AUTHOR : ADINA XAVIER

DATE : 14/10/2023

In the digital age, secure and efficient payment processing is crucial for businesses of all sizes. Payment gateway providers play a vital role in facilitating online transactions, ensuring seamless and secure payment experiences for both businesses and customers. In the United States, a variety of payment gateway providers offer diverse solutions to cater to the needs of businesses. In this article, we will explore the top payment gateway providers in the USA, delving into their features and services, helping you make an informed choice for your online payment processing needs.

1. Introduction

The payment landscape in the USA has witnessed significant transformation over the years. As e-commerce continues to grow, so does the demand for secure and efficient payment gateways. In this article, we will explore the payment gateway providers in the USA, highlighting their key features, also helping you choose the right one for your business.

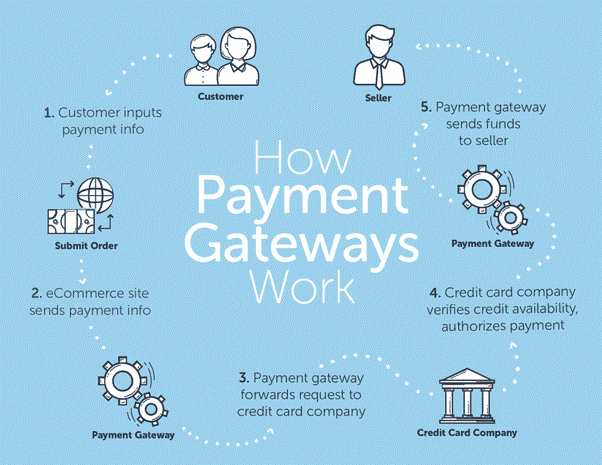

2. What is a Payment Gateway?

A payment gateway is a technology that facilitates the transfer of payment information between a customer, a business, also the financial institutions involved. It ensures the security of online transactions, encrypting sensitive data, also verifying payments in real-time.

3. Why Choose a Payment Gateway Provider?

Payment gateway providers offer a range of benefits to businesses. They help in streamlining the payment process[1], ensuring security, also providing diverse payment options, enhancing the customer experience.

