment Gateways

Payment gateways act as intermediaries, ensuring that sensitive financial data is securely transmitted and verified. They play a pivotal role in processing payments for online businesses.

Payment Gateway vs. Payment Processor

It’s essential to distinguish between payment gateways and payment processors[1]. While payment gateways handle the authorization and security aspects, payment processors manage the actual transfer of funds.

Key Components of a Payment Gateway

To understand payment gateway settlements, we must first grasp the components that make up a payment gateway. These include the merchant, the customer, and the payment gateway itself.

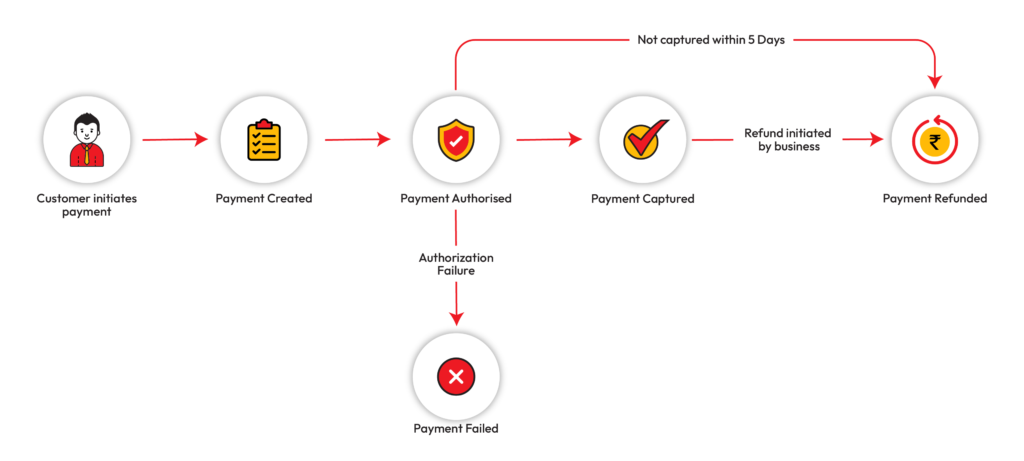

The Payment Process Step by Step

Let’s break down the payment gateway settlement process into simple steps, shedding light on each stage of a transaction.

Step 1: Customer Initiates Payment

The process begins when a customer initiates a payment on the merchant’s website, adding products to their cart and proceeding to checkout.

Step 2: Encryption and Security

To ensure the security of sensitive data, payment gateways[2] use advanced encryption methods, safeguarding the information during transmission.

Step 3: Authorization Request

Upon receiving the payment request, the payment gateway forwards it to the issuing bank, seeking authorization for the transaction.

Step 4: Transaction Routing

The payment gateway routes the transaction to the relevant payment processor, which handles fund transfer between the customer and the merchant.

Step 5: Issuing Bank Approval

The issuing bank reviews the transaction[3], verifying the customer’s account also available funds. If approved, the transaction proceeds.

Step 6: Settlement and Funding

Once the payment is approved, the funds are settled and transferred from the customer’s account to the merchant’s account.

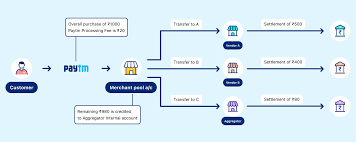

Types of Payment Gateway Models

Payment gateways come in different models, each with its own set of advantages and disadvantages. Let’s explore the most common types.

Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure external page for payment processing[4], ensuring minimal security responsibilities for the merchant.

Self-hosted Payment Gateways

Self-hosted payment gateways allow merchants to process payments on their own website, offering more control but requiring additional security measures.

API-based Payment Gateways

API-based gateways provide a seamless payment experience by integrating directly with the merchant’s website, offering both control and security.

Importance of Security in Payment Gateways

Security is paramount in payment gateway settlements. We discuss the rigorous measures payment gateways employ to protect sensitive information.

Choosing the Right Payment Gateway

Selecting the right payment gateway is crucial for the success of your e-commerce business.

Common Challenges in Payment Gateway Settlements

Explore the challenges businesses often face when dealing with payment gateway settlements and how to overcome them.

Benefits of an Efficient Payment Gateway

Efficient payment gateways offer a plethora of benefits, from increased customer trust to improved cash flow for businesses.

The Future of Payment Gateway Settlements

As technology evolves, so does the payment gateway[5] industry. We offer a glimpse into the future of payment gateway settlements.

Conclusion

In conclusion, payment gateway settlement processes are the unsung heroes of the e-commerce world, enabling secure and efficient online transactions. Understanding these processes is crucial for both merchants and consumers, as they navigate the digital landscape.

FAQs

- What is the primary role of a payment gateway?A payment gateway acts as an intermediary for processing online payments securely.

- How do payment gateways ensure data security?Payment gateways use advanced encryption methods to safeguard sensitive information during transmission.

- What is the difference between a payment gateway and a payment processor?Payment gateways handle authorization and security, while payment processors manage fund transfers.

- Why is the selection of the right payment gateway crucial for businesses?The right payment gateway can impact customer trust and cash flow, making it a pivotal decision for e-commerce businesses.

- How is the payment gateway industry expected to evolve in the future?The future of payment gateways may involve enhanced security measures and more seamless integration with emerging technologies.

Get In Touch