AUTHOR : ADINA XAVIER

DATE : 14/10/2023

In today’s fast-paced digital world, the online marketplace has become the epicenter of commercial transactions. Whether you’re running an e-commerce store, offering subscription services, or processing payments for your business, having a reliable payment gateway is crucial. Payment gateways facilitate secure online transactions, making them an indispensable tool for businesses. In this article, we’ll delve into the world of payment gateway providers and explore the options available to you.

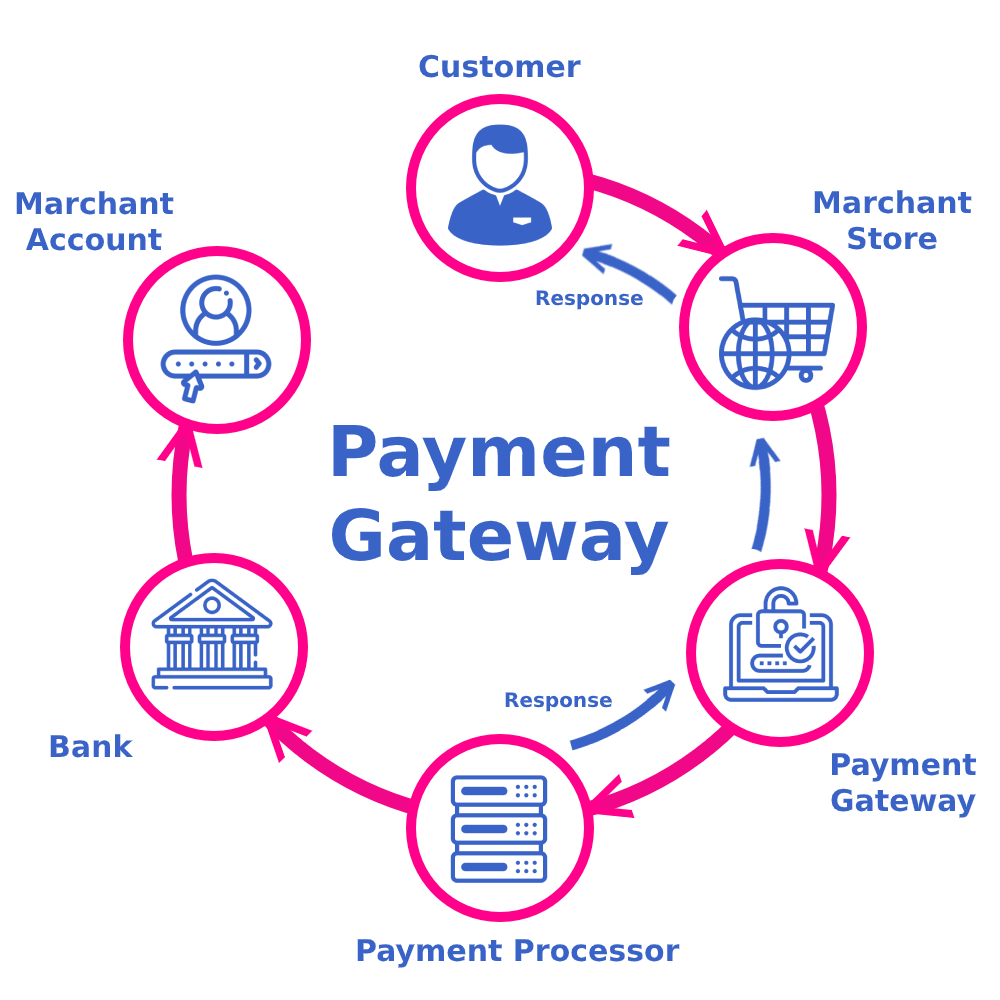

Understanding Payment Gateways

A payment gateway is an e-commerce service that authorizes payments for online and offline businesses. It acts as the middleman between the merchant’s website also the financial institutions, ensuring that customer payments are processed seamlessly and securely. These gateways enable businesses to accept credit and debit card payments, as well as other forms of online payment.

