Name : Buddy Kim

Date : 3-11-2023

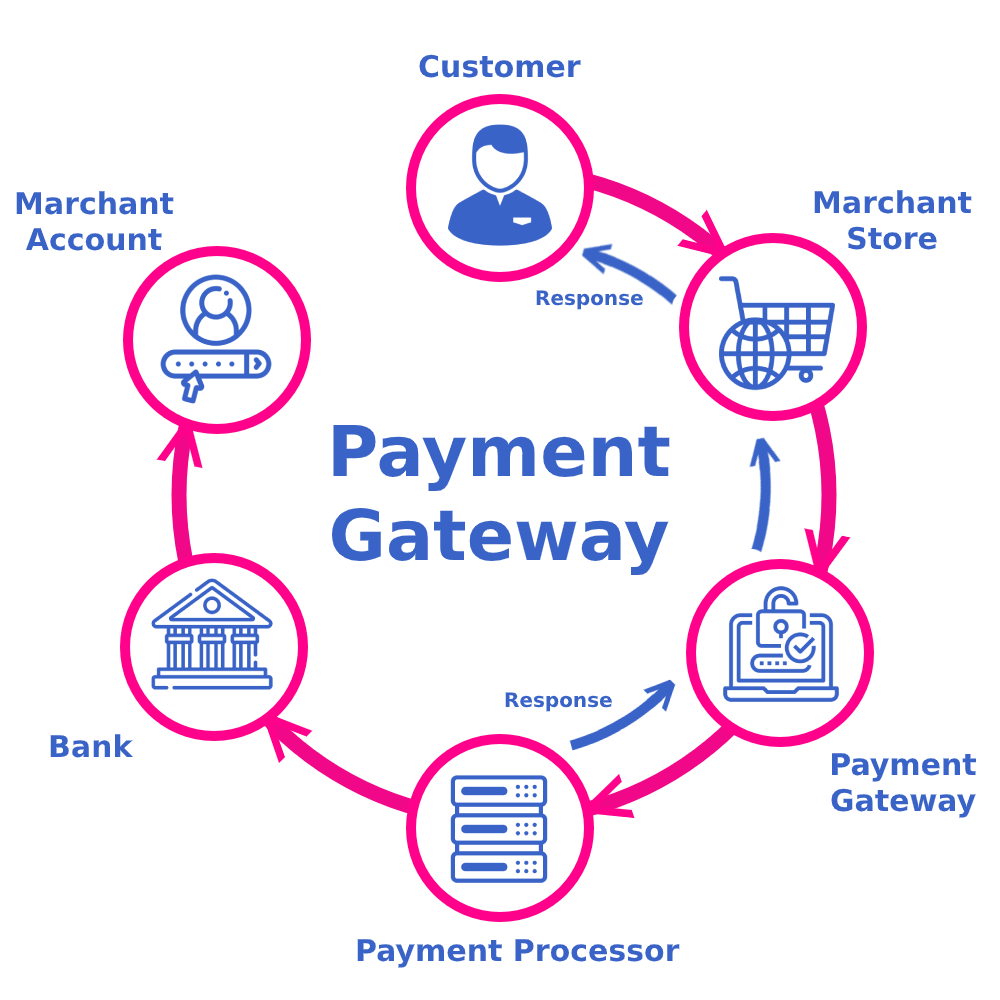

Payment gateways are an essential component of online transactions and e-commerce[1]. They serve as the virtual bridge between customers and businesses, ensuring secure and efficient[2] payment processing. In this article, we will explore the world of payment gateways, discussing their types, key considerations, and some of the most popular options available.

Understanding the Importance of Payment Gateways

Payment gateways play a pivotal role in the success of online businesses. They enable seamless transactions, ensuring that customers[3] can make payments conveniently and securely. Whether you run an e-commerce store or provide online services, the right payment gateway [4]can significantly impact your business’s[5] bottom line.

Types of Payment Gateways

Hosted Payment Gateways

Hosted payment gateways[1] are third-party platforms that handle the entire payment process for you. They are user-friendly and suitable for businesses that want a hassle-free solution. Popular options include PayPal and Stripe.

