AUTHOR : ADINA XAVIER

DATE : 13/10/2023

In today’s digital age, the United Arab Emirates (UAE)[1] stands as a beacon of modernity and financial prosperity. With a burgeoning e-commerce industry [2]and increasing online transactions,[3] the need for reliable payment gateway providers[4] has never been more crucial. In this article, we will explore the diverse landscape of payment gateway providers in the UAE[5], examining their role in facilitating secure and efficient transactions.

Introduction to Payment Gateways

Payment gateways are online systems that allow businesses to accept payments electronically. They act as intermediaries between online merchants and customers, ensuring that financial transactions are swift, secure, also hassle-free. In the UAE, numerous providers offer these services, each with its unique features and benefits.

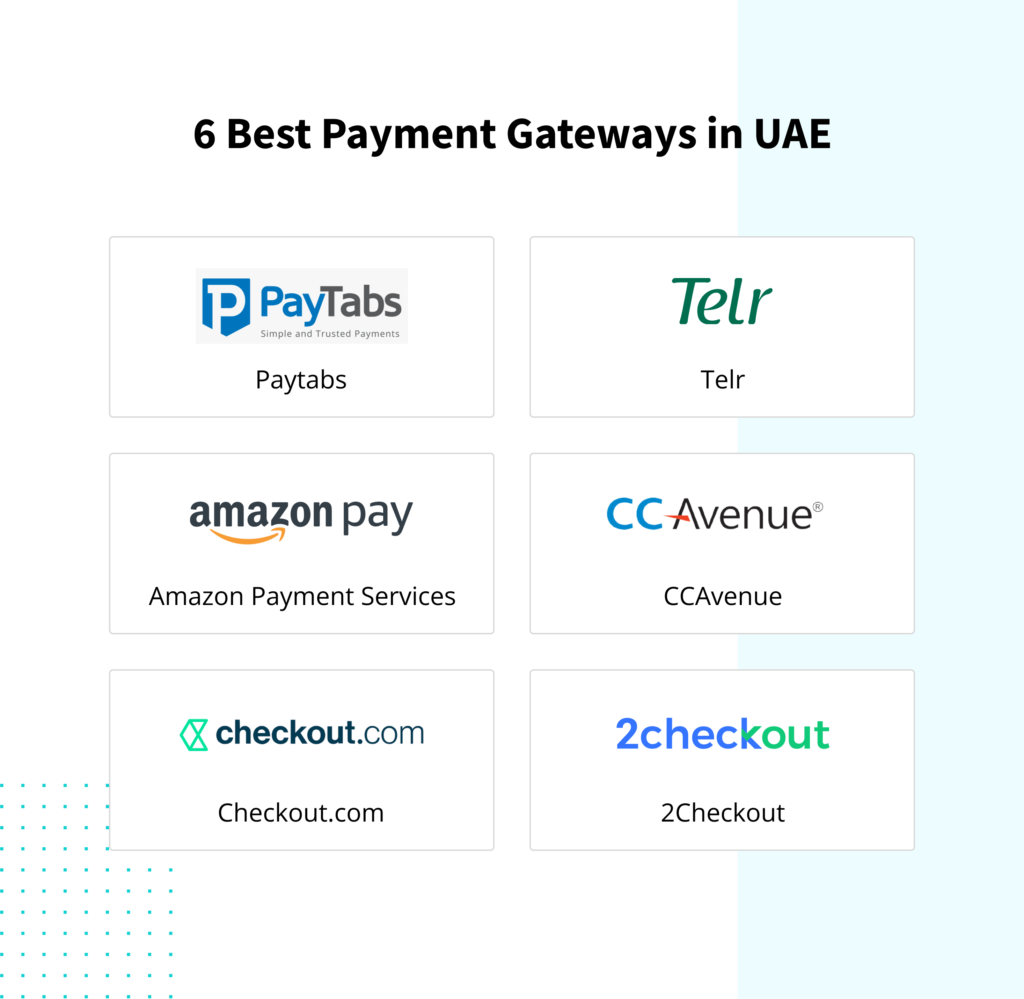

Leading Payment Gateway Providers in the UAE

Telr

Telr is a prominent payment gateway provider in the UAE. With a robust platform and a variety of payment options, it caters to both startups and established businesses. Telr ensures secure transactions also offers an easy integration process.

PayTabs

PayTabs is another noteworthy player in the UAE’s payment gateway market. It provides a seamless also secure online payment experience for businesses of all sizes. Their user-friendly interface and strong fraud prevention mechanisms make them a popular choice.

Network International

Network International, a regional leader, offers a wide range of payment solutions, from credit card processing to mobile payments[1]. They have a strong presence in the UAE also provide services to numerous sectors, including retail, e-commerce, and hospitality.