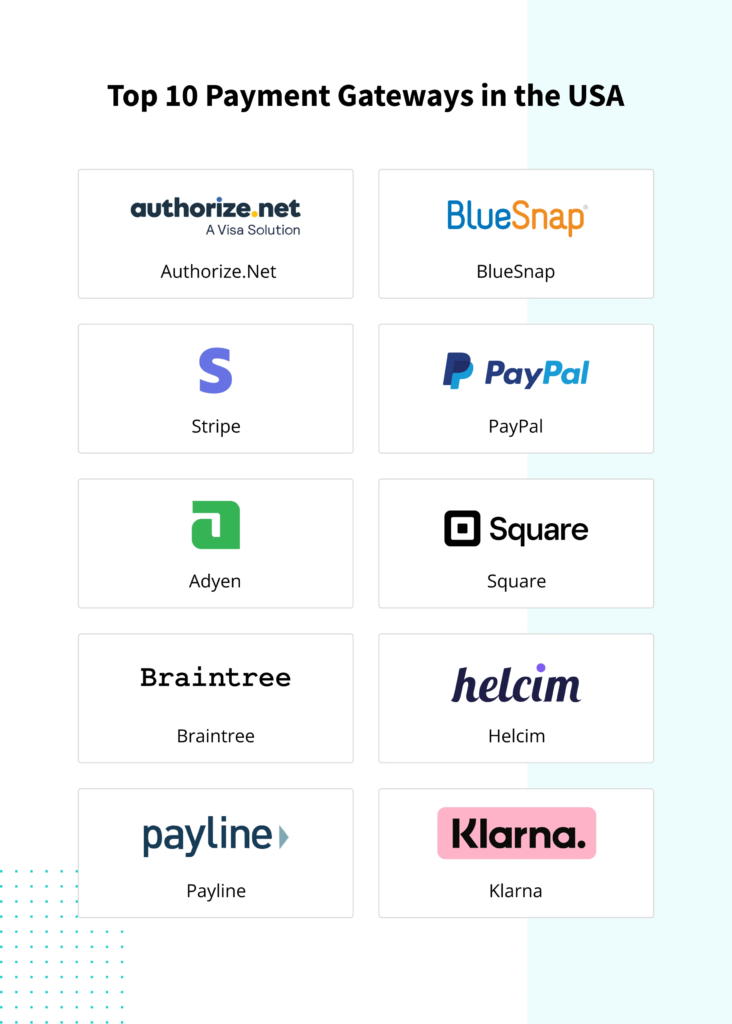

4. Top Payment Gateway Providers in the USA

4.1. PayPal

PayPal is one of the most well-known also widely used payment gateways in the USA. It offers both merchant and customer-focused services, making it ideal for businesses of all sizes. With PayPal, you can accept payments online, in-app, or in-person.

4.2. Stripe

Stripe is another popular choice among businesses, known for its developer-friendly platform and robust APIs. It offers a wide range of customization options, making it an excellent choice for businesses with unique needs.

4.3. Square

Square is known for its simplicity also ease of use. It provides a suite of services, including a point-of-sale system, making it a comprehensive solution for small businesses.

4.4. Authorize.Net

Authorize.Net boasts a rich history also a well-established presence within the payment gateway[2] sector. It offers secure payment processing, fraud detection, also recurring billing services, catering to businesses of all types.

4.5. Braintree

Braintree, a subsidiary of PayPal, is known for its international reach also support for various payment methods. It’s an excellent choice for businesses looking to expand globally.

5. Factors to Consider When Choosing a Payment Gateway Provider

When selecting a payment gateway provider, consider factors like ease of integration, security features, and the payment methods they support. Assess your specific business needs to make the right choice.

6. Setting up a Payment Gateway

Setting up a payment gateway involves several steps, from signing up with the provider to integrating it with your website or application. Choose a provider that offers easy setup also clear documentation[3].

7. Security and Compliance

Security is paramount in online payments. Ensure that your chosen payment gateway is compliant with industry standards also offers features like data encryption and fraud protection.

8. Mobile Payment Solutions

With the growing use of mobile devices for shopping, having mobile payment options is essential. Check if your chosen payment gateway supports mobile payments seamlessly.

9. Payment Gateway Integration

The ease of integration with your e-commerce platform or website is crucial. Opt for a payment gateway that offers plugins or APIs for smooth integration.

10. Fees and Pricing

Understand the fee structure of the payment gateway, including transaction fees, monthly charges, also any additional costs. Compare these fees to your business’s revenue to ensure cost-effectiveness.

11. Customer Support

Good customer support is vital in case you encounter issues. Choose a payment gateway provider with responsive and knowledgeable customer support.

12. E-commerce Platforms and Payment Gateways

Some payment gateways are better suited for specific e-commerce[4] platforms. Ensure compatibility with your chosen e-commerce system.

13. Challenges and Trends in Payment Processing

Explore the challenges and emerging trends in the payment processing industry, including the impact of cryptocurrencies, AI, also machine learning.

14. Conclusion

Selecting the right payment gateway provider is a crucial decision for your business. Each provider offers unique features, and your choice should align with your business’s specific needs and goals.

15. Frequently Asked Questions (FAQs)

1. How does a payment gateway function, and what is its operational mechanism?

A payment gateway is a technology that enables the transfer of payment information between a customer, a business, and financial institutions, ensuring secure online transactions.

2. Are there any free payment gateway options available?

Some payment gateway providers offer free plans, but they often come with limitations. Make certain to carefully examine and assess the stipulated terms and conditions.

3. How do I integrate a payment gateway with my e-commerce website?

Integration typically involves using the provided APIs or plugins. Consult your payment gateway provider’s documentation for step-by-step instructions.

4. What should I do if I encounter a payment processing issue?

Contact your payment gateway provider’s customer support for assistance. They are equipped to resolve issues and answer your questions.

5. Can I switch payment gateway providers after I’ve already integrated one?

Yes, you can switch, but it may involve technical work. Be prepared for the transition and ensure a smooth handover of payment processing.

Get In Touch