Self-hosted Payment Gateways

Self-hosted gateways give you more control over the payment process[2]. You host the payment page on your website, providing a seamless and branded experience. This type of gateway is ideal for larger enterprises with specific customization needs.

Transaction Fees

Transaction fees[3] can vary significantly among payment gateways. It’s essential to consider these fees and how they fit into your business’s profitability. While some gateways charge a fixed fee per transaction, others charge a percentage of the transaction amount.

Security Features

Security is paramount in online payments. Look for a payment gateway with robust security features[4], such as encryption and fraud prevention tools. Your customers should feel confident that their financial information is safe when making a purchase.

Integration Options

Consider how well the payment gateway integrates with your existing systems[5]. Whether you use a popular e-commerce platform or have a custom website, smooth integration is vital for a seamless user experience payment gateway options.

Popular Payment Gateways in the Market

PayPal

It’s known for its ease of use, international acceptance, and a range of payment options. Many customers trust PayPal, making it a valuable addition to your payment options.

Stripe

Stripe is a developer-friendly payment gateway. It offers extensive customization options and is a favorite among businesses looking to create a unique payment experience. Stripe’s well-documented APIs make it a top choice for developers.

Square

Square is a versatile payment gateway known for its user-friendly interface and compatibility with both online and in-person payments. It’s an excellent choice for businesses with a mix of online and physical sales.

Setting Up a Payment Gateway for Your Business

The process of setting up a payment gateway may vary depending on the provider you choose. However, it typically involves registering with the gateway, configuring your payment settings, and integrating it with your website or app.

The Role of Payment Gateways in E-commerce

E-commerce relies heavily on payment gateways to facilitate transactions. Payment gateways ensure that customers can easily and securely make online purchases, leading to increased sales and customer satisfaction.

Mobile Payment Solutions

The rise, and payment gateways play a crucial role in this shift.

like Apple Pay and Google Wallet, allow customers to make payments using their smartphones. Payment gateways need to support these options to cater to the mobile-savvy audience.

QR Code Payments

QR code payments are gaining popularity, especially in Asia. Businesses can use payment gateways to accept QR code payments, making transactions quicker and more convenient.

Challenges and Concerns with Payment Gateways

While payment gateways offer numerous benefits, there are also challenges and concerns to address. These may include transaction disputes, technical issues, or even fraudulent activities. It’s crucial to have a strategy in place to tackle these issues effectively.

Benefits of Using Payment Gateways

Using payment gateways brings several advantages, including increased sales, enhanced security, and improved customer trust. These benefits make them an essential tool for online businesses.

Case Studies of Successful Payment Gateway Implementations

To illustrate the impact of payment gateways, we’ll explore a few case studies of businesses that successfully integrated payment gateways and saw significant improvements in their sales and customer satisfaction.

Future Trends in Payment Gateway Technology

As technology evolves, payment gateways continue to innovate. The future may bring developments in areas like biometric authentication, blockchain technology, and enhanced data analytics to further improve the payment process.

Conclusion

Payment gateways are the unsung heroes of the e-commerce world. They enable businesses to accept payments efficiently and securely, contributing to a seamless customer experience. Whether you opt for a hosted or self-hosted gateway, choosing the right payment solution is vital for your business’s success.

Unique FAQ Section

- Q: Are payment gateways safe for online transactions?

- Payment gateways prioritize security, employing encryption and fraud prevention measures to protect both businesses and customers.

- Q: What are the typical transaction fees for payment gateways?

- Transaction fees vary but often include a combination of a fixed fee and a percentage of the transaction amount.

- Q: Can I use multiple payment gateways for my business?

- Yes, many businesses use multiple gateways to offer customers a variety of payment options.

- Q: Do I need technical expertise to set up a payment gateway?

- The level of technical expertise required depends on the gateway you choose. Some are user-friendly, while others may require more technical know-how.

- Q: What’s the future of payment gateways?

- The future of payment gateways includes innovations in biometrics, blockchain, and enhanced security measures to improve the overall payment experience for businesses and customers.