The Importance of Choosing the Right Payment Gateway

Selecting the appropriate payment gateway provider is vital for any business. The right choice can significantly impact customer satisfaction, transaction security, and overall revenue. Factors to consider include:

Transaction Fees

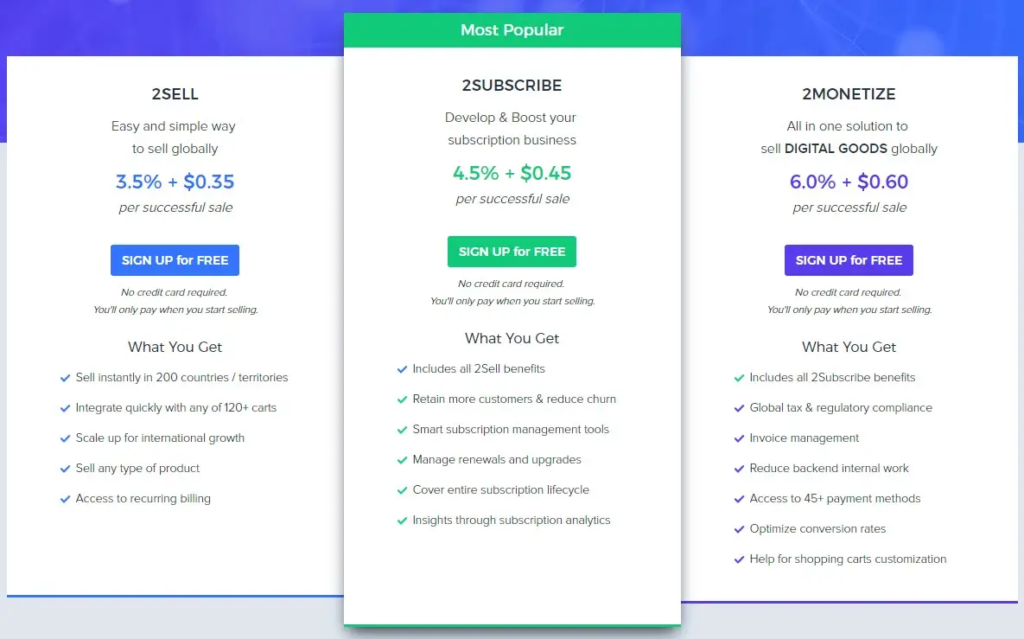

Different payment gateway providers have varying fee structures. Consider how these fees align with your business model to maximize profitability.

Security Measures

Security is paramount. Ensure that your chosen provider offers robust security features to protect sensitive customer information.

Integration

Seamless integration with your e-commerce platform is essential for a smooth customer experience. Check for compatibility with your existing systems.

Customer Support

24/7 customer support is a valuable asset, especially in the event of payment issues or technical glitches.

How Payment Gateways Work

Payment gateways follow a straightforward process to facilitate transactions:

- The customer selects products or services and proceeds to checkout.

- The payment gateway securely collects and encrypts the customer’s payment details.

- It forwards the data to the bank or financial institution[2] for authorization.

- Upon approval, the payment is processed, and a receipt is issued to the customer and merchant.

The Diversity of Payment Methods

In the UAE, a wide range of payment methods is commonly accepted by these payment gateway providers. These methods cater to the diverse financial preferences of customers, whether they prefer traditional options or embrace modern digital trends. Some of the common payment methods include:

Credit and Debit Cards

Credit and debit cards, including Visa, MasterCard, and American Express, are widely accepted by payment gateways in the UAE. These methods offer convenience and security for both customers and businesses.

Mobile Wallets

With the rise of smartphone usage, mobile wallets like Apple Pay and Samsung Pay have gained popularity. Payment gateway providers in the UAE often integrate these digital wallets for a smooth and contactless transaction experience.

Cryptocurrency

The UAE, known for its forward-thinking approach to finance and technology, has also seen the emergence of cryptocurrency[3] payments. Some payment gateway providers now support digital currencies like Bitcoin, allowing tech-savvy customers to make secure transactions.

E-commerce Platforms

Payment gateways are not limited to online stores; they are also essential for e-commerce platforms. These platforms provide the infrastructure for businesses to set up their online stores and offer integrated payment solutions.

Regulatory Compliance

Operating in the UAE requires adherence to local laws and regulations, especially regarding financial transactions and data security. Payment gateway providers must comply with these regulations to ensure a safe and legal operating environment. This compliance includes measures to prevent money laundering and terrorist financing, as well as safeguarding customer data.

The Future of Payment Gateways in the UAE

As the UAE continues to evolve as a global hub for finance and commerce, the payment gateway industry is expected to grow exponentially. The future holds the promise of even more secure, convenient, and innovative payment methods[4]. Additionally, as businesses adapt to the digital economy, payment gateways will become indispensable tools for their success.

Conclusion

In the UAE’s thriving e-commerce environment, selecting the right payment gateway provider is pivotal to success. Telr, PayTabs, and Network International are just a few examples of the diverse options available. Consider your business’s specific needs, transaction volume, and security requirements when making your choice. Ultimately, a reliable payment gateway ensures secure and efficient transactions[5], enhancing the overall customer experience.

FAQs

1. How do payment gateways protect against fraud?

Payment gateways employ advanced fraud prevention mechanisms, including encryption and identity verification, to safeguard transactions.

2. Can small businesses benefit from using payment gateways in the UAE?

Absolutely. Payment gateways like PayTabs offer solutions that cater to the needs of small businesses, making online transactions accessible to all.

3. What payment methods are typically supported by these gateways?

Commonly supported payment methods include credit cards, debit cards, mobile wallets, and even cryptocurrency, depending on the provider.

4. Are payment gateway transactions in the UAE subject to taxation?

The taxation of online transactions can vary, so it’s advisable to consult with a financial expert for precise information regarding your business.

5. How long does it take for funds from online transactions to reach a business account?

The processing time can vary, but it typically takes 2-3 business days for funds from online transactions to be deposited into a business account in the UAE.