Significance of Opting for the Correct Payment Gateway

Selecting the right payment gateway is essential for your business’s success. The choice impacts your website’s user experience, security, and ultimately, your bottom line. A seamless also secure payment process can boost customer trust and satisfaction, increasing the likelihood of repeat business.

Popular Payment Gateway Providers

1. PayPal

PayPal is one of the most recognized and widely used payment gateways worldwide. It offers a range of services, from basic online payment processing to advanced solutions for businesses of all sizes.

2. Stripe

Stripe is known for its developer-friendly approach and robust set of tools. It’s a popular choice for businesses looking to integrate customizable payment solutions.

3. Square

Square is renowned for its user-friendly mobile payment processing[1]. It’s an excellent option for small businesses and entrepreneurs, especially those with physical stores.

4. Authorize.Net

Authorize.Net is a well-established gateway provider that focuses on security and reliability. It’s a favorite among e-commerce businesses.

5. Braintree

Braintree, owned by PayPal, specializes in mobile also in-app payments. It’s suitable for businesses seeking a seamless mobile payment experience.

Attributes to Consider When Evaluating a Payment Gateway

When choosing a payment gateway, it’s essential to consider the following features:

Security

Ensure the gateway provides robust security measures, such as data encryption and fraud prevention[2] tools.

Ease of Integration

The gateway should be easy to integrate into your website or app, saving time also development costs.

Transaction Fees

Be aware of the transaction fees charged by the provider. Compare also choose one that aligns with your budget.

Accepted Payment Methods

Check which payment methods the gateway supports, including credit cards, digital wallets, also more.

Key Elements to Weigh When Selecting a Payment Gateway

Business Type

The nature of your business affects the choice of a payment gateway. E-commerce[3], subscription services, and physical stores may have different requirements.

Geographical Reach

Consider the geographical regions you plan to serve. Ensure your chosen gateway supports transactions in those areas.

Customer Experience

A seamless payment experience can improve customer satisfaction also trust, leading to higher conversion rates.

How to Integrate a Payment Gateway

Integrating a payment gateway can be a complex process, but most providers offer detailed documentation and support to help you seamlessly integrate it with your website or app.

The Future of Payment Gateways

As technology evolves, payment gateways are likely to become even more user-friendly and secure. Keep an eye on emerging trends and innovations in the payment processing industry.

Payment Gateway Security

You want your customers to feel confident when making purchases on your website. Payment gateways should offer robust security features, such as data encryption and fraud detection. Always prioritize gateways that are PCI DSS compliant, as this ensures a high level of data protection.

Customer Support

Reliable customer support is invaluable. If issues arise with your payment gateway, you’ll want responsive and knowledgeable support to resolve them swiftly. Check if your provider offers 24/7 customer support and multiple channels of communication, such as phone, email, or chat.

Reporting and Analytics

Understanding your payment data is key to optimizing your business. Look for gateways that provide comprehensive reporting and analytics tools. These can help you track sales, monitor payment trends, and make data-driven decisions to improve your business’s financial performance.

Scalability

Your business may grow, and your payment processing[4] needs will evolve. Ensure that the provider offers plans or features that can accommodate your growth without hassle.

User Experience

The user experience during the payment process should be seamless and intuitive. Consider gateways that offer a well-designed and mobile-responsive payment interface. A smooth checkout process can significantly reduce cart abandonment rates.

International Transactions

If your business caters to an international audience, it’s essential to choose a payment gateway that supports multiple currencies and provides a global reach. This ensures that customers from different parts of the world can transact with ease.

Conclusion

Selecting the right payment gateway is a pivotal decision for any business. By understanding the options available and your specific needs, you can make an informed choice that enhances your customers’ experience and the security of your transactions[5].

FAQs

- What is a payment gateway?

- A payment gateway is an e-commerce service that facilitates online transactions by authorizing payments for businesses.

- Which payment gateway is best for small businesses?

- For small businesses, options like Square and Stripe are often preferred due to their user-friendly interfaces and affordable pricing.

- How do payment gateways secure transactions?

- Payment gateways use encryption and fraud prevention measures to ensure the security of online transactions.

- What fees are associated with payment gateways?

- Transaction fees and sometimes setup fees are associated with payment gateways. These fees vary by provider.

Get In Touch