AUTHOR : ADINA XAVIER

DATE : 28/10/2023

In the dynamic landscape of e-commerce, having a reliable payment gateway service provider in India[1] is essential for businesses looking to thrive online. As digital transactions become increasingly common, the need for secure and efficient payment solutions[2] has never been greater. This article delves into the crucial aspects of payment gateways in India, exploring the features, benefits, and key players in this sector, along with frequently asked questions to help businesses navigate their options.

What is a Payment Gateway?

A payment gateway[3] is a technological solution that allows businesses to securely process online payments from their customers. It acts as a bridge between the customer and the merchant, facilitating the transfer of payment information. When a customer makes a purchase, the payment gateway encrypts their sensitive information and sends it to the bank or payment processor[4] for authorization. Once approved, the transaction is completed, and the funds are transferred to the merchant’s account. The choice of a payment gateway service provider in India[5] is crucial for ensuring that this process is smooth, secure, and efficient.

The Role of Payment Gateways in E-commerce

Payment gateways are essential components of the e-commerce framework, facilitating secure transactions and enabling smooth online purchasing experiences. They not only enable transactions but also enhance customer experience and security. Here are some key functions of payment gateways:

- Authorization: involves verifying payment details and approving transactions instantaneously.

- Security: Payment gateways use advanced encryption methods to protect sensitive data from fraud and theft.

- Payment Processing: They facilitate various payment methods, including credit/debit cards, net banking, UPI, and digital wallets.

- Reporting and Analytics: Many payment gateways provide merchants with detailed reports and analytics to track sales, monitor performance, and identify trends.

Benefits of Using a Payment Gateway Service Provider in India

1. Enhanced Security

Security is paramount in online transactions. Reputable payment gateways comply with the Payment Card Industry Data Security Standard (PCI DSS), ensuring that customer data is encrypted and securely processed. This helps to build trust with customers and protect businesses from fraud.

2. Wide Range of Payment Options

A good payment gateway supports multiple payment methods, allowing customers to choose their preferred mode of payment. This can include credit and debit cards, UPI, net banking, and popular digital wallets. Providing diverse options can lead to higher conversion rates and increased sales.

3. Improved Customer Experience

A seamless payment process enhances the overall shopping experience for customers. Fast, efficient transactions and user-friendly interfaces can reduce cart abandonment rates and encourage repeat business. A well-designed checkout process is crucial for retaining customers in the competitive e-commerce landscape.

4. Cost-Effectiveness

Many payment gateways offer competitive pricing structures with transparent fee models. By analyzing transaction fees and other costs associated with different providers, businesses can find a solution that fits their budget while providing the necessary features.

5. Scalability

As companies expand, their requirements for payment processing can change and develop. A reliable payment gateway service provider in India can accommodate increasing transaction volumes and offer additional features as needed. This scalability is vital for businesses looking to expand their online presence.

Must-Have Features of a Payment Gateway

1. Integration Capabilities

A payment gateway should integrate seamlessly with existing e-commerce platforms and websites. Popular platforms such as Shopify, WooCommerce, and Magento often have built-in support for various payment gateways, simplifying the integration process.

2. Transaction Fees

Understanding the fee structure is crucial for businesses. Certain gateways impose a fee based on a percentage of each transaction, whereas others may charge a fixed rate. Analyzing these costs in relation to transaction volumes can help businesses choose the most cost-effective option.

3. Customer Support

Reliable customer support is essential for resolving issues that may arise during transactions. Look for payment gateways that offer multiple support channels, including phone, email, and chat support.

4. Mobile Compatibility

With the rise of mobile shopping, it’s important to choose a payment gateway that offers a mobile-friendly checkout process. A responsive design ensures that customers have a smooth experience on their smartphones and tablets.

Top Payment Gateway Service Providers in India

1. Razor pay

Razor pay is one of the leading payment gateway service providers in India, known for its user-friendly interface and robust features.

- Transaction Fees: Razor pay charges a fee of 2% for domestic transactions and 3% for international transactions.

- Key Features: Supports multiple payment methods, including UPI, credit/debit cards, net banking, and wallets. It also provides comprehensive APIs for developers.

- Customer Support: Offers 24/7 support via chat, email, and phone.

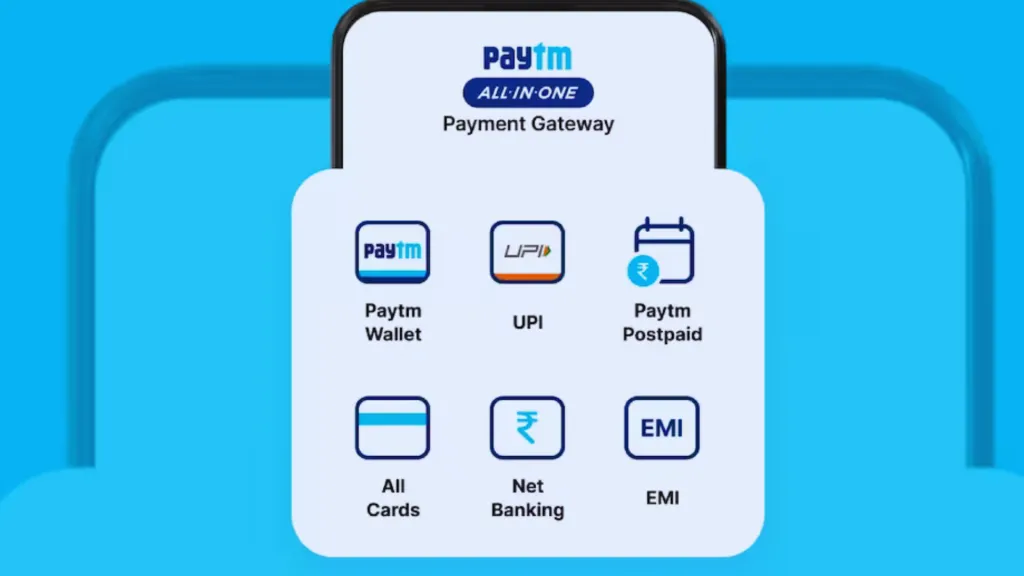

2. Paytm Payment Gateway

As a well-established brand in India, Paytm offers a comprehensive payment gateway solution suitable for businesses of all sizes.

- Transaction Fees: Paytm charges between 1.75% to 2% per transaction, depending on the payment method.

- Key Features: Supports a wide range of payment options, including Paytm Wallet, UPI, and bank transfers. It also provides an easy-to-use dashboard for tracking transactions.

- Customer Support: Provides extensive customer support through a dedicated helpline and online resources.

3. CCA venue

CCA venue is one of the oldest payment gateways in India, with a strong reputation for reliability and security.

- Transaction Fees: CCA venue charges between 2% to 3% per transaction, depending on the business model.

- Key Features: Offers multilingual support, a wide range of payment options, and customizable payment pages.

- Customer Support: Provides comprehensive support via email, chat, and phone.

4. PayPal India

PayPal is a globally recognized payment gateway that also operates in India, catering to both domestic and international transactions.

- Transaction Fees: PayPal charges a fee of 4.4% plus a fixed fee based on the currency for domestic transactions.

- Key Features: Supports various payment methods and currencies, making it ideal for businesses with international customers.

- Customer Support: Offers extensive online resources and support options.

5. Insta mojo

Insta mojo is an emerging payment gateway service provider in India, particularly popular among startups and small businesses.

- Transaction Fees: Instamojo charges a flat fee of 2% per transaction.

- Key Features: Supports UPI, wallets, credit/debit cards, and offers a simple onboarding process.

- Customer Support: Provides support via chat and email, making it accessible for small business owners.

Conclusion

In the evolving landscape of e-commerce, selecting a reliable payment gateway service provider in India is essential for businesses aiming to enhance their online transactions. With numerous options available, each offering unique features and pricing structures, businesses must evaluate their specific needs to find the right solution. Understanding the top players in the market and the key features they offer will empower businesses to make informed decisions. By investing in a robust payment gateway, companies can improve customer satisfaction, increase sales, and ultimately thrive in the competitive Indian market.

FAQs

1. What is a payment gateway service provider in India?

A payment gateway service provider in India is a company that facilitates online transactions by securely processing payment information between customers and merchants.

2. How do I choose the right payment gateway for my business?

To choose the right payment gateway, consider factors such as transaction fees, security features, payment options, integration capabilities, and customer support.

3. Are there any hidden fees with payment gateways?

Most payment gateways are transparent about their pricing, but businesses should carefully review the terms to understand any potential additional fees, such as chargebacks or international transaction fees.

4. Can I integrate multiple payment gateways?

Yes, businesses can integrate multiple payment gateways to offer customers various payment options, enhancing the chances of successful transactions.

5. How secure are payment gateways in India?

Reputable payment gateways in India implement advanced security measures, including PCI compliance, encryption, and fraud detection tools, to ensure secure transactions.