AUTHOR : RIVA BLACKLEY

DATE : 04-11-23

In the bustling landscape of e-commerce, the smooth processing of payments is crucial. In this digital era businesses in Oman need a reliable payment gateway system to ensure secure and convenient online transactions. Let’s dive into the world of payment “portals,” their significance, and their impact on Oman’s growing online economy.

What Is a Payment Gateway?

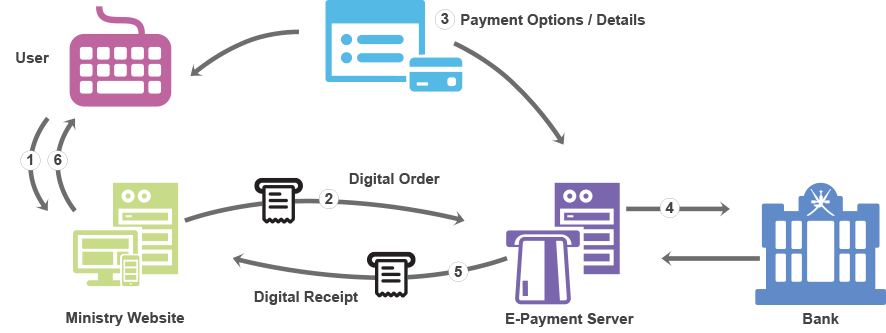

A payment gateway is a technology that facilitates online transactions by serving as the intermediary between an e-commerce website and the financial institutions that handle the funds. It plays a pivotal[1] role in securely [2]transmitting customer[3] payment data [4]to the payment processor [5]and returning transaction results to the website.

The Importance of Payment Gateways

Payment gateways are the backbone of online businesses. They ensure that transactions are completed efficiently, protecting sensitive customer information, and delivering a seamless user experience. Without a reliable payment gateway, businesses can lose sales and compromise customer trust.

Types of Payment Gateways

Multiple varieties of payment gateways are accessible for use:

4.1 Hosted Payment Gateways

Hosted payment gateways redirect customers to an external page to complete transactions. This approach simplifies the process for businesses but may lead to a less customized checkout experience.

4.2 Self-hosted Payment Gateways

Self-hosted payment gateways allow businesses to handle the entire transaction process on their website. This offers more control and customization but requires stronger security measures.

4.3 API-based Payment Gateways

API-based payment gateways provide a balance between customization and security. They allow businesses to integrate payment processing into their website while maintaining a high level of security.

Why Payment Gateways Matter in Oman

Oman is witnessing a surge in online shopping, making payment gateways a critical part of the e-commerce ecosystem. Customers expect secure and convenient payment options, and businesses that provide them are more likely to succeed.

Choosing the Right Payment Gateway

Choosing the right payment gateway for your enterprise is of utmost importance. Factors to consider include transaction fees, user experience, security features, and compatibility with your e-commerce platform.

Setting Up a Payment Gateway

Once you’ve chosen a payment gateway, you need to set it up. This usually involves creating an account, configuring settings, and integrating it into your website.

Integration with E-commerce Websites

Smooth integration between your payment gateway and e-commerce website is vital. It ensures that customers can seamlessly make payments without any hiccups.

Security Measures for Payment Gateways

Protecting customer data is a top priority. Payment gateways employ encryption and security protocols to safeguard sensitive information.

Benefits of a Local Payment Gateway

Using a local payment gateway can provide advantages such as faster transaction processing, better customer support, and adherence to local regulations.

Challenges in Payment Processing

Payment processing in Oman may have its challenges, including currency conversion, cross-border transactions, and regulatory compliance.

Payment Gateway Fees

Understanding the fees associated with your chosen payment gateway is essential for managing your business’s financials effectively.

Customer Experience and Payment Gateways

A positive customer experience hinges on a smooth payment process. A user-friendly payment gateway can enhance customer satisfaction and loyalty.

Mobile Payment Solutions in Oman

With the rise of mobile commerce, mobile payment solutions are gaining importance in Oman. Businesses should consider offering convenient mobile payment options.

The Future of Payment Gateways in Oman

As Oman’s e-commerce sector continues to grow and evolve, the future of payment gateways in the country holds great promise. The digitization of payment processes is expected to accelerate, with more businesses and consumers adopting online and mobile payment methods.Here are a selection of evolving trends worth monitoring:

- Blockchain Technology: With its transparent and secure nature, blockchain technology is making its mark in the world of payments. Oman may witness the integration of blockchain-based payment gateways, offering enhanced security and transparency in financial transactions.

- Contactless payments gained momentum due to the COVID-19 pandemic, expediting their widespread adoption.This trend is expected to persist, with more businesses in Oman embracing contactless payment methods, such as NFC (Near Field Communication) and QR codes.

- Cryptocurrency Acceptance: While cryptocurrencies like Bitcoin and Ethereum are still emerging in Oman, they are gaining recognition worldwide. In the future, we may see more businesses in Oman accepting cryptocurrencies as a form of payment, facilitated by specialized payment gateways.

- Enhanced Security Measures: With the constant threat of cyberattacks, payment gateways will continue to enhance their security measures. This includes advanced encryption, multi-factor authentication, and AI-driven fraud detection systems.

- Seamless Cross-Border Transactions: As Omani businesses expand their reach globally, payment gateways will need to offer seamless cross-border transaction capabilities, including currency conversion and international payment processing.

Conclusion

In Oman’s expanding e-commerce market, a reliable payment gateway is indispensable for businesses seeking success. It ensures secure and efficient online transactions, enhances customer trust, and contributes to overall business growth.

FAQs (Frequently Asked Questions)

- What is the role of a payment gateway in e-commerce? A payment gateway facilitates secure online transactions by connecting e-commerce websites with financial institutions.

- How do I choose the right payment gateway for my business in Oman? Consider factors like transaction fees, security, user experience, and compatibility with your e-commerce platform.

- Why are local payment gateways advantageous in Oman? Local payment gateways offer faster processing, better support, and compliance with local regulations.

- What challenges are associated with payment processing in Oman? Challenges include currency conversion, cross-border transactions, and regulatory compliance.

- Why is a user-friendly payment gateway important for businesses in Oman? A user-friendly payment gateway enhances the customer experience, leading to increased satisfaction and loyalty.