AUTHOR : SARIKA PATHAK

DATE : 13 / 10 / 2023

Understanding Payment Gateways

In the digital age, payment gateways have become an essential component of online transactions. They serve as the virtual cashiers of the internet, allowing businesses and also customers to exchange money securely and efficiently.

1. Enhanced Security Measures

One of the foremost concerns for payment gateways is security. With the persistent threat of cyberattacks and data breaches, the industry will continue to fortify its security protocols. This includes stricter compliance with regulations like GDPR and the implementation of advanced authentication methods, such as biometrics.

2. Support for Cryptocurrencies

The rise of cryptocurrencies like Bitcoin and Ethereum has prompted some payment gateways to explore the integration of digital currencies. This could potentially open up a new dimension in online payments, offering more options for both businesses and consumers.

3. Integration with Emerging Payment Methods

Payment gateways will evolve to accommodate evolving payment preferences. This may include seamless integration with mobile wallets, QR code payments, and other innovative methods that gain popularity among consumers.

4. Global Expansion

As businesses increasingly target international markets, Payment Gateway Work [1] will need to facilitate cross-border transactions. Enhanced multi-currency support and international payment processing will become standard features, enabling global commerce.

5. User-Friendly Interfaces

Simplicity and ease of use will remain a priority. Payment gateways will continue to develop user-friendly interfaces that enhance the customer experience, reducing friction in the payment process and also boosting conversion rates.

6. Subscription-Based Models

Subscription services have gained prominence across various industries. Payment gateways will likely introduce features that cater to subscription-based businesses, making it easier to manage recurring payments and subscription renewals.

7. Real-Time Data Analytics

Access to real-time transaction data and analytics will empower businesses to make informed decisions. Payment gateways will increasingly offer advanced reporting and analytics tools, allowing merchants to track and optimize their payment processes[2].

8. Voice-Activated Payments

The rise of voice-activated devices like smart speakers has the potential to transform the way payments are made. Payment gateways may develop voice-activated payment options, making it even more convenient to shop online.

In conclusion, payment gateways are the backbone of the digital economy, ensuring seamless, secure, and efficient transactions. As the digital landscape continues to evolve, payment gateways will adapt to meet the ever-changing needs of businesses and also consumers. Embracing these trends and advancements will be key to staying competitive and providing a top-tier online shopping experience.

Understanding Payment Gateways

In the digital age, payment gateways have become an essential component of online transactions.[3] They serve as the virtual cashiers of the internet, allowing businesses and customers to exchange money securely and efficiently.

The Importance of Payment Gateways

Payment gateways play a crucial role in facilitating smooth and secure online transactions. They ensure that sensitive financial information remains protected while enabling businesses to accept payments from customers.

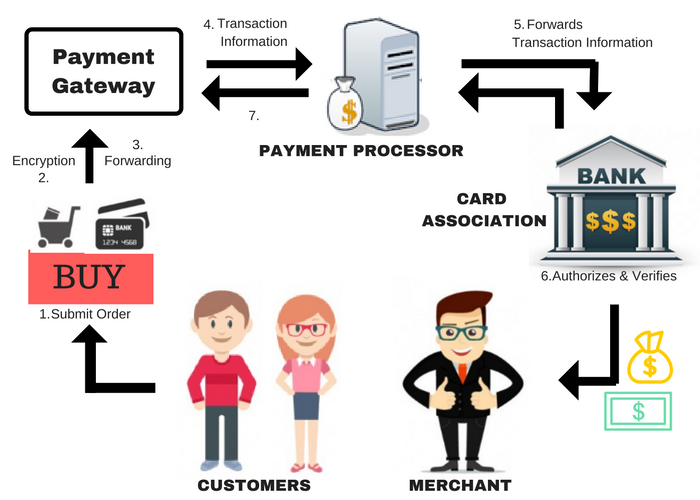

How Payment Gateways Function

These gateways act as intermediaries between the merchant, the customer, and the financial institution. They securely transmit transaction data, validate the information, and also process payments.This procedure is usually completed in a matter of mere moments.

Types of Payment Gateways

come in two primary forms:hosted and integrated. Hosted gateways[4] redirect customers to a separate payment page, while integrated gateways allow customers to complete transactions on the merchant’s website.

Payment Gateway Integration

Integrating a payment gateway into an e-commerce[5] platform or website is a crucial step for businesses looking to accept online payments. The integration process ensures that the payment gateway seamlessly fits into the existing infrastructure.

Security Measures in Payment Gateways

Security is paramount in the world of payment gateways. Payment Gateway Work Industry standards like PCI DSS (Payment Card Industry Data Security Standard) are enforced to protect sensitive information from breaches.

Mobile Payment Gateways

The rise of mobile commerce has led to the development of mobile payment gateways, allowing customers to make transactions using their smartphones and also other mobile devices.

E-commerce and Payment Gateways

For e-commerce businesses, payment gateways are the lifeline of their operations. Payment Gateway Work These gateways enable customers to make online purchases with ease, boosting sales and revenue.

Key Players in the Payment Gateway Industry

Several prominent companies dominate the payment gateway industry, including PayPal, Stripe, and Square. These industry giants offer a wide range of services and also solutions to businesses of all sizes.

As you contemplate your choice of a payment gateway,

Opting for the suitable payment gateway is a pivotal choice for any business. Factors to consider include transaction fees, payment options, and also customer support.

Benefits of Using Payment Gateways

The advantages of using payment gateways extend to both businesses and consumers. Payment Gateway Work They include convenience, enhanced security, and access to a global customer base.

Common Payment Gateway Issues

Despite their efficiency, payment gateways may encounter issues such as declined transactions, payment delays, or technical glitches. It’s essential to address these promptly.

The Future of Payment Gateways

As technology evolves, payment gateways will continue to adapt. Future innovations may include increased security measures and also support for emerging payment methods.

Conclusion

Payment gateways stand as the often-overlooked champions of digital transactions.They simplify the payment process, provide security, and open up opportunities for businesses in the digital landscape.

Frequently Asked Questions

- What is a payment gateway?

- A payment gateway is a technology that enables secure online transactions by transmitting and processing payment information between merchants, customers, and financial institutions.

- Are payment gateways safe to use?

- Yes, payment gateways prioritize security and also use encryption and industry standards like PCI DSS to protect sensitive data.

- Which payment gateway is the best for small businesses?

- The ideal payment gateway for a small business depends on factors like transaction volume, budget, and specific needs. Some popular choices include PayPal, Stripe, and also Square.

- What should businesses do when faced with payment gateway issues?

- When encountering payment gateway issues, businesses should promptly contact their payment gateway provider’s customer support for assistance.

- How can businesses stay prepared for the future of payment gateways?

- To stay prepared for future developments in payment gateways, businesses should stay updated with industry trends, consider adopting emerging payment methods, and also prioritize customer security.

Get In